Hey, Ross here:

And before I announce what the fear-mongering mainstream media won’t, here’s an actionable trade idea to start your week.

Chart of the Day

Datadog (DDOG) is trying to put an end to what has been a vicious Stage 4 downtrend.

The stock fell 68% in last year’s bear market but is now rising quickly off the lows.

DDOG has reclaimed its 200-day moving average (white line on chart) for the first time in over a year after reporting better-than-expected earnings numbers last week.

The stock has stalled just under $90 per share where it has seen resistance previously. I would like to see the stock consolidate for a few days in this area (yellow triangle) to digest any sellers and then break out to new highs.

A move through $90 on above average volume would be buyable for me.

P.S. Would you like special trade prospects and potential market moves sent directly to your phone? Text the word ross to 74121.

Insight of the Day

THE BEAR MARKET IS OVER.

CNBC doesn’t have the guts to say it – so I will.

The bear market is OVER.

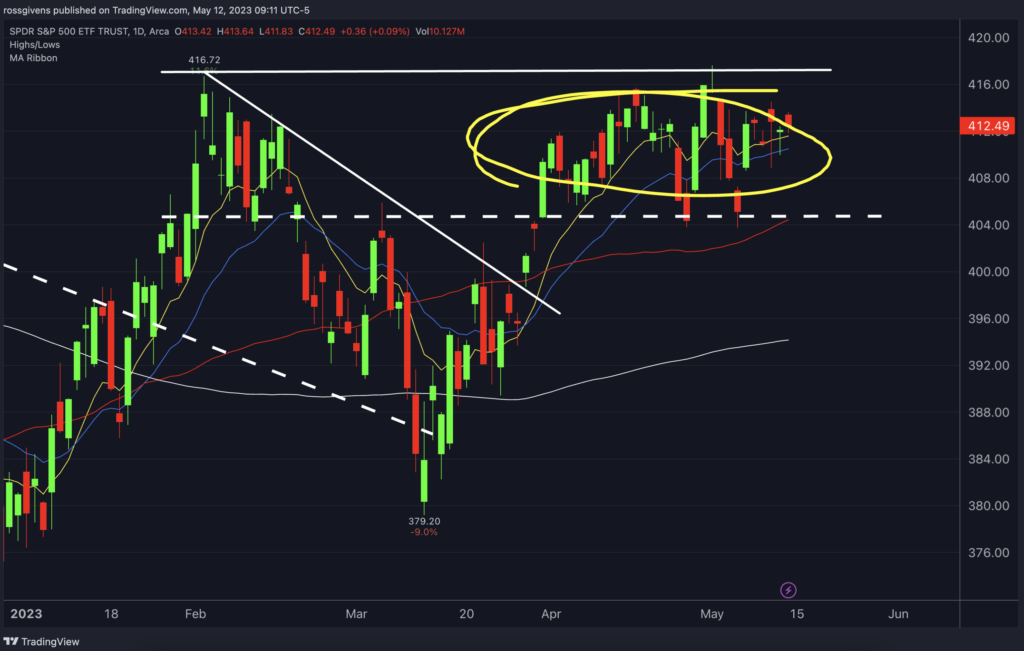

Sure, the market hasn’t been going anywhere – stuck in a tight range for the past 6 weeks.

The perma-bears think of this as bad news. For me, it’s just the opposite.

You see, excluding anomalies like the 2020 V-shaped correction, markets do not go straight up after a bear market.

There is a period of backing and filling that takes place as bulls and bears battle it out for direction.

Stubborn bears who are convinced we have lower to go sell into the initial rallies and cap the moves higher.

This causes pullbacks which are bought by bullish traders trying to build back the positions they sold in the bear market.

These conflicting forces cause range-bound action which can be frustrating to say the least.

But stocks are holding up well. And sellers are no longer in control.

We are nearing the end of earnings season and the results have been good overall. Bad numbers from any of the key players could have sent the major indexes tumbling. More dovish language from Powell at last week’s Fed meeting would have also been trouble.

But the market survived these potential landmines and held its ground.

It has been 214 days since the market made a low. Bears are steadily throwing in the towel, and we have seen a series of higher highs and higher lows.

So let me repeat it again – the bear market is over.

Pullbacks should be bought, and investors should focus on market-leading stocks that have made the largest advances since the October low.

I’m sharing some of these leading stocks right here on this newsletter.

But if you want to get a hold of all of them – and earlier than the rest – then be sure to read this.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily