Hey, Ross here:

Let’s start the day by comparing how consumers are viewing the economy…

Versus how the CEOs are.

Chart of the Day

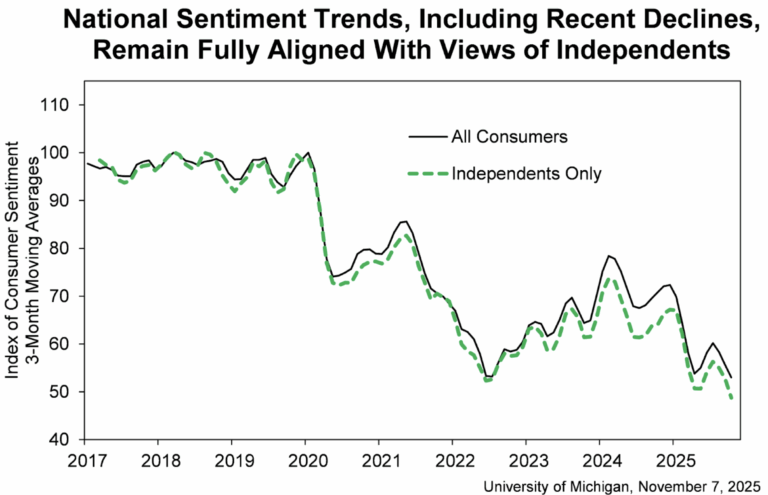

This chart shows the results of the monthly consumer confidence survey conducted by the University of Michigan.

As you can see, as of November – it’s fallen to the lowest levels on record.

Now, keep in mind this is just one survey.

There are other consumer confidence surveys out there.

And while pretty much all of them show a continued deterioration in consumer confidence…

This is the only one with consumer confidence at record lows.

Still, when it comes to consumer confidence, the trend is clear – it’s heading downward.

And yet, take a look at how the CEOs are feeling.

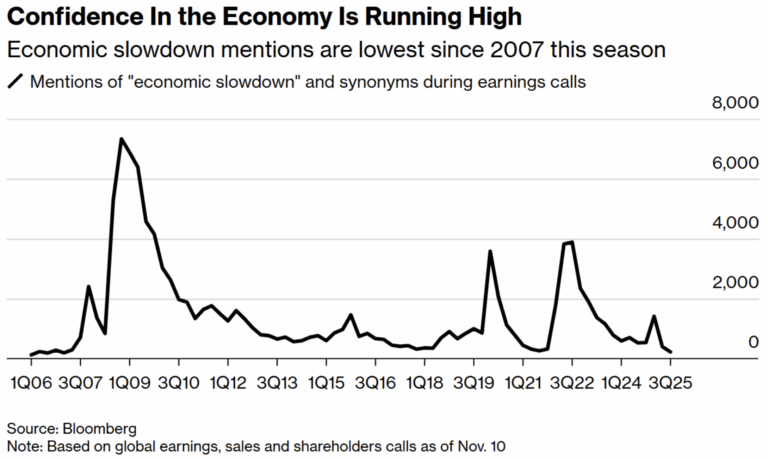

This shows how many CEOs are talking about the economy slowing down during earnings calls.

While there was a spike earlier in the year…

As of the most recent quarter, company management is barely mentioning economic slowdowns at all.

In other words, they’re extremely confident in the economy.

I unpack this divergence – and the opportunity it creates – below.

Insight of the Day

Insiders are bullish while consumers are bearish.

That, in essence, is a one-sentence summary of what the data is saying.

Company insiders are bullish, while the man on the street is bearish.

Now, don’t get me wrong, I have no love for the fatcat execs that clutter up boardrooms…

But the fact is, when it comes trading and market positioning – they’re the ones I’m paying attention to.

They have the hard numbers telling them exactly how well their business is doing – while consumers are relying on feelings.

And these insiders can’t just blow smoke during earnings calls either, because if they do, they’re setting their stock up for a massive fall if they miss next quarter.

Plus, they already know what’s coming down the pipeline for their own companies…

Which is what makes them a leading indicator – while consumer sentiment is always a lagging one.

That’s why I’m such a big advocate of following the insiders.

And it’s also why tomorrow, Thursday November 13 at 3 p.m. Eastern…

I’m going LIVE to show you how to follow the top insiders that are not just talking up their company on earnings calls…

But insiders that are actively putting their money where their mouth is.

You see, many of these insiders have trading records that make Wall Street’s best look like a joke…

But if you consider the advantage they have when trading their own stock, it’s not surprising.

That’s why my strategy for following the insiders has never had a losing year since 2017…

And could have delivered a 19X compounded return since then.

I’ll walk you through the entire thing Thursday afternoon, including:

- Where to find insider trades before they hit the news

- The must-know warning signs of “go nowhere” insider trades

- The 3 counterintuitive signals that identify high-conviction buying

I’m already seeing insider activity pick up strongly.

So click here to reserve your seat for my live insider presentation…

And I’ll see you Thursday afternoon at 3 p.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross and the Traders Agency team are trustworthy.

I watched from the sidelines for several months, before joining. My wife was still skeptical after I signed up.

But now, after a month in, she sees the gains I am getting and she’s becoming much more optimistic.

This is important to me, because I have signed up for other services that didn’t work.

Ross’ strategy is the best (and most consistent) I have ever used.

I appreciate his straightforward approach to teaching. He’s clear and easy to understand.

I currently have The Insider Effect and Alpha Stocks. I am looking forward to the future, when I can also sign up for The Black Edge and Fire Traders.

Thank you Traders Agency for helping me and all the other “little guys” out there.”

Ross Givens

Editor, Stock Surge Daily