Good morning, Traders!

The Nasdaq 100 (NQ) is hitting some serious highs right now! The market continues to rally as the bullish push keeps rolling. But the NQ’s price has entered territory where it’s wise for us to back off and wait for a price dip.

We buy the market at low prices and sell at high ones. It sounds simplistic, but that’s the foundational formula for making money with trading. When a market price gets too high, we take a step back and wait for more buying opportunities to develop. It doesn’t mean we’re done trading altogether. It just means we’re not buying the NQ for the moment.

To better understand why we do that, check out my free resources on how successful trading actually works.

As today’s timeframe analysis will show you, there are times where we’ll want to wait for the market to cool down a bit but remain in the buy zone. We just want lower prices at a known U-turn.

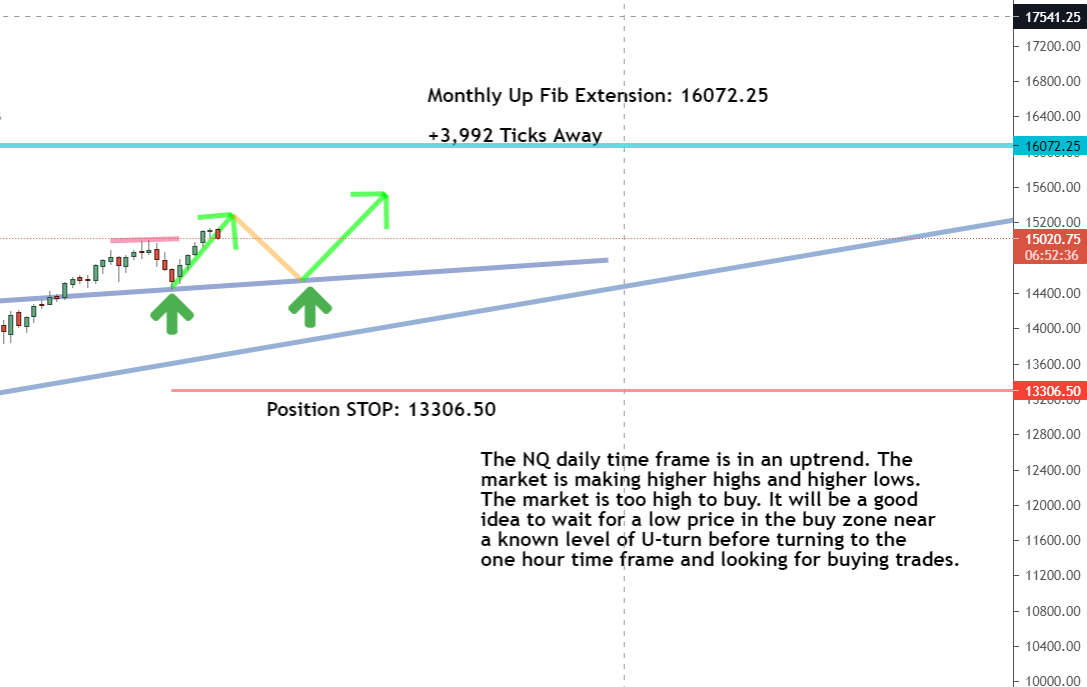

Let’s look at our timeframe charts to get a better understanding of how this plays out:Daily Timeframe Analysis

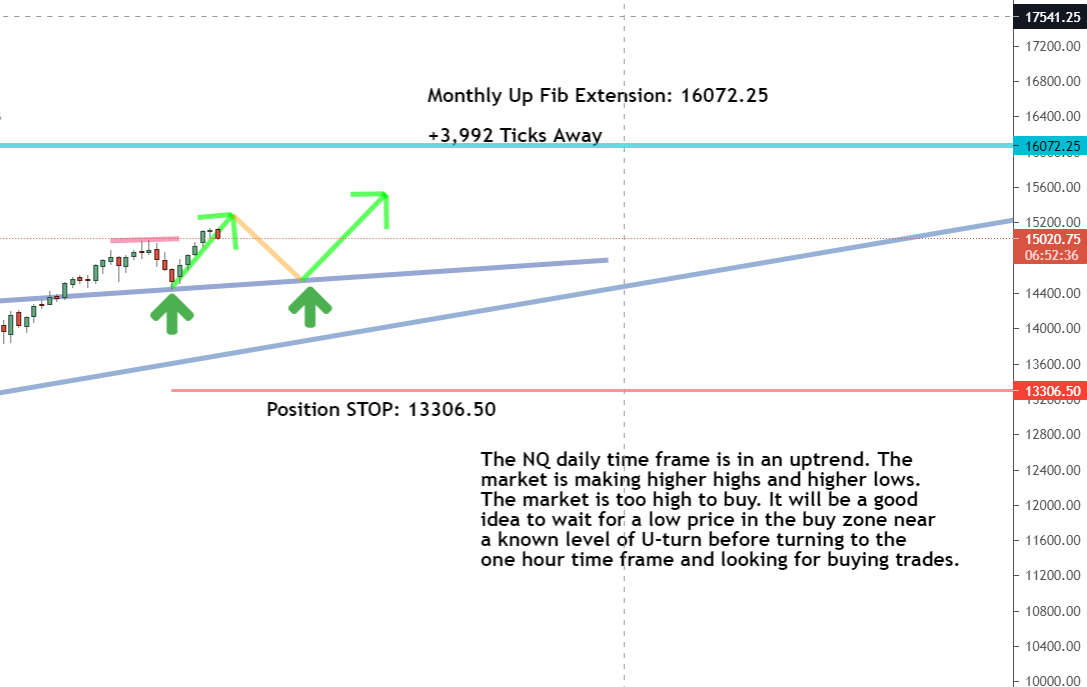

The NQ is clearly in a bullish trend within the daily timeframe. Just look at that steep climb on the chart!

