Good morning, Daily Direction readers!

Waiting for a market to get into the right position so we can buy it can be frustrating. But patience pays off!

That’s why we’re keeping a close eye on the E-mini Russell 2000 (RTY) market as it gets closer to moving into the buy zone.

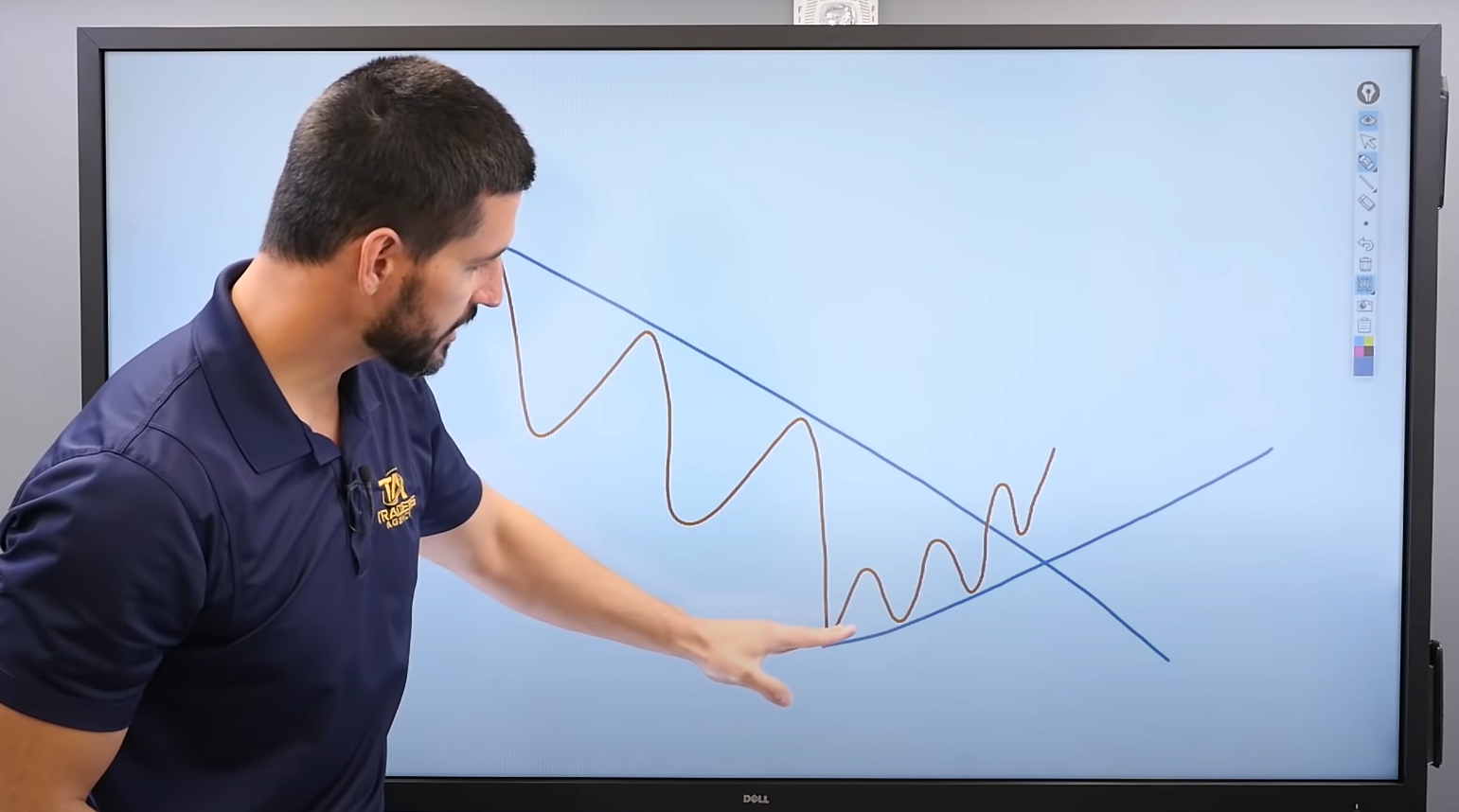

Right now, it’s just on the cusp of breaking the down trendline in our one-hour timeframe chart. Once the market can close above that line and stay there, we’ll look for signs of a bullish push and prepare to buy the market.

Trendlines are important because they give us an idea of a market’s overall direction, both in the long-term and short-term. If a market breaks a trendline, we know that a direction shift is happening.

For the RTY, the market is ready to push into the buy zone and give us an opportunity to execute our buy-in strategy. Then we’ll work toward making profitable trades in the RTY!

Now let’s look at our timeframe analysis to get a clearer picture of what the RTY is doing:

One-Hour Timeframe Analysis

A quick look at the one-hour timeframe for the RTY shows the market barely edging above the trendline but not entirely closing within the buy zone. If the market can stay above the trendline, we’ll start looking for signs that the market is pushing bullish through the buy zone.

That will be our signal to use our buy-in strategy and take a position in the RTY.

But we don’t want to act until that happens. Just because a market is close to meeting our requirements for buying doesn’t mean we should jump in right now. Our patience will pay off. Once the RTY is in the buy zone, we’ll act accordingly.

By following our strategy as strictly as possible, we increase our chances of making good trades that earn us money. It doesn’t make sense for us to abandon everything because we’re tired of waiting!

Learn more about the Daily Direction Indicators here…

As soon as we see our indicators telling us the RTY is in the buy zone, we’ll follow the one-hour timeframe and look for a chance to buy the market as it moves to higher prices.

Not sure how all of this works? Check out my resources on how to read market indicators!

The Bottom Line

We’re almost at the point where we can jump into the RTY market. But we need to wait until the market is in the right spot on our charts before we dive in and buy it.

By keeping our emotions in check, we stand a better chance of making wise trading decisions. We can’t let anticipation or excitement cloud our judgment. We’ll make the trade when the moment is right.

And if you’re ready to take the next step in working toward a better trading strategy, be sure to check out my resources to learn more about my setups, charts, and the best way to approach the futures market.

Keep On Trading,

Mindset Advantage: Stop

If it gives you pause… then pause.

How many times have you plowed into a trade… with second thoughts? Once you enter, your stomach immediately drops – the regret is almost unbearable.

Welcome to trading for millions of retail traders. The very thing that’s supposed to bring the freedom, happiness and financial independence they’ve been hoping for… is making them sick to their stomachs.

Why do something that makes you feel less than awesome? Take a minute. Save your money and your account. Collect yourself… practice, watch the videos, talk to one of our traders and get your mojo.

Simply put… Just stop and only trade when you’re ready. There’s plenty of money to be made out there.

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post This Market Is Right on the Edge appeared first on Josh Daily Direction.