Hey, Ross here:

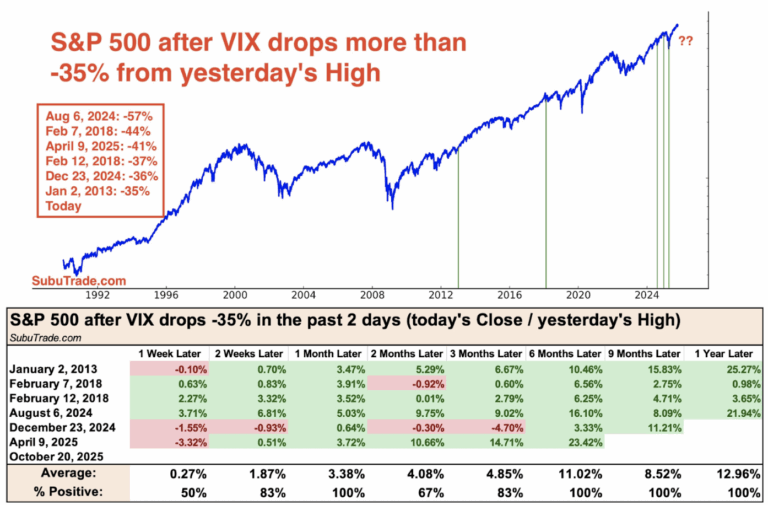

Yesterday I shared about how Friday’s drastic intraday volatility drop was a positive sign for the markets.

Today, let’s look at the historical evidence.

Chart of the Day

The Volatility Index dropped a further 12% yesterday.

If we compare it to Friday’s intra-day high, that’s a total drop of over 35%.

And as the chart above shows, each time the VIX has dropped over 35% from the day before’s high…

The S&P 500 has been overwhelmingly positive in the weeks and months after (although the market may be choppy in the immediate days).

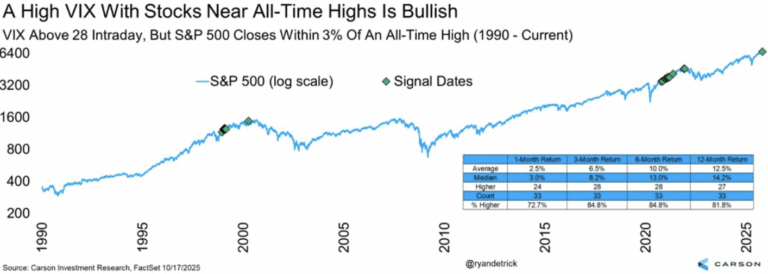

Want more evidence?

Take a look at this second chart – which shows that the VIX hitting a high above the 28 mark when the market was near all-time highs is also highly bullish.

The conclusion?

Don’t be surprised if we see choppy market action this week and leading into the Fed meeting next week.

But in the longer term, expect the markets to just keep moving up.

And there’s even better news – which I explain in the Insight of the Day below.

Insight of the Day

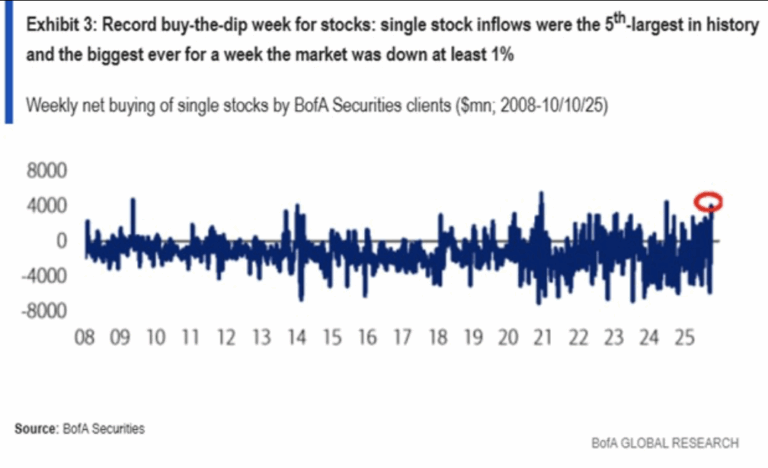

The “smart money” is moving to aggressively buy the dip – especially in single stocks.

Take a look at this chart.

It shows how, in the week leading up to October 10, single stock inflows were the fifth-largest in history…

With most of the buying coming from the “smart money” institutional investors.

As I said before, there are a lot of institutional investors chasing returns before the year-end hits…

So it makes sense that they’re also heavily buying single stocks instead of ETFs.

And while this data is 10 days old…

I see no reason why this aggressive dip buying behavior by the “smart money” would not have continued.

This is something we can and should take advantage of.

That’s why later this morning at 11 a.m. Eastern…

I’m going LIVE to reveal how you could target the exact same stocks as the institutional investors…

And essentially use their money for your profit.

That’s why stocks this strategy has identified in recent months have shot up as high as 547%.

But with how aggressively the “smart money” is buying the dip…

Gains like these could just be the start.

I’ll be walking you through this strategy step-by-step later…

So click here to guarantee your seat my live strategy walkthrough if you haven’t yet…

And I’ll see you in just a bit 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Great service! It has a great education component, which is great for those just beginning in trading. I highly recommend them and I have done very well following their advice. A+++”

Ross Givens

Editor, Stock Surge Daily