Good morning, Daily Direction readers!

We’re currently out of the Nasdaq 100 E-mini futures market (NQ), as the long-term remains bullish, but the short-term is bearish.

The market hit the very top of the channel, fulfilling the Fibonacci extension. We’re waiting for the NQ to sell off and settle at a lower price.

That isn’t to say we aren’t interested in the market. Though we can’t buy it right now, we’ll keep an eye on the NQ’s timeframe charts in the hopes of a new bullish push following the sell-off.

For now, we’ll follow the timeframe analysis to gain a better understanding of what the NQ is up to:

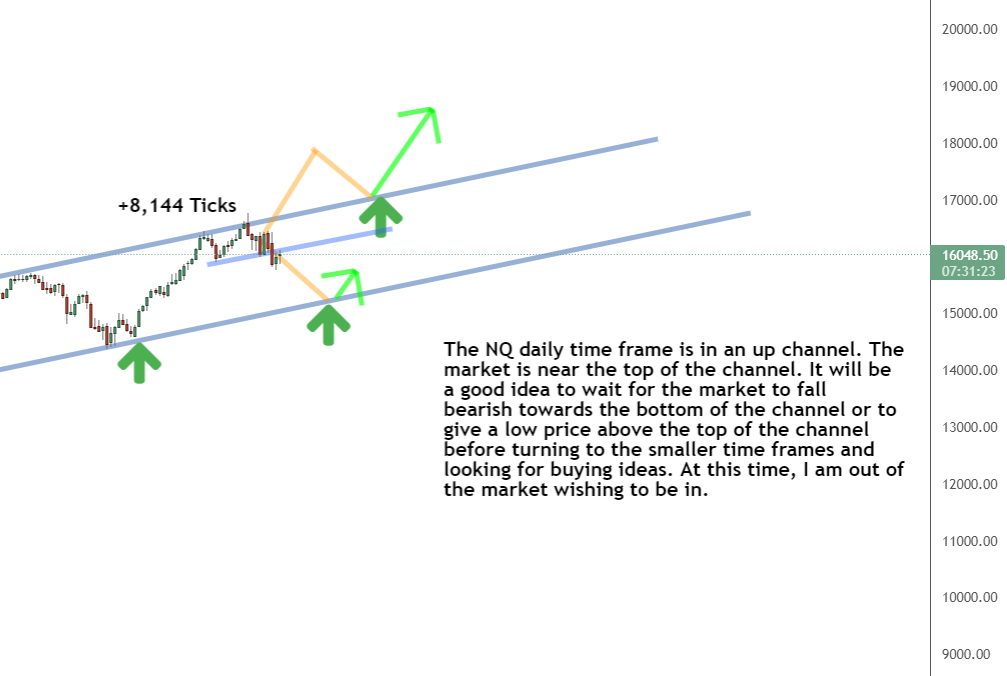

Daily Timeframe Analysis

The NQ has bounced off the top of the channel and is now turning bearish in a sell-off back to the bottom, as shown in today’s daily timeframe chart. Despite this, the NQ’s long-term trend remains positive.

I’m currently out of the NQ as I wait for the market to drop back down to the bottom of the channel. When that happens, I’ll look for evidence that the market is turning bullish in the short-term again.

Despite the fact that the market is now outside of our trading range, this is a good time to plan our buy-in approach while we wait for the market to strike a new bottom price within the current channel.

DAILY TIMEFRAME

The long-term direction is up for the NQ

1-HR TIMEFRAME

The short-term direction of the NQ is down for now

THE BOTTOM LINE

The NQ hit our limit and is preparing for a sell-off

Learn more about the Daily Direction Indicators here…

The Bottom Line

We’ve exited the NQ market since it’s risen over our price limit, reached the channel’s top, and is on the verge of a sell-off. Before a fresh bullish rally takes over, I’m predicting a selloff that will send the market to the bottom of the channel.

While we will not trade the NQ during the sell-off, a new low price will provide us with an excellent chance to enter the market. We’ll simply have to wait and see how everything plays out!

You’d be absolutely lost if you didn’t have my technique to guide you through the current movements of the NQ futures market. That’s why it’s time to start utilizing my knowledge and expertise! You can’t afford to miss out on this.

Keep On Trading,

Mindset Advantage: Accept

It’s what you don’t lose that counts first.

Followed by what you get to keep.

We hear the same story time and time again… the money gets made… the profits are amazing… and then it’s all given back to the harsh maiden of the market.

