Hey, Ross here:

Markets have pulled back slightly over the past couple of days – which is completely normal.

Even with a few days of dips, the markets have completely defied the negative September seasonality thus far.

And if history is any indication – that bodes extra well for the rest of the year.

Chart of the Day

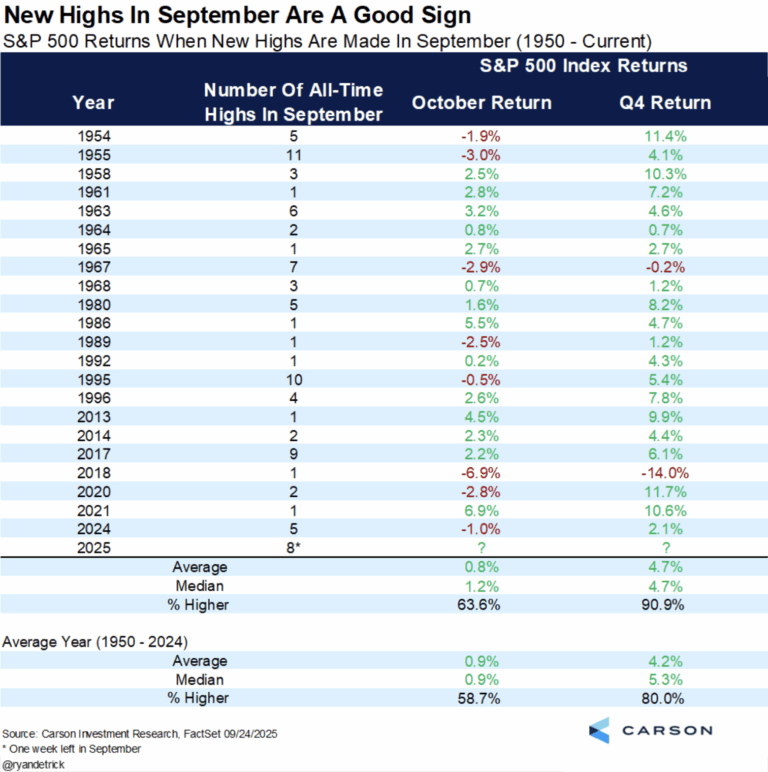

This table shows just how the market has performed in October and fourth quarter every time the S&P 500 has made new highs in September.

This data goes back 75 years…

Yet there are only 25 instances of new highs in September (including this year).

The good news is that every time there have been new highs in what is historically the worst month of the year…

It generally bodes well for the fourth quarter, which is higher 91% of the time with a solid 4.7% average gain for the period.

October is a much more mixed period however, although still generally positive.

So I wouldn’t be surprised if we see some choppy market action in the following month.

But given how strong the market action has been this month…

A choppy October would likely spark far more fear than is warranted.

And that’s an opportunity. I explain more below.

Insight of the Day

Considering how fragile retail sentiment is, a choppy October could spark a deeper pullback.

Here are the facts.

The Fed is cutting rates – but they’ve explicitly said that it’s largely to support the labor market.

Inflation is still running closer to 3% than the 2% target.

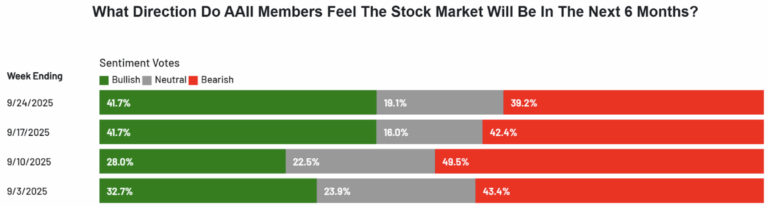

And while retail sentiment has recovered in the past couple of weeks thanks to the rate cuts…

The latest AAII survey shows that the bulls are just barely outnumbering the bears.

Remember, even before the Fed cut rates, we had seen nearly three months of consistently new all-time highs.

And yet, retail investors were still extremely bearish.

That means that should we experience the “October chop”…

We’re likely to see retail sentiment deteriorate once more – which would open up multiple opportunities.

Given the pullback over the past couple of days, we may even see this “October chop” start now.

That’s why tomorrow, Friday September 26, at 11 a.m. Eastern…

I’m going LIVE to show you how to exploit any market chop…

By following the trail of the insider money into potential wins like 771% in two months, 157% in two weeks and 321% in two days.

These insiders love to take advantage of market turmoil to buy up their own company stocks on the cheap…

Especially if they know there’s something big coming down the pipeline.

That’s what makes following their moves so powerful.

And tomorrow, I’ll show you the RIGHT kind of insiders you want to follow…

As well as the WRONG kind you want to avoid like the plague.

Just click here to secure your spot for my LIVE insider training tomorrow…

And I’ll see you Friday morning at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Traders Agency is the best thing to happen to me.

This team of stock gurus has educated me and helped me start earning money in my portfolio.

Been using the methods that TA teaches for 3 months now and increased my earnings.

Shout out to the Cartier Family for having Ross on their YouTube!

This is not a get rich quick scheme, this is to educate you on how to read the market and make decisions to earn money.

Thank you Ross and team for passing on your knowledge to me.

Looking forward to what the future holds.”

Ross Givens

Editor, Stock Surge Daily