Hey, Ross here:

The market today isn’t the same as the AI-driven bull market of 2023–2024 (or even 2025).

As I’ve been saying, we’re seeing a massive rotation in a “dispersed” market.

And to top all that off – as today’s chart shows – uncertainty is also at all-time highs.

Chart of the Day

This is the World Uncertainty Index.

It measures how often economic and political uncertainty is being discussed across major countries around the globe – essentially a gauge of how nervous the world feels.

And as you can see, it’s made a parabolic surge to all-time highs – and is now at levels far surpassing the pandemic, the Iraq war, or 9/11.

Yes, this isn’t a market-specific gauge.

But it does bleed over into investor behavior – and we’re seeing it reflected in the market right now.

The general sentiment is that no one knows where the market will go next.

Half believe the AI bubble is due to pop any second now…

The other half believe the bull market could keep going on for years.

As I’ve said before, the data is telling me it’s unlikely we’ll see a crash before the end of the year at the earliest.

And while I’m pretty confident in this outlook…

It’s clear that there is a huge swathe of investors out there who aren’t.

They’re fearful of what could come next.

But as I explain below – this is actually a major window of opportunity.

Insight of the Day

When retail sentiment crashes – the opportunity window opens

A couple of weeks ago, I said in this newsletter that it’s likely we’ll soon see a big dip in retail sentiment.

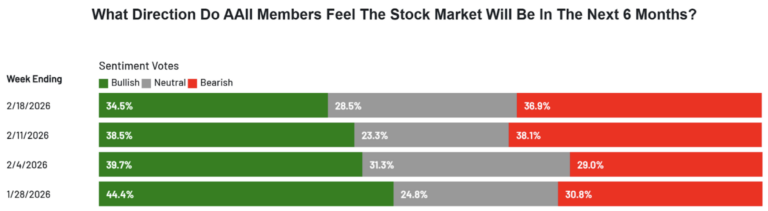

As the latest American Association of Individual Investors sentiment survey shows – that has just happened.

Two weeks ago, the retail bulls comfortably outnumbered the bears.

Today, things have flipped.

Fear is back on the retail menu.

And yet, at the same time that retail sentiment is crashing…

I’m seeing an uptick in corporate insider activity.

Coincidence? I don’t think so.

As retail becomes fearful, the insiders become greedy – because they recognize the opportunity to scoop up stocks at bargain prices.

That’s the opportunity we can go after as well.

That’s why in just a few hours at 11 a.m. Eastern today…

I’ll walk you through my proven strategy for targeting the most explosive insider trades.

I’ll reveal:

- Where to find these insider trades before the media catches on

- How to identify the highest-conviction insider moves

- The 3 counterintuitive insider buying signals I’ve tested over many years

As well as the type of insider trades you want to avoid.

So click here to lock in your free seat if you haven’t already…

And I’ll see you in just a bit at 11 a.m ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“By FAR !! the best way to understand the workings in the stock market. Ross and the team are the real deal, no BS.

I’m a lifetime full subscription member and couldn’t be more satisfied.”

Ross Givens

Editor, Stock Surge Daily