Hey, Ross here:

Markets took a pretty sharp dip yesterday.

I think it could dip further.

Let me show you why.

Chart of the Day

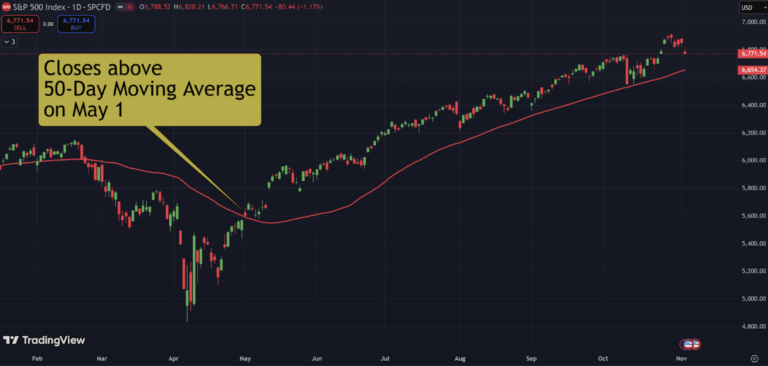

This is a chart of the S&P 500.

That red line is its 50-day moving average – a sign of its medium-term direction.

During the tariff selloff, the index plunged below the 50-day MA, but closed above it on May 1 again after the markets bounced back.

Since May 1, it’s never once closed below the 50-day MA.

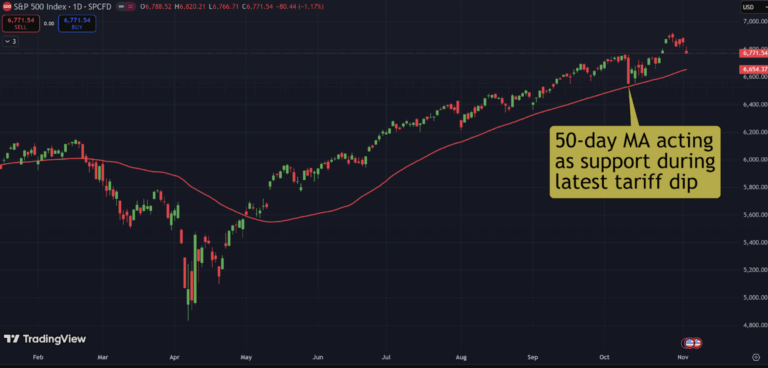

It got close during Trump’s “additional 100% tariffs on China” scare…

But as you can see below, the 50-day MA actually acted as support during that drop.

After yesterday’s close, we’re now at 129 trading days (188 calendar days) of the S&P 500 trading above the 50-day MA.

If this holds for just two more days…

That would make it the longest streak since 2006–2007.

I think there’s a very good chance this streak will come to an end this month.

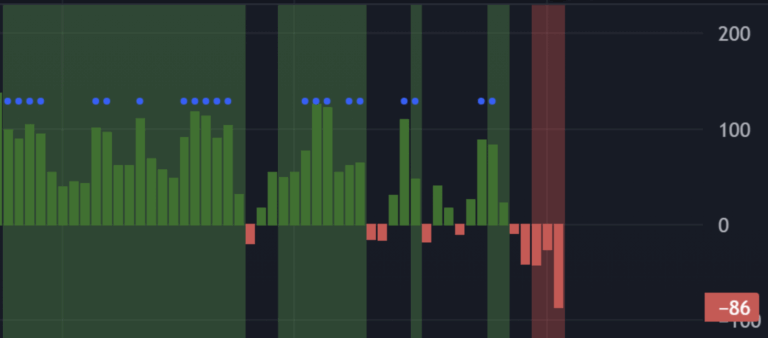

We’re already seeing clear signs of internal deterioration, with the past five trading days having more new lows than new highs.

Now, this doesn’t mean the end of the bull market.

Even during 2024, which was a strong year, we saw the S&P 500 dip below the 50-day MA numerous times.

The index pulling back below its 50-day MA is not only expected – it’s natural.

Should the markets dip to close – or even below – the 50-day MA, I will be taking it as an opportunity (and you should too).

But before you do that, there’s something critical you’ll need to understand about pullbacks first.

Insight of the Day

During pullbacks, the price action tends to stay the same – but the narrative always change.

It’s very easy to tell someone to buy pullbacks.

You just bring up a price chart and show them time and time again why buying pullbacks is such a profitable strategy.

So you would think it would be easy to implement a pullback-buying strategy.

But the thing is, although the price action on each pullback tends to look fairly similar…

The narrative surrounding each one always changes.

Just in the past two years, the narratives around pullbacks have ranged from tariff escalations and bubble fears to weak employment and the yen carry trade.

Sure, some of them repeat…

But the narrative is generally always different.

And that’s why it’s so hard to buy pullbacks…

Because the narrative always makes us feel that “this time” it’s going to be a major market crash.

Sure, you need to be aware of the narratives.

But ultimately, you have to keep reminding yourself that most of it is just noise…

Noise that will prevent you from implementing a proven strategy.

P.S. Want to see how I like to buy pullbacks? Watch this video now.

Customer Story of the Day

“I’ve been slacking on my part, but everything I’ve received via Traders Agency has been more than beneficial.

I’ve learned so much in such a short time span.

Everything I’ve researched after learning from Traders Agency has been beneficial and backed with real time evidence.

Definitely worth the investment! Thanks for all that you do Traders Agency!”

Ross Givens

Editor, Stock Surge Daily