Hey, Ross here:

Welcome back to a new trading week.

With producer prices coming in scalding hot…

And the retail bears now severely outnumber the bulls…

It’s worth asking the question…

How stressed is the market? Is there a real cause for concern?

To help answer that question, let’s look at something just outside the stock market.

Chart of the Day

This is the ICE BofA US High Yield Index Option-Adjusted Spread.

It measures how much extra yield investors are demanding to invest in risky bonds versus US Treasuries.

The more yield investors are demanding, the more stress there is in the financial system…

Because it means they’re worried about the safety of those bonds, and are thus demanding a higher return to compensate.

While the yield spread right now is not the lowest it’s been this year…

It’s still far lower than during most of the 2023 and 2024 bull market.

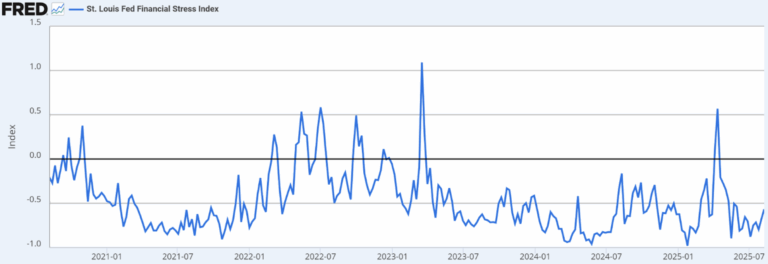

The same goes for the St. Louis Fed Financial Stress Index, which is an aggregate measure pulling from 18 data points.

Again, it’s not the lowest we’ve seen this year…

But it’s pretty much on par with the past bull market periods.

So, to go back to the question I posed earlier – is the market stressed?

The data shows it isn’t – or at the very least, not yet.

Now, here’s a deeper question – one that exposes where the opportunities are right now.

How stressed do people think the market is?

I elaborate in the Insight of the Day below.

P.S. Did you miss my 2 Trades in 2 Minutes last week? Well, don’t miss the next edition – coming out tomorrow. Just text the word “trade” to 87858 and get it straight to your inbox when it’s out.

Insight of the Day

If people think the market is stressed when it isn’t – that’s when opportunities appear.

Most opportunities in the market are created by “perception gaps”.

When a segment of the market perceives one thing – but the reality is another thing…

There’s a “perception gap”.

And because these gaps will inevitably close as reality catches up…

All “perception gaps” are also opportunities.

These “perception gaps” are everywhere, but we will only ever be able to spot a few of them.

That’s just the nature of the market.

So when we do, we need to take maximum advantage of them.

Because I promise you the institutional investors certainly are.

That’s why tomorrow, Tuesday August 19, at 11 a.m. Eastern…

I’m going LIVE to show you how to exploit the current “perception gap” and target the stocks with the highest chances of breaking out.

The strategy I’ll be demonstrating currently has an average gain of 184% across all open positions.

But considering the size of the “perception gap” we’re facing right now, this could just be the start.

So click here to secure your seat for my live masterclass tomorrow…

And I’ll see you Tuesday morning at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I’m not someone that usually leaves reviews, however, if I could give more stars I absolutely would!

I am currently enrolled in two of their courses. I knew NOTHING about the stock market when I joined back in March after seeing Ross on The Cartier Family YouTube Channel.

Ross and Jean have rather quickly taught me how to navigate the market. They are so patient with ‘newbies’ like me and have eagerly answered my questions with demonstrations.

I would highly recommend this down to earth and knowledgeable team to anyone that is on the fence about joining. Just take the leap and watch your wallet grow!”

Ross Givens

Editor, Stock Surge Daily