Hello, Daily Direction readers!

The end of the year is quickly approaching, and that means we only have a few more trading days left in 2021.

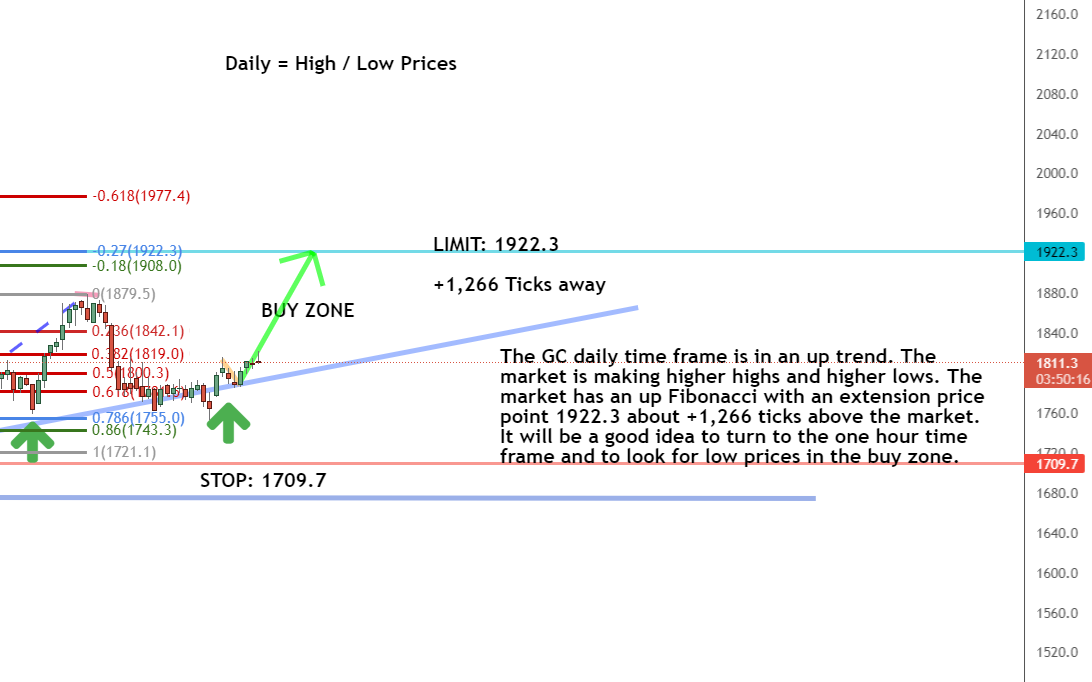

Right now, we’re watching gold futures (GC) as the market has bounced from the bottom of the channel and is headed back up toward a new high price!

We’re actively seeking for opportunities to purchase the GC market as a result of the move. We’ll look for any opportunity to implement our buy-in strategy with the GC as long as the market continues on this path.

This market has nearly +180 ticks toward our next price limit. That means we have room to make respectable profits from this trade!

Now’s the time to watch the GC for opportunities to buy in. Let’s look at the timeframe analysis to learn more:

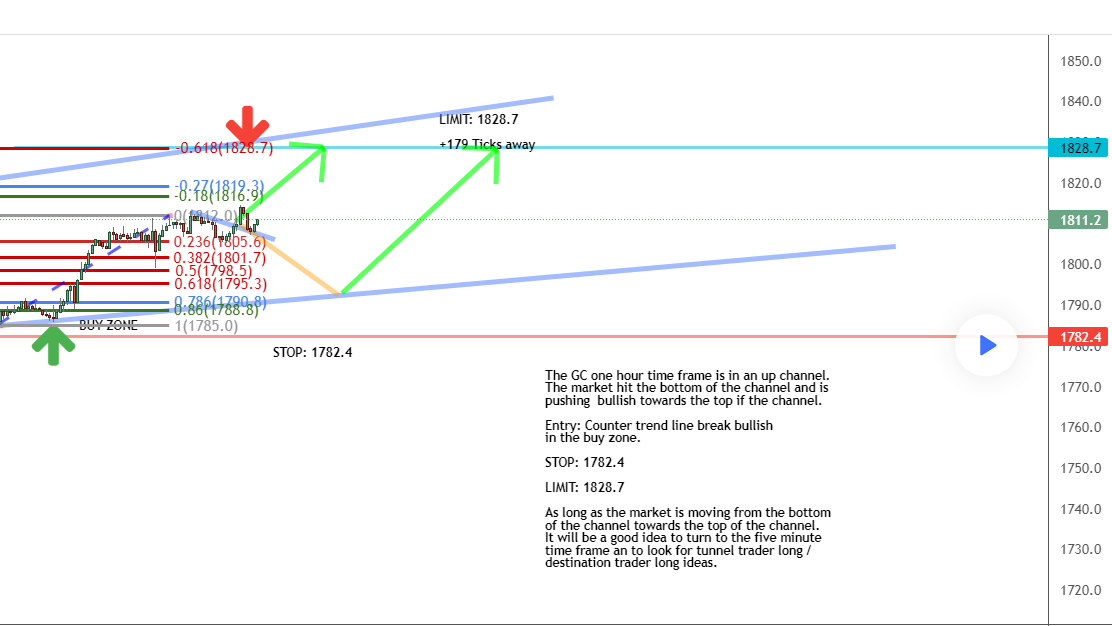

One-Hour Timeframe Analysis

According to our latest charts, the GC has broken through the counter trendline and is moving along in a bullish trend.

Keep in mind that we purchase low in the buy zone and sell when the market reaches high prices. That is the core principle of executing winning futures trades. Check out my free resources here if you want to learn more!

This is a good time to find low prices for the GC and make an entry while we can. We’re looking at approximately +180 ticks before the market hits our price limit of 1828.7

With the current market conditions, we’ll want to keep a close watch on the GC. While we want to take advantage of market opportunities, we also need to be aware of potential market developments that might force us out.

Your timeframe chart is the best way to monitor a futures market. Don’t forget that!

Learn more about the Daily Direction Indicators here…

The Bottom Line

As long as the GC remains in the buy zone, we’ll trade it. We’ll keep an eye on our one-hour timeframe charts for any opportunities to buy the market at low prices in the buy zone. If the market stays on track, we’ll trade until we hit our price limit.

We’ll take a break whenever the market reaches our limit and wait for a fresh positive trend to emerge. We have a higher chance of executing good trades with this setup if we keep to the foundations of our approach.

And if you watch me trade, you’ll immediately understand how my method can help you improve your trading skills!

You’d be completely lost if you didn’t have my strategy to guide you through the present GC futures market setup. Without a proper timeframe analysis, it’s difficult to see the potential market movements.

That’s why it’s time to start utilizing my knowledge and expertise!

Don’t be the one to miss out on this.

Keep On Trading,

Mindset Advantage: Ignore The News

Put the news in its place – once and for all.

Sure. They’re entertaining. They have a lot to say. And yes, they bring you information.

But when it comes to your trading, those talking heads can cost you a lot of money.

It’s their job to entertain and retain viewers – not give you the entry or exit you really need, let alone an insight that will provide an advantage.

Let’s face it: by the time it’s coming out of their mouth, the market has already responded.

So don’t let them whip you into a frenzy. Don’t take the information they provide and place a trade on it. Forget those talking heads!

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post Keep a Close Eye on This Futures Market appeared first on Josh Daily Direction.