Hey, Ross here:

Yesterday, I talked about why focusing on single stocks instead of buying the broad indexes is so important right now.

Today, let’s look at more data that supports this.

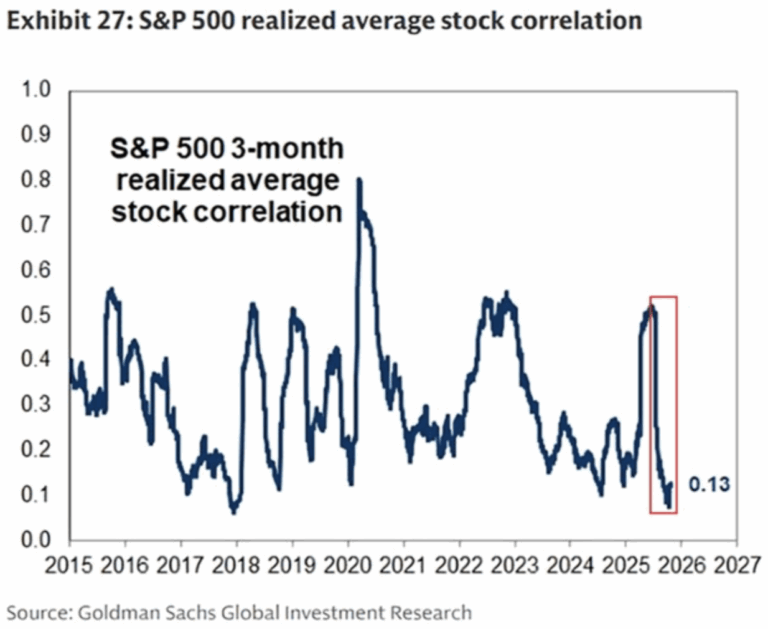

Chart of the Day

This chart shows how correlated stocks in the S&P 500 are to each other – i.e. how much they tend to move in tandem (whether up or down).

A value of zero means there is absolutely no correlation, while a value of one means they’re perfectly correlated.

Right now, their correlation value is 0.13 – the lowest since 2018.

In other words, some stocks will do great, others will do poorly.

Some stocks can keep rising even if many others fall.

This makes it a much better stock picking environment.

If you buy the index, the “average” returns from all these uncorrelated stocks could be extremely mediocre.

And it’s not just me saying this…

This is a strategy the “smart money” is aggressively implementing right now.

I explain in the Insight of the Day below.

Insight of the Day

The “smart money” will be aggressively exploiting any dips, pullbacks, or choppy action.

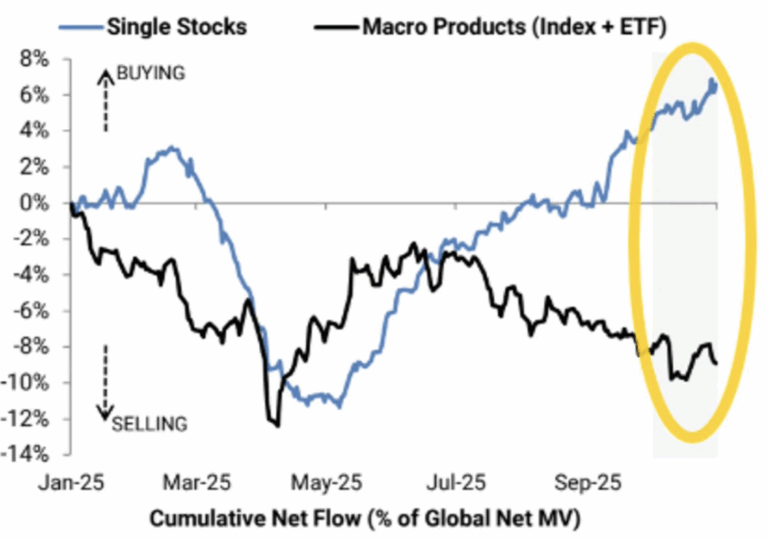

Take a look at this chart:

It shows institutional investors heavily buying single stocks…

While heavily shorting the index.

That means they believe the market as a whole will drop…

But that select stocks are poised to still win big.

This is hard data showing why stock picking is almost a “must” right now.

I wouldn’t buy the index.

The best investors in the world aren’t.

And I’m not just talking about the institutional investors…

I’m talking about the corporate insiders…

CEOs, CFOs, COOs, directors – all openly buying their own company stock…

Despite knowing more about their own companies’ prospects than even the best Wall Street analyst.

If you were the CFO of a company about to announce a huge earnings beat…

Why would you bother with the index?

That’s why following the insiders is such a powerful strategy…

With my insider strategy never having a losing year since 2017.

And later this morning at 11 a.m. Eastern…

I’m going LIVE to walk you through the entire strategy, including:

- Where to find insider trades before they hit the news

- The must-know warning signs of “go nowhere” insider trades

- The 3 counterintuitive signals that identify high-conviction buying

You’re going to get everything you need to start using this strategy for yourself.

So click here to guarantee your spot if you haven’t already…

And I’ll see you in just a bit at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross is a minefield of knowledge.

Really enjoying his live sessions a lot of information to process being new enough to the game.

Enjoying the teaching style – break things down well and says it how it is.

No fluff, no messing about – this man knows his onions recommend 10/10”

Ross Givens

Editor, Stock Surge Daily