We’re seeing higher highs and higher lows as the market continues to push north. But we’ve reached a point where the price is just too high to buy. It may sound weird, but there are times where we have to step back when the price of a market climbs too high. Check out this video I made that explains how market patterns work. It’ll help you see what I’m talking about!DAILY TIMEFRAME

The long-term direction is up for the NQ

The short-term direction of the market is up for the NQ

We’re waiting for the NQ selloff to bottom out and U-turn back bullish

Learn more about the Daily Direction Indicators here…

The NQ is still seriously pushing bullish. But the price is too high to buy right now, so we’re going to wait for a new low price at a known level of U-turn

And to really see how this all plays out, utilize this information I’ve gathered on future price movement predictions. You’ll need it if you really want to jump into futures trading fully prepared.

Now let’s look at the one-hour timeframe and discuss our options as we moved forward within the NQ:

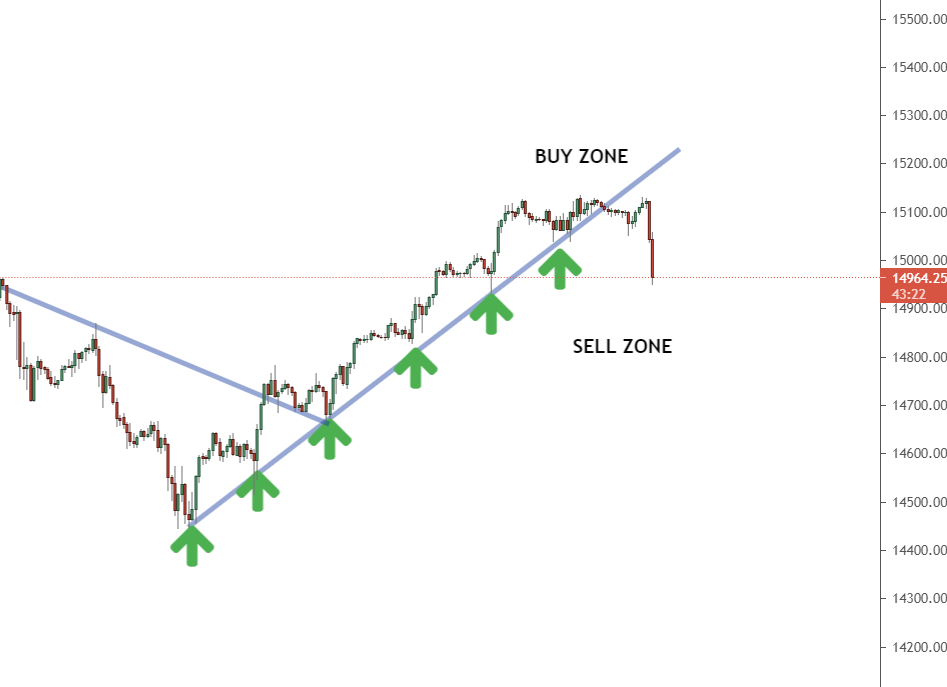

One-Hour Timeframe Analysis

We’re already seeing a price dip within the one-hour timeframe for the NQ. That’s what I mean when I say we want to wait for a lower price at a known U-turn level.

If you look at the dark green arrows in the chart, you’ll see where the market has historically U-turned. We want to see that again after the price drops. That means we’ve reached a new low price, and the market is starting to turn back positive. Such a move allows us to buy at a low price in the buy zone without the increased risk of the market dropping too low.

We’ll watch for a U-turn and prepare our entry strategy as the market retraces (temporarily drops in price)

But before you jump into the NQ when it turns around, you’ll need to know how to enter the market on a counter trendline break. Read this article if you want to get this trade right!The Bottom Line

We’re not buying the NQ just yet since the price is too high. But as the price retraces (temporarily drops) and heads back down towards support, we’ll watch our timeframe charts for signs that the market is U-turning back toward another bullish run.

That will be our signal to look for a low price within the buy zone and execute our entry strategy! This is a good example of how markets trade in waves.

For now, it’s best that we wait for a lower price in the NQ before we think about buying

So what are you waiting for? Dump the excuses and get started now! Follow along as I reveal the crucial aspects of my trading strategy that will allow you to become a profitable futures trader!

Keep On Trading,

Mindset Advantage: Own It

It’s not the market. It’s not your indicator. It’s you. Own it.

‘Oh that one was a mistake’…. and then there’s ‘I had the settings on my indicator wrong’… or our personal favorite: ‘I was trying an experiment’…

Like a 7th grade English teacher, after a while you hear them all. The number one thing we look for when working with a new trader? Accountability.

Own where you’re at with your trading. Embrace the failures and the setbacks. Stare them in the face with an unflinching honesty.

Only then will you conquer and advance to consistent profitability.Traders Training Session

Understanding Trading Margin and Managing Losing Trades

The post I’m waiting on the right price to buy… appeared first on Josh Daily Direction.