Hey, Ross here:

The S&P 500 has hit just another all-time high – despite the government shutdown.

Some are saying this is a sign that things are getting a bit too stretched.

But as today’s chart shows – there’s still plenty of room for this rally left to run.

Chart of the Day

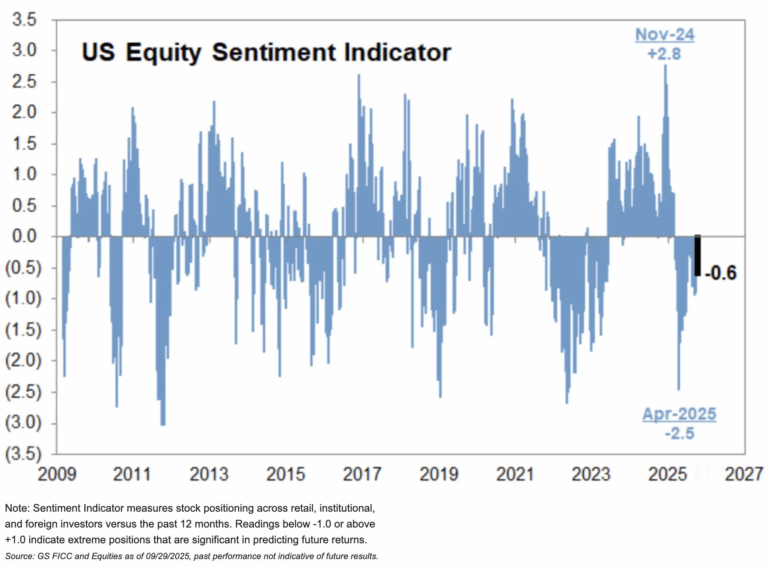

This is Goldman Sach’s US Equity Sentiment Indicator.

It basically measures stock positioning across retail, institutional, and foreign investors.

In other words, it is an overarching indicator that includes both the “dumb money” and the “smart money”.

The lower the values are below the zero line, the lighter the positioning in US stocks.

The higher the values above said zero line, the heavier the positioning.

The lightest positioning this year was in April 2025, which is completely expected. The value was -2.5.

Before that the heaviest positioning was in November 2024 – with a value of 2.8 – right after Trump’s election. Again that was also completely expected.

But right now, the value is still -0.6 – despite one of the strongest third-quarters in recent history, with the market hitting one new high after another.

US stock positioning is far from stretched.

In fact, we can say that overall investors are still underweight US stocks.

And that has critical implications for the rally – and the opportunities within.

I explain below.

Insight of the Day

There’s still a LOT of “dumb money” and “smart money” sitting on the sidelines.

I’ve talked a lot about how fickle the retail investors – the so-called “dumb money” – can be.

We’ve seen how fragile their sentiment is, even in a strong market.

However, as today’s chart shows, there’s still a lot of “smart money” also sitting out.

Now, unlike the retail crowd, they’re probably not hoarding cash.

They’re likely invested in other global stock markets – for instance, emerging markets – instead of US stocks.

But the practical effect is the same.

When it comes to US stocks, they’re effectively sitting on the sidelines.

That means there’s piles of money sitting outside the US market that could keep driving this rally higher.

As I said, investors as a whole are actually underweight US stocks.

Of course, the average trader has no clue that this is the case.

With the clickbait news screaming about “overvaluations” and “bubbles” everyday…

Most people probably think that investors are overweight US stocks instead.

Now, if you look at the chart again…

You can see that although the indicators are still below zero, they’ve been steadily increasing over the past few months.

That means the money – especially the “smart money” – is steadily flowing into US stocks.

That’s the opportunity.

And that’s why tomorrow, Friday October 3, at 11 a.m. Eastern…

I’m going LIVE to show you a time-tested strategy for tracking these smart money moves…

And following them to explosive opportunities regardless of the headline drama.

It’s a strategy that’s led us to wins of 51% in 15 days… 77% in three weeks… and even 87% in just 24 hours.

I’ll walk you through it step by step tomorrow…

And even share details of some fresh opportunities the smart money is piling into right now.

It’s free to attend but space is limited…

So click right here to reserve your seat now…

And I’ll see you Friday at 11 a.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I’m not someone that usually leaves reviews, however, if I could give more stars I absolutely would!

I am currently enrolled in two of their courses.

I knew NOTHING about the stock market when I joined back in March after seeing Ross on The Cartier Family YouTube Channel.

Ross and Jean have rather quickly taught me how to navigate the market. They are so patient with ‘newbies’ like me and have eagerly answered my questions with demonstrations.

I would highly recommend this down to earth and knowledgeable team to anyone that is on the fence about joining.

Just take the leap and watch your wallet grow!”

Ross Givens

Editor, Stock Surge Daily