It’s not because the money isn’t there to be made. It’s often due to good old fashioned greed. Stops get pushed back. Targets get forgotten. That trade made $100… why not turn it into $500 or $1,000?

These are the traps that snare 95% of the trading profit. Take what the market gives you and go about your business. Honor ‘thy stop’ and your risk / reward ratio.

Don’t take that trade if you don’t feel good about it.

The ones you don’t take, or the ones that you end up stopping out of… those are the ones that keep you on the path to consistent profits!

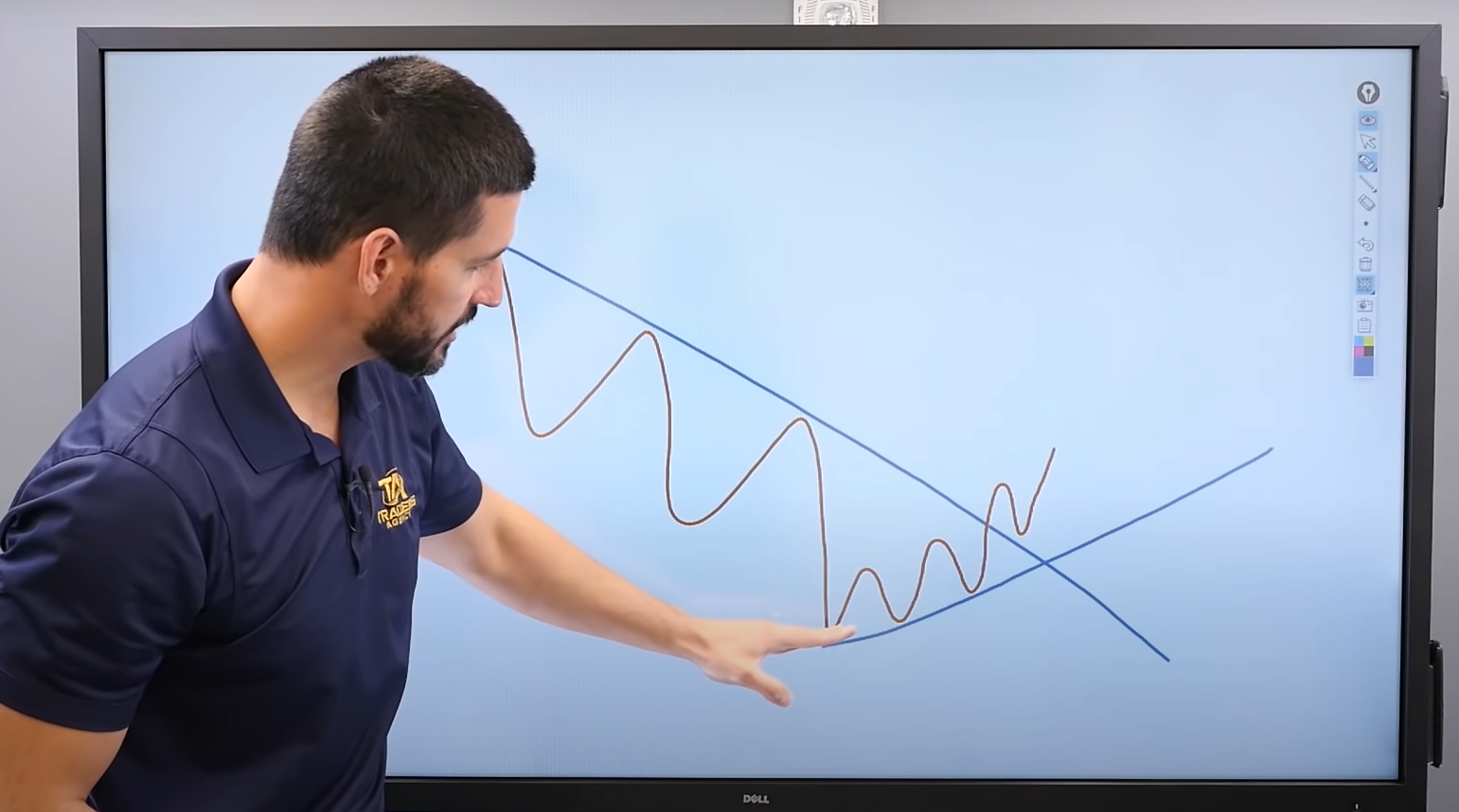

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.com/ to get signed up!

The post How to Handle a Looming Selloff appeared first on Josh Daily Direction.