Hey, Ross here:

Tomorrow will be the last trading day of the month and the quarter.

Despite the minor pullback we saw last week, the market has been appreciably higher for the month.

That would make it a 5-month win streak for the broader market.

As we approach the fourth quarter, I’m seeing more and more concerns about the market being “overvalued” – which is understandable.

So for today, let’s look at just how far more the bull market could run.

Chart of the Day

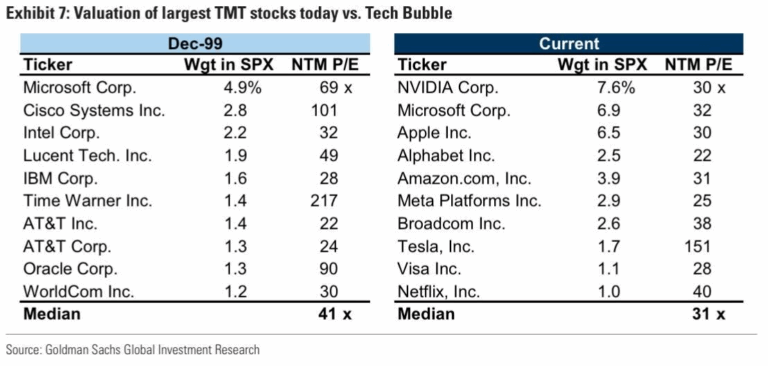

This chart shows the Price-Earnings ratios of the biggest stocks in the S&P 500 back in December 99 – right before the Dot-Com bubble burst – and today.

As you can see, right now, the 10 largest stocks have a median P/E ratio of 31X.

Back in December of ‘99, the 10 largest stocks had a median P/E ratio of 41X.

Based solely on earning multiples, this implies that the current market can still increase by about 32%.

And remember, that’s just based on earning multiples alone – without accounting for any earnings growth.

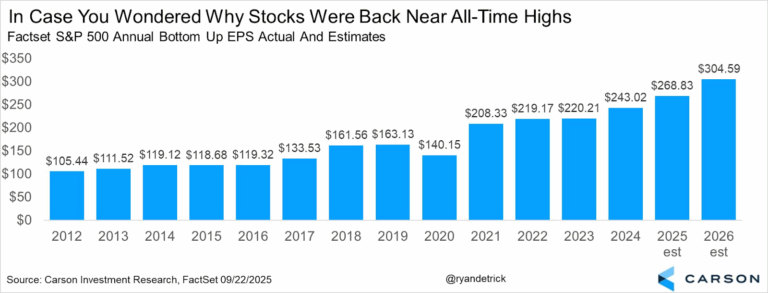

And as the chart below shows, earnings growth has also been solid.

Source: @RyanDetrick via X

In sum, earnings multiples still have room to run…

And underlying earnings still keep increasing.

So, how much runway does this bull market have left?

I elaborate below.

Insight of the Day

The bull market runway is much, much longer than the pessimistic bears would have you believe.

Nowadays, it’s easy to find someone who thinks the stock market is currently overvalued.

All you have to do is throw a rock and you’ll hit one of them on the head.

But how many of them have actually bothered to look at the data? Very few.

Now, make no mistake…

Valuations are absolutely stretched – and this party will eventually have to come to an end.

But it’s unlikely to come this year or even the next.

In fact, over a one-year timeframe, the data shows that earnings multiples and 1-year market returns are basically uncorrelated.

Source: @RyanDetrick via X

The top right of the chart below shows both high valuations and subsequently high returns, while the bottom left shows low valuations followed by low market returns.

Both sections of the chart have plenty of data points.

Now, does this mean the market will only go straight up from here on out? Definitely not.

In fact, I wouldn’t be surprised to see some deeper pullbacks in the fourth quarter…

Especially given how fragile sentiment is, as this would only exacerbate any normal pullbacks and volatility.

In short, prepare for a bumpy ride…

But one that will deliver plenty of opportunities to take advantage of if you know where to look.

That’s why I’m going LIVE tomorrow, Tuesday September 30, at 11 a.m. Eastern for an exclusive members-only State of the Market session.

I’ll be diving deep into what I’m seeing in the various sectors of the market…

The different kinds of opportunities coming down the pipeline for the fourth quarter…

And then going into how my various strategies can help you exploit these opportunities from different angles.

Don’t let the market catch you off guard.

Click here to save your seat for my LIVE members-only State of the Market session tomorrow…

And I’ll see you Tuesday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Customer Story of the Day

“I’m not someone that usually leaves reviews, however, if I could give more stars I absolutely would!

I am currently enrolled in two of their courses. I knew NOTHING about the stock market when I joined back in March after seeing Ross on The Cartier Family YouTube Channel.

Ross and Jean have rather quickly taught me how to navigate the market. They are so patient with ‘newbies’ like me and have eagerly answered my questions with demonstrations.

I would highly recommend this down to earth and knowledgeable team to anyone that is on the fence about joining. Just take the leap and watch your wallet grow!”

Ross Givens

Editor, Stock Surge Daily