Hey, Ross here:

After the Wednesday dip, markets ripped to new highs yesterday.

But the one area of the market I’ve got my eye on right now?

Small-caps.

Chart of the Day

This is the small-cap Russell 2000 surging to a new high.

Its previous all-time high? November 2021. That’s 969 days ago.

That 969 day gap between all-time highs is the longest dating back to 2000.

So the fact that small-caps are ripping to new highs again is a great sign for risk appetite.

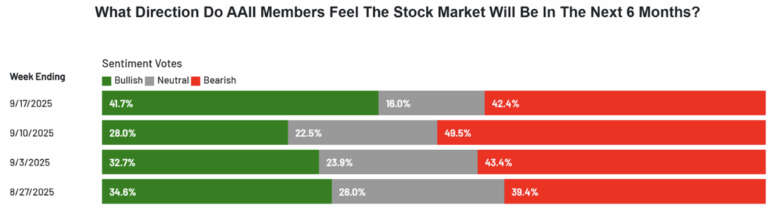

Bullish sentiment among retail investors – as measured by the weekly American Association of Individual Investors (AAII) survey – has also taken a big jump.

But beneath that bullish sentiment surge, there’s a critical lesson about trading there.

Did you manage to catch it from the chart?

Here’s a clue – it’s all about the date the latest survey was taken.

If not, I explain it below.

Insight of the Day

One of the most important thing to know as trader is to know which way the money is flowing.

Notice the date of the latest AAII survey – Wednesday, September 17.

This was right after the Fed cut rates by 25 points – and before the market ripped higher yesterday.

That cut is what caused the big surge in bullish sentiment.

It couldn’t have been the price action, since the market had already hit new highs the week prior.

But the thing is – that 25 point cut was nearly unanimously expected. Absolutely no one should have been surprised.

And yet – the individual investors needed to see the rate cut first-hand before they turned bullish.

That’s what I mean when I say that retail sentiment is a lagging indicator.

I’ve said it before…

But I hope that this example helps drill it in further.

Because if you want to beat the masses, the first step is to understand why you can’t follow them in the first place – because they’re always one step behind.

The second step?

Following the ones that are consistently ahead instead.

And that’s what I’m going LIVE to show you in just a few hours at 11 a.m. Eastern…

How to track down the money flows of the “smart money” that are always ahead of the game…

So you can follow them into stocks that are poised for an explosive move higher.

The strategy I’ll be demonstrating has led to wins of 51% in 15 days… 77% in three weeks… and even 87% in just 24 hours.

I’m going to walk you through it step by step…

And even share details of some fresh opportunities the smart money is piling into right now.

So click here to guarantee your spot for my live training session if you haven’t already…

And I’ll see you in just a bit at 11 a.m. ET.

Customer Story of the Day

“Ross has been a consistent investment pro, guiding me for the past 2 years.

I’ve made a profit of $21,000 in that time frame.

His live Zoom’s are personal and profitable.

Calls them like he sees them, no BS! I’ve just upgraded to life membership.”

Ross Givens

Editor, Stock Surge Daily