Hey, Ross here:

The Greenland and Europe tariffs situation resolved itself much faster than I expected.

I’ll talk about Trump’s negotiating playbook – and what we can learn from it – a little later.

But for now, with so much talk about the “AI bubble” still floating around, let’s look at today’s chart…

A chart which answers the question:

How is the average stock doing?

Chart of the Day

I don’t think I’ve shown this chart on this newsletter before.

This is the Value Line Geometric Index (VALUG).

The index tracks the performance of thousands of U.S. stocks…

But gives each of them equal weight (so the big names don’t skew the results) – and then it takes the geometric average of them all.

It is one of the best indicators I know of for measuring the performance of the “median stock”.

And as you can see, the index has just broken out to the highest levels we’ve seen in four years.

If we zoom in, we can also see that it has broken out past a clear resistance level it has been trying to move past since early September last year.

This is a fantastic sign for 2026.

Because if the average stock is hitting new highs….

By definition, it cannot be an AI-driven bubble,

Now, let’s look at Trump’s negotiation playbook…

And how we can use it in our own trading.

Insight of the Day

Trump’s playbook is profiting from overreactions.

Here’s Trump’s negotiating playbook in a nutshell.

Start from an extreme “unreasonable” position to force people to pay attention and come to the table…

And then scale it back to a solution both sides can agree on.

It’s happened time and time again…

And yet, every time he whips out the same playbook, people keep reacting the same way.

They throw their hands in the air and panic, proclaim the world is over and blah blah blah.

So it’s no wonder Trump keeps exploiting it – because it still keeps working.

It’s the same with us traders and our edges.

As long as it keeps working, we’re going to keep exploiting it.

And when you boil it down to its core…

Trump’s playbook is nothing more than “profiting” from overreactions.

If that sounds familiar…

It’s because that’s the exact same strategy the corporate insiders use….

Especially during earnings season – which we are in now.

They wait for investors to overreact to earnings announcements – which usually sends the stock downward.

And then they swoop in and load up on more shares at bargain prices.

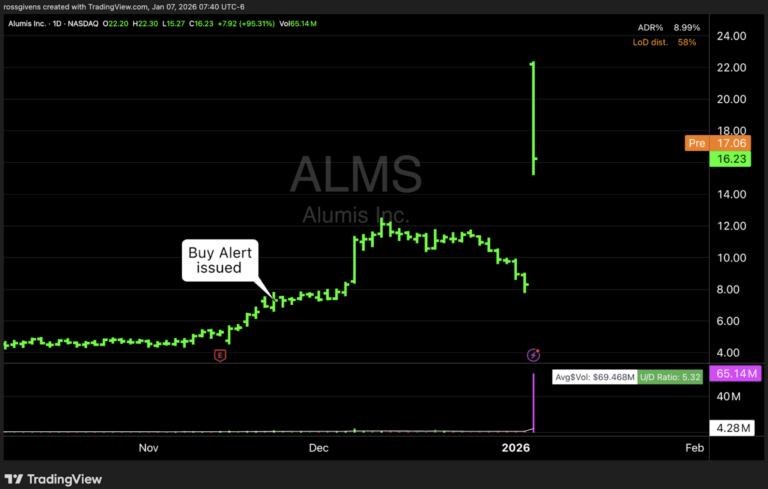

One of the biggest examples is a tiny biotech called Alumis Inc. (ALMS).

It got absolutely wrecked during earnings last November.

Several key insiders used the chance to buy in big…

Just weeks before the company announced successful Phase 3 clinical trial results for its plaque psoriasis drug.

Luckily I had already spotted this insider activity…

And issued a buy alert to my insider members – allowing them to profit from the stock’s huge pop.

By the way, that stock is now up 279% since the buy alert – in just two months.

And while the gains on that trade have already gone to those who had the foresight to join my insider group back then…

The good news is there are still plenty of insider trades up for the taking during this earnings season.

And tomorrow, Friday January 23, at 11 a.m. Eastern…

I’m going LIVE to walk you through my entire insider strategy…

And show you exactly what you need to look for when targeting these insider trades (because insiders are NOT all created equal).

You don’t want to end up following the wrong insiders – and destroying your portfolio in the process.

I’ll give you all the details you won’t get anywhere else tomorrow morning – including on a brand-new hot insider trade I just spotted.

So just click here to secure your free spot for my live insider walkthrough…

And I’ll see you Friday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross Givens from Trader’s Agency is an awesome resource to help you with your investing needs and investing education.

I waited about three months to write this review to give myself time to see the impact on my portfolio and I have been completely satisfied.

Ross has a no nonsense, simple approach that makes it easy for all investors and he takes the time to answer all questions on a weekly basis.

Thanks, Ross and Traders Agency!”

Ross Givens

Editor, Stock Surge Daily