Hey, Ross here:

Today let’s look at a chart describing just how much “panic” there is in the markets.

Chart of the Day

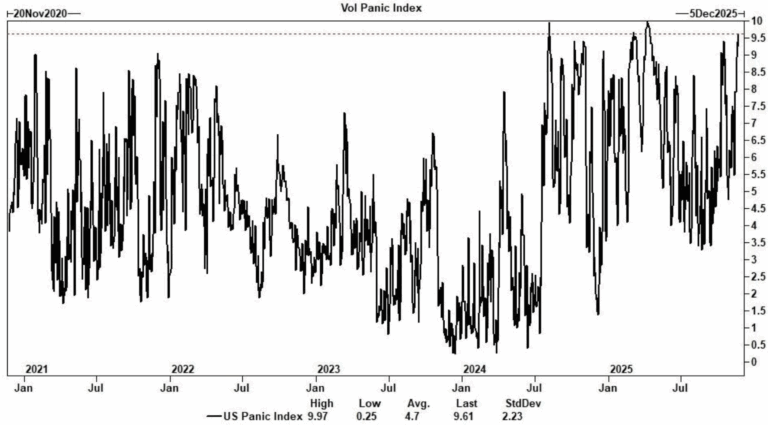

This is Goldman Sachs’ Volatility Panic Index.

It’s a proprietary chart that measures how much “panic hedging” professional investors are doing.

The scale runs from 0 to 10, where 0 means no fear and 10 means extreme fear. Over the past five years, the average reading has been around the 5 midpoint.

Right now, the index is sitting near 9.6 – one of the highest levels in the entire chart, and just shy of the five-year peak of 9.97.

What does that mean?

It means institutions have been buying protection aggressively.

They’re paying up for hedges, tail insurance, and volatility – all signs that big money is bracing for trouble.

But here’s the interesting part:

Historically, when the Panic Index spikes toward the upper end of its range, markets are already pricing in the worst.

And once that fear is fully expressed, stocks often stabilize and reverse higher as hedges unwind.

In other words, we may already have reached “peak panic”, with room for further upside from here.

Insight of the Day

Extremes always lead to opportunity.

This has nothing to do with being bullish or bearish.

Extremes at both ends tend to lead to opportunity.

But right now, the data is indicating extreme fear.

And while volatility is likely to remain elevated in the near term…

I think there are some great opportunities just waiting to be scooped up for those who know where to find them.

And that’s why in just a few hours at 11 a.m. Eastern today…

I’m going LIVE for my special State of the Market briefing…

Where I’ll break down in detail everything I’m seeing in the crazy markets right now…

And reveal the hidden opportunities I’ve spotted in the final weeks of 2025.

If this market has you confused or anxious, this is a briefing you don’t want to miss.

So just click here to guarantee your spot if you haven’t already…

And I’ll see you in just a bit at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross and his staff at Traders Agency are great.

Not only sharing profitable stock trades in real time, but also explaining everything in a common language and making me feel like part of a smart, thriving community.

I highly recommend.”

Ross Givens

Editor, Stock Surge Daily