Hey friend,

We got some manufacturing data this morning, which was mixed – with one gauge showing a slight expansion in activity but another showing a slight contraction.

Tonight, Fed Chair Powell is due to give a speech.

And given how much is riding on a Fed rate cut in December, what he says – or doesn’t say – could move markets.

We’ll also get some big private employment numbers on Wednesday…

Plus the Fed’s preferred inflation gauge – the PCE – on Friday.

All these could influence the market’s expectations in a big way.

Let’s see how the markets have been moving.

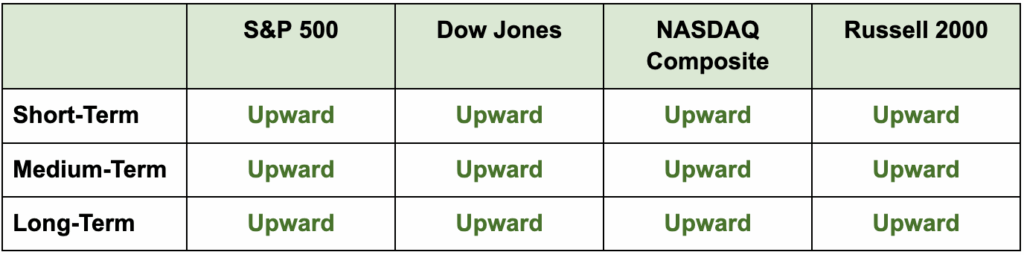

The Daily Direction

Note: After five straight sessions of consecutive gains, all index directions are back in upward territory.

The Daily Nugget

It’s not about what you believe – it’s what you see.

It’s easy to get stuck in beliefs.

The market should be up because AI is the next big thing…

Or it should be down because AI is a bubble that’s about to pop.

Or it should be doing something else entirely.

Now, it’s true that the market moves based on beliefs…

But the key nuance is that it moves based on the aggregate collective beliefs of all its participants.

And while it’s easy to think you know what these collective beliefs “should” be…

The only way to truly know is to ditch any preconceived beliefs of your own – and watch what the market is telling you.

And right now, the market is telling Head Trader Ross Givens that we’ve recovered from the pullback…

With ample opportunities to target rebounding stocks.

Which is why tomorrow morning at 11 a.m. Eastern…

Ross is going LIVE to show you exactly how to target the smaller, under-the-radar stocks which could be on the verge of breaking out.

He’ll show you how to use his proprietary “pressure gauge” that tells you when the buying pressure could be about to cause these stocks to erupt.

This “pressure gauge” has signaled moves of 77% in 3 weeks, 87% in 24 hours, and 136% in just four weeks.

And when you attend his live demo tomorrow morning, you’ll see firsthand how it works – and how you can use it yourself.

So click here to save your seat if you haven’t already.

And Ross will see you Tuesday morning at 11 a.m. ET.

The early stages of a rebound is the best time to use this “pressure gauge” – so don’t let these breakouts pass you by.

The Traders Agency Team

P.S. Planning to attend on a mobile device? Make sure you download the presentation apps now so you don’t miss a second of valuable information.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps