Hey friend,

Let’s find out the markets have been moving as we start a new trading week (and month).

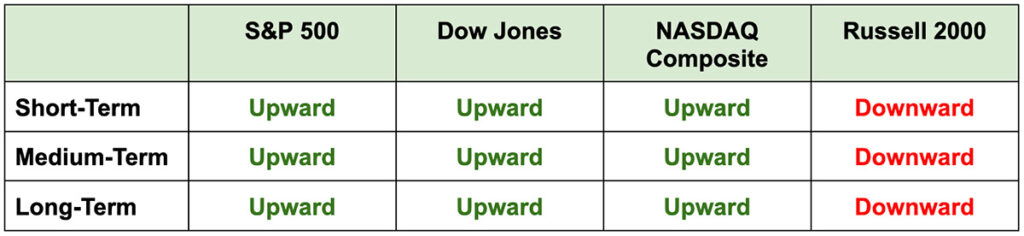

The Daily Direction

Note: Strong positive corporate earnings kept the end-of-week rally going, marking a positive end to April and the start of a new month.

The Daily Nugget

Simplicity beats complexity.

Pull up your TradingView (or whatever platform you use) right now, and look at any stock chart.

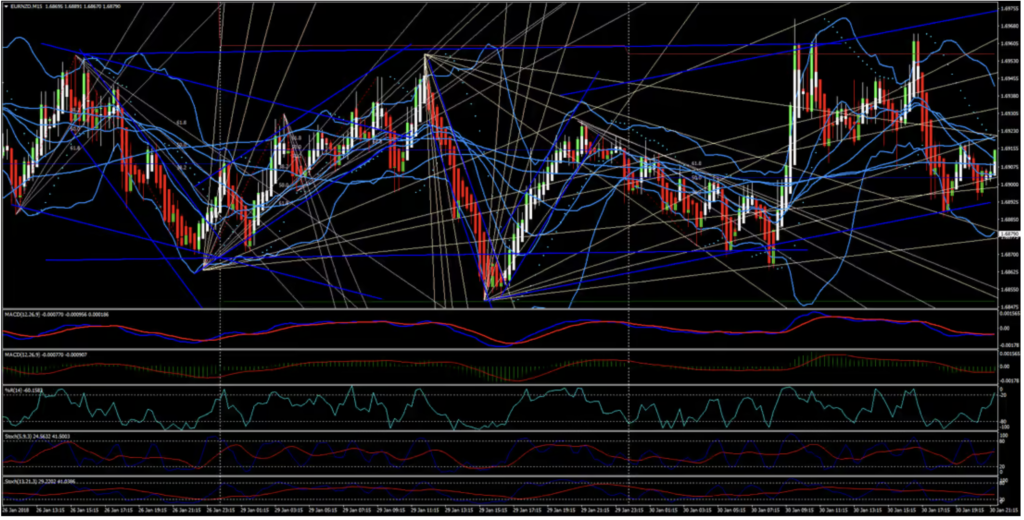

Does your page look anything like this?

Because if it does – you have a problem.

Many traders think that the more information (i.e, the more indicators) they have – the better decisions they’ll be able to make.

That’s not true. After a certain point, the value of new information dives off sharply – and in fact, can become negative. This means more information now equals worse decisions, because you don’t know how to “weigh” them against each other.

That’s why even pros like Ross Givens use less than 7 indicators. Less is more.

Because really, all you need your indicators to do is to tell you when a specific price-moving catalyst (this will differ depending on your strategy) appears.For Ross, it’s all about using his indica

tors to look for the #1 price-moving catalyst he knows. He explains everything in this short message here.

The Traders Agency Team

P.S. Want special trade prospects and potential market moves from Ross sent directly to your phone so you don’t miss out on anything? Text the word ross to 74121 now.