At the end of September, the S&P 500 (ES) futures market closed firmly below its monthly up trending support level.

What that tells us is that the ES is still stuck in a short term down trend and should continue to push bearish.

At this point, there is a daily down Fibonacci level at 3,199 as well as a monthly down Fibonacci level at 3,026.

These extension levels each represent a potential downside move of over 2,000 ticks, but finding the proper entry is going to be important…

Waiting for an Entry

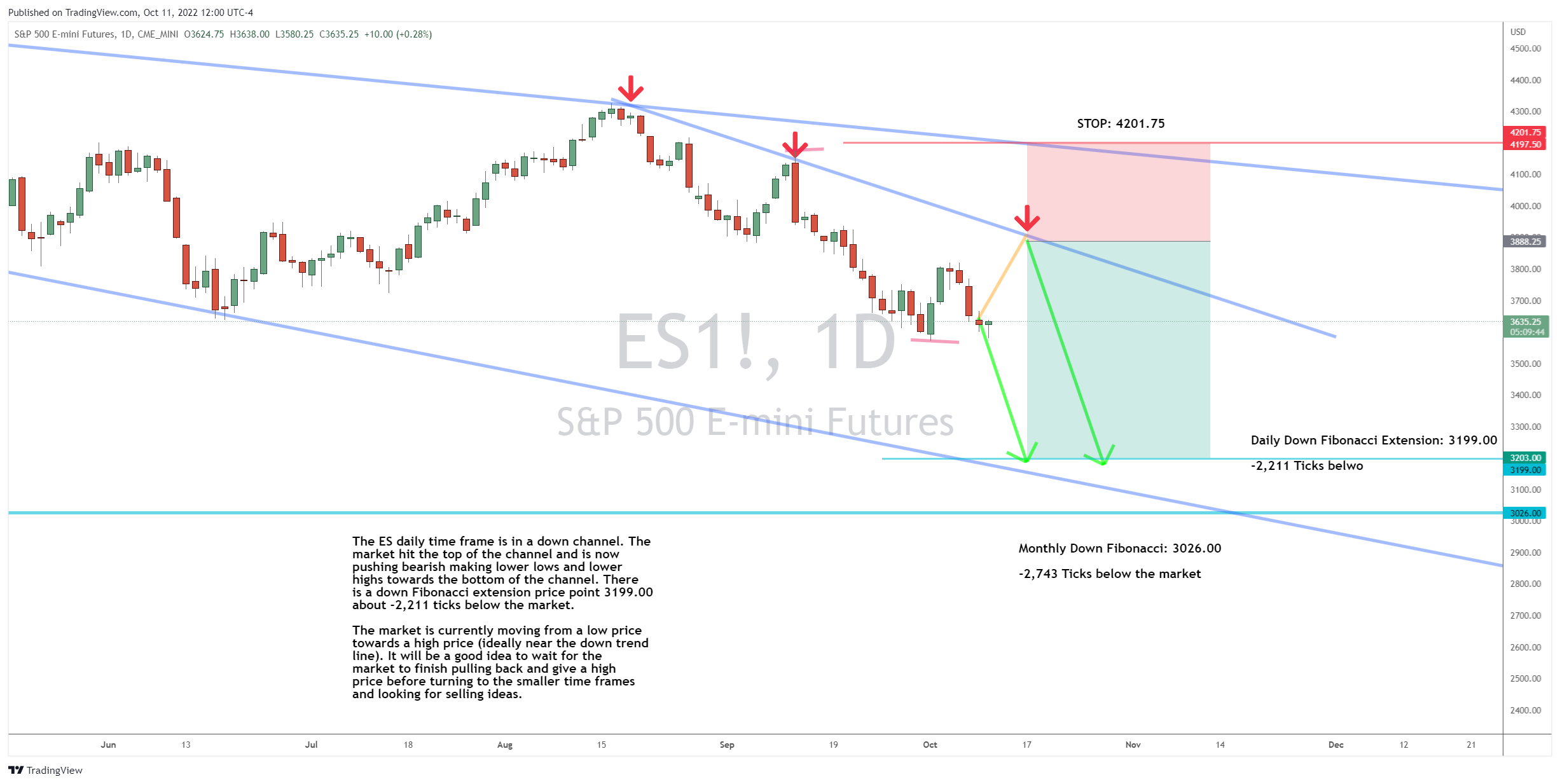

Here’s how the daily chart is shaping up for the ES market…

The ES daily time frame is in a down channel.

The market hit the top of the channel and is now pushing bearish making lower lows and lower highs towards the bottom of the channel.

There is a down Fibonacci extension price point 3,199.00, about -2,211 ticks below the market.

The market is currently moving from a low price towards a high price (ideally near the down trend line).

Therefore, it will be a good idea to wait for the market to finish pulling back and give a high price before turning to the smaller time frames and looking for selling ideas.

The Bottom Line

There are multiple ways to trade the futures, stock and other markets. We can trade the indexes, both up and down, as well as individual stocks.

But with inflation on a fast-track, you need to know how to amplify your gains. To see how I do it, check out the link in the P.S. below…

For more on the markets as well as trading education and trading ideas like this one, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my stock and futures contract trading tutorials as well as some additional trading ideas.

And if you know someone who’d love to make this a part of their daily trading routine, send them over to joshsdailydirection.com to get signed up!

Keep on trading,

P.S. Trading is not just a great job for building a portfolio… It can also act as the foundation for a side job for the right trader.

To learn more on how you might build a side job from trading, I have put together a special tutorial.

The post S&P 500 Futures Gearing Up for a 2,000-Tick Move? appeared first on Josh Daily Direction.