Hey, Ross here:

Yesterday I talked about how the institutional buyers – the “big money” – were ruthlessly exploiting the flip-flopping sentiment around AI.

Today, let’s look at some proof.

Chart of the Day

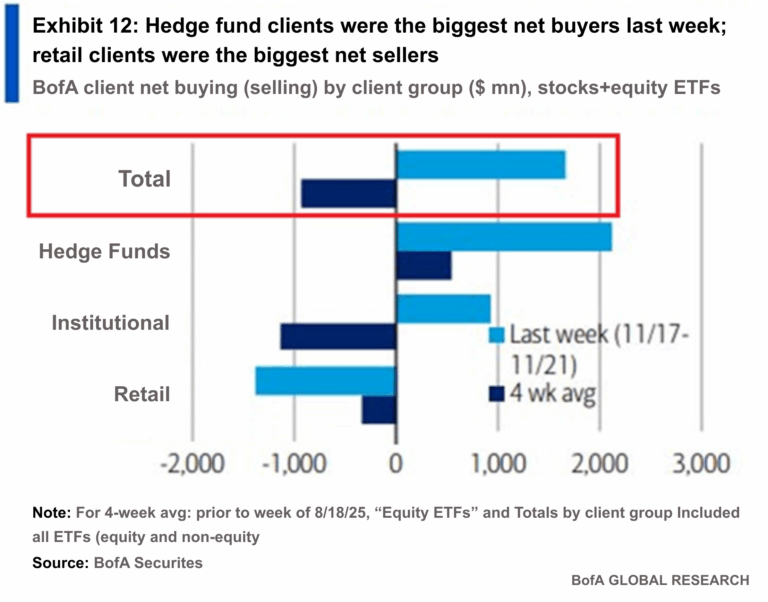

This chart shows the inflows and outflows for various investor classes for the week of November 17 (light blue bars) as well as the four-week average (dark blue bars).

If you recall, the low came in that week on Thursday, November 20 – something which I called.

And during the week of November 17, as today’s chart shows…

Retail investors were heavy net sellers…

While both institutional and hedge funds were net buyers.

In short, retail fled the market, while the “smart money” bought the dip.

If you were surprised by this…

Then you just haven’t been reading this newsletter enough.

On top of all that, historically speaking, late November is the strongest time for the market.

Insight of the Day

Retail traders are often treated as pawns by the institutions.

This is a harsh truth about the markets.

The retail crowd are often treated as nothing but pawns by the big institutional guys.

Either they’re used as “exit liquidity” – aka being the bagholders as the institutions dump their positions…

Or as in this recent case…

They’re the ones being “shaken out” of the market so that the institutions can buy in at better prices.

The sad part is, I don’t see this changing anytime soon.

As a whole, the retail crowd is just too fickle – their conviction too fragile.

But again, I’m talking about the retail crowd in general.

You don’t have to be a part of that crowd.

In fact, if you know how to spot the tell-tale signs of institutional buying…

You can actually flip the tables on them, and use their money for your profits.

And that’s what I’m going LIVE to show in a free broadcast at 11 a.m. Eastern later this morning.

I’ll reveal the “pressure points” that tell you when the institutions are targeting a stock…

And show you exactly how to get in before their big money flows send that stock surging.

So click here to guarantee your slot for my free live broadcast if you haven’t already…

And I’ll see you in just a bit at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“Ross and his staff at Traders Agency are great.

Not only sharing profitable stock trades in real time, but also explaining everything in a common language and making me feel like part of a smart, thriving community.

I highly recommend.”

Ross Givens

Editor, Stock Surge Daily