Hey, Ross here:

Welcome back to a new trading week.

Tomorrow, we will get the latest inflation numbers…

Which will in turn influence the market’s expectations of a Fed rate cut.

And since expectations of a rate cut is what’s holding up the market right now…

Tomorrow’s data could create a shock of volatility through the markets.

Chart of the Day

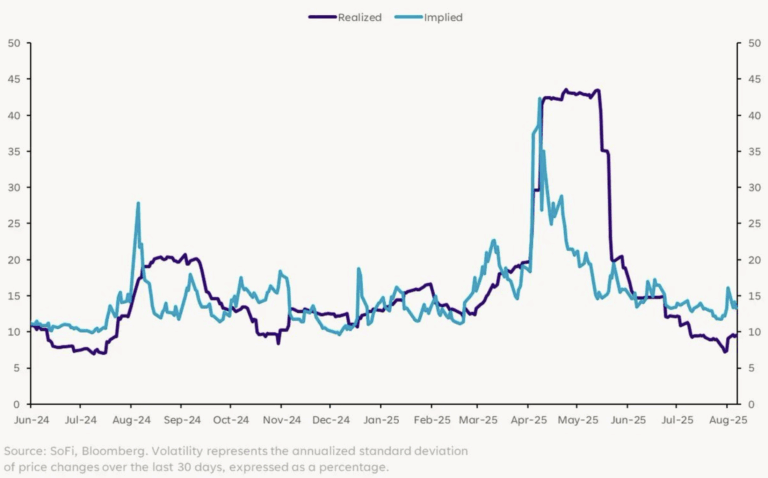

This chart shows the difference between Implied Volatility (blue line) and Realized Volatility (purple line).

Implied Volatility is what the market thinks volatility will be, based on option prices.

Realized volatility is the actual volatility, based on past data.

Right now, Implied Volatility is significantly higher than Realized Volatility.

That means the market – or to be more specific, the options traders – expect volatility to spike.

Looking at what’s ahead, I’m not surprised.

We might see a fast, sharp, and sudden pullback – one that many traders will likely confuse with a correction.

Again, there’s the big inflation data release tomorrow…

As well as talks about an economic recession heating up.

On the topic of a recession though, America’s businesses seem much less worried than the clickbait media.

But despite the facts…

The truth is, the media has a bigger effect on sentiment than boring business numbers.

And since short-term market movements are heavily affected by sentiment…

We might see an incoming volatility shock – and a sharp pullback – very soon.

I explain a likely scenario below.

P.S. I’m releasing two free trades tomorrow as part of my 2 Trades in 2 Minutes series. Text the word “trade” to 87858 and get the trades straight to your mobile the moment they’re released.

Insight of the Day

With retail sentiment having taken a big dip recently, a volatility spike will send many of them fleeing for the exits.

Contagion. No trader is immune from it.

The good ones are better able to resist it…

While the best ones are able to take the complete opposite position.

As a reader of this newsletter, you’re already in a better position than most.

Most retail traders however, can only move with the herd.

Should volatility spike and the market dip…

We’ll see a lot of them fleeing for the exits.

But even as this happens…

We’ll see another group of traders come swooping in…

A group known to exploit the herd-like tendencies of most retail traders again and again.

You can’t change it.

But you can take advantage of it.

And tomorrow, Tuesday August 12, at 11 a.m. Eastern…

I’m going LIVE to show you how.

The same way we can use the options market to gauge the market’s expectations of future volatility…

We can also use the options market to sniff out where these traders are placing their bets…

And position ourselves in under-the-radar stocks that could surge by as much as 287%… 542%… and 806% – all in a matter of weeks or even days.

I admit, some may find this strategy overly exploitative.

But it’s so effective that it would be irresponsible of me not to share it with you…

Especially with the likelihood of an incoming volatility shock.

So click here to secure your seat for my live session tomorrow…

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

Customer Story of the Day

“I joined both the War Room and the Stealth trades programs a little over 6 months ago.

I honestly do have to say that I have learned more in these last 6 months about chart patterns, insider buying, how to follow the money, pullbacks, analytics, chart/price indicators, when to buy, when to sell, how to look for quality stocks and just really developing/having a much better and clearer look and understanding about the market than I have learned in the past 2 yrs of my trading career trying to learn myself or with other so called market trading mentors and that are not.

Ross Givens is genuinely a master when it comes to the market and is genuinely here to really help his students succeed, profit and learn.

AND YOU WILL!!!!.. If you watch, study, learn and show up to every amazing war room/ trader’s agency webinars/classes. Which are so incredibly beneficiary and valuable just in itself.

I started trading in my individual IRA 6 months ago with $3700 and it is worth $6900 today. I’m up $3200 profit about 187% return on my IRA from when I first started by taking and using what I’ve learned and continue to learn from within the Traders Agency.

Nothing but respect for Ross and his team at TA. They are 100000000000% the REAL DEAL and

I cannot thank them enough for the results I am seeing now with my trading. Solely due to the TA teaching strategies, webinars and all the very in-depth knowledge Ross and his team has to offer. RG and TA will change your life.”

Ross Givens

Editor, Stock Surge Daily