Right now, physical silver is being hoarded globally. This isn’t retail enthusiasm—it’s a systemic shift in how the world views hard assets.

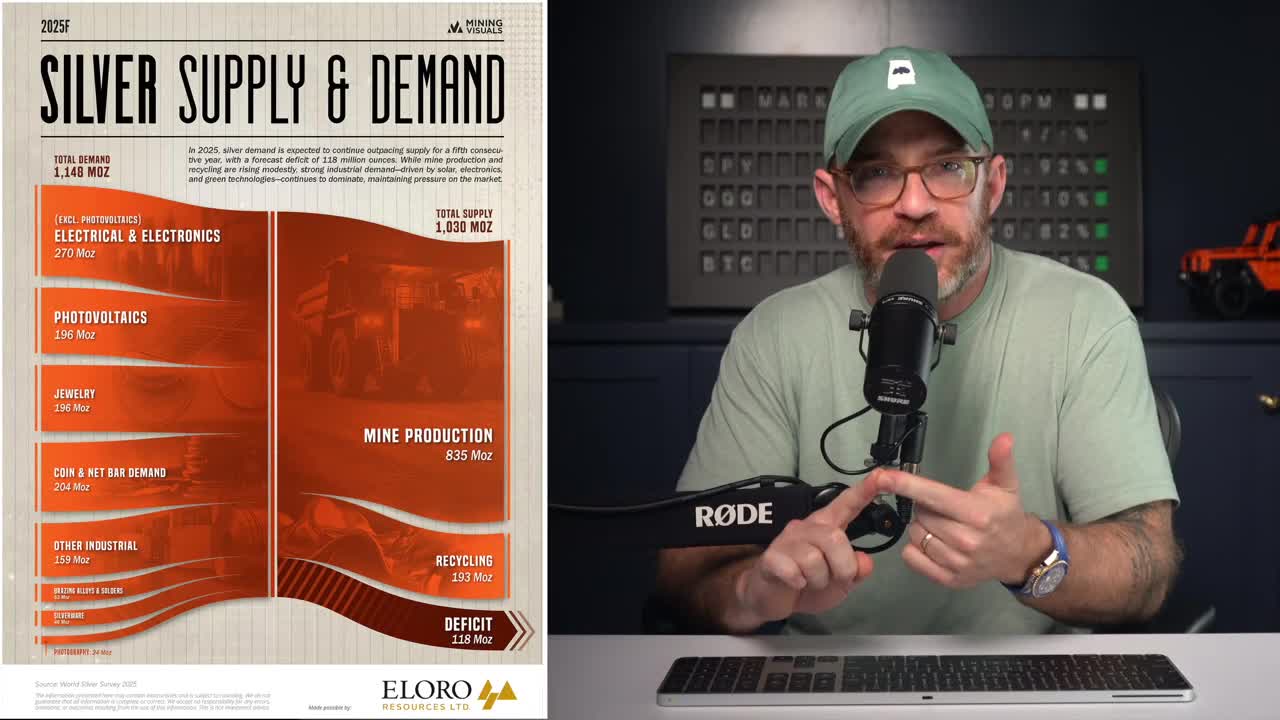

Supply can’t respond for years. National governments are stepping back into the market. We’re witnessing a collision of finite supply and unprecedented demand that nothing has been able to slow down.

The COMEX exchange just raised margin requirements on silver futures for the third time in a month. Historically, that kills a rally.

But today? The price keeps surging higher. This is a clear indicator why silver prices can’t be stopped right now.

This tells you everything you need to know. When the exchanges try to tap the brakes and the market accelerates anyway, you’re not looking at a bubble. You’re looking at a supply crisis. I believe we are still early in the silver run, and I’m continuing to monitor the silver buying opportunity into 2026 and beyond.

The “Physical Is King” Signal

Phil Baker, the president and CEO of Hecla Mining and a long time silver executive, recently sat down with Kitco during the Vancouver Resource Investment Conference. Baker isn’t a man who chases headlines. He’s been inside this industry for decades.

He just returned from the London Bullion Market Association conference, and according to him, the comment of the conference was: “Physical is king.”

That phrase sounds simple. The implications are massive.

While this has always been the thought process of diehard silver stackers, institutions have always been satisfied with paper. But today, everyone is trying to hold more physical silver at the same time.

We’re seeing this behavior from:

- Exchanges

- Manufacturers

- Governments

- Individuals

This is not speculation. Speculators want liquidity. They buy futures contracts, options, ETFs. You don’t purchase silver by the metric ton if you have intentions of selling anytime soon. It’s a logistical nightmare.

Instead, what we’re seeing is preparation. If this stuff were easy to produce, if it were cheap to replace, quick to ramp up, the price wouldn’t be doing what it’s doing right now. When the world collectively decides it wants inventory instead of efficiency, prices don’t need hype to move higher. They move higher because supply is finite.

The COMEX Shortage

The behavior at the exchanges confirms this shift.

Silver is the every man’s precious metal. Retail demand is the highest ever recorded. Exchanges are seeing buyers take physical delivery en masse. Before last year, this almost never happened.

As a result, COMEX has a shortage of physical supply.

Government Stockpiles Returning?

Phil Baker mentioned private conversations—while they haven’t been confirmed, they do seem credible—that people inside the administration are looking at increasing U.S. silver stockpiles.

The U.S. government hasn’t meaningfully stockpiled silver in decades. Even the discussion of doing that again changes behavior across the entire market.

Manufacturers start moving sooner. Exchanges tighten rules. Investors front-run the policy.

That’s how these cycles start.

Get an entire year of live weekly mentoring sessions, my newsletter, indicators, bonus reports, tons more. Click the link and I’ll see you in the next live session.

The Supply Cliff: 2016 Was the Peak

Here’s the data point that matters most: Global silver production peaked in 2016.

That was a decade ago. According to Baker, we won’t exceed that production level until at least 2030.

Think about the math. Even if silver goes to $500 an ounce, there simply aren’t enough projects that can come online in the next four or five years.

Just how crazy is demand right now? Major investors are pouring money into Bolivia—an area once thought to be uninvestable—just to access the country’s large silver reserves.

That’s a level of risk we typically don’t see unless the expected payout is huge. But even with tens of billions in fresh capital, meaningful production growth is still a good five years away.

Supply might grow someday. But not in time to solve what’s happening right now.

Why Copper Cannot Save Us

You’ll hear analysts talk about alternatives. There’s some talk about copper replacing silver, especially in solar panels.

Now it’s nowhere near as efficient. Sacrifices would have to be made. And in some applications, maybe. But if silver could be swapped for copper, they would have done it already. Silver is $80 an ounce. Copper is $6 a pound.

Manufacturers aren’t choosing to use silver because it’s pretty. They’re choosing it because it’s the only thing that works.

On top of that, there’s a shortage in copper too. The demand we’re seeing today—driven by AI, data centers, and electrification—is far bigger than anything that could be made up with marginal efficiency gains.

Even if industrial silver use softens a little, total demand keeps rising.

My Strategy and Price Targets

I’m putting my money where my mouth is. I bought another 100 ounces of physical silver just last week.

I had a target to add to my position if silver fell to $70 an ounce. On a Thursday night, it dipped even lower. By the time I placed the order, silver was down to $65.

Four days later, we were back up in the 80s.

This volatility is not a warning sign. It’s an opportunity.

Where is this going?

- Base Case: $200 an ounce. We could see this by the end of the year.

- 5-Year Target: $500 an ounce is more than realistic.

We have rising physical demand, potential government stockpiling, a decade-old production peak, and no near-term supply response. That isn’t a trade. That’s a structural setup creating a once-in-a-decade investment opportunity.

How to Get Exposure

1. Physical Silver

The diehard stackers will tell you: “If you don’t hold it, you don’t own it.” I do hold physical gold and silver.

Online brokers like APMEX and JM Bullion sell it in just about every form—coins, bars, even old quarters that are 90% silver.

All of it is selling for a premium right now. If you find anyone selling it on Facebook Marketplace at anywhere near spot price, jump on it.

2. ETFs (Exchange Traded Funds)

An easier way to buy silver—which you can do in your IRA or investment account—is via ETFs.

- SLV (iShares Silver Trust): Trades just like a stock and is backed by physical silver bars in secure vaults.

- SIL (Global X Silver Miners ETF): Holds a basket of silver mining stocks to give you broad exposure to the entire sector.

- SILJ (Junior Silver Miners ETF): Holds a basket of silver mining stocks to give you broad exposure to the entire sector.

We Are Still Early

The market is signaling a shortage that cannot be fixed with paper contracts.

We’re looking at a scenario where the world collectively decides it wants inventory over efficiency. The price action we’re seeing—where margin hikes fail to stop the rally and dips are bought aggressively—confirms that the bull run is just getting started.

I’ll continue to break this down clearly, calmly, and with real data every step of the way.

Because we are still early.

Get an entire year of live weekly mentoring sessions, my newsletter, indicators, bonus reports, tons more. Click the link and I’ll see you in the next live session.

DISCLAIMER: Traders Agency does not offer financial advice. The information provided is for educational purposes only and should not be considered financial advice. Traders Agency is not responsible for any financial losses or consequences resulting from the use of the information provided. Trading carries inherent risks and may not be suitable for all individuals. You are advised to conduct your own research and seek personalized advice before making any investment decisions, recognizing the potential risks and rewards involved.