Hey, Ross here:

Wall Street is more interested in Nvidia’s earnings later today than Trump’s firing of Fed governor Lisa Cook.

Nvidia is likely the most influential stock in the world right now, so I can’t say I’m surprised.

Speaking of earnings, here’s a quick question:

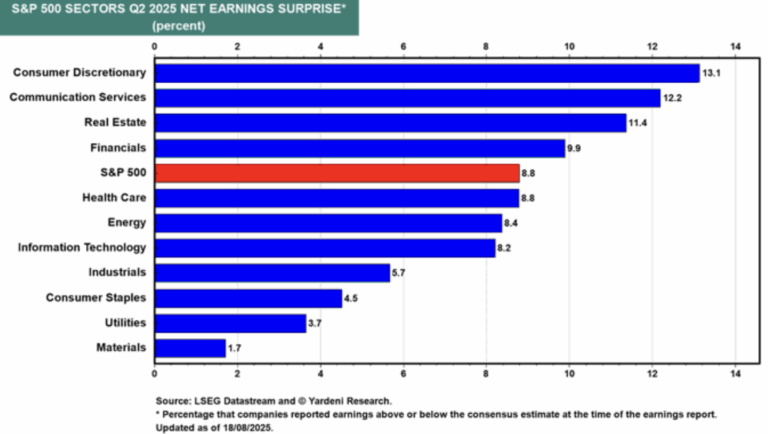

Which sector do you think surprised the market the most during the latest earnings season?

If you said tech… you would be wrong.

Take a look below.

Chart of the Day

This chart shows what percentage of each sector reported an earnings surprise – i.e. earnings above expectations – for the recent earnings season.

As you can see, the sector with the highest level of positive earnings surprises was consumer discretionary – not tech.

If you go deeper, this makes sense.

For months now, sentiment surveys have shown consumer confidence steadily falling…

So it’s no surprise that expectations of the consumer discretionary sector were so low…

Especially when you factor in all the doom and gloom being constantly peddled by the clickbait media.

Remember, in the markets, expectations don’t always match the underlying reality.

And in fact, we don’t want them to…

Because this mismatch is how opportunities are created.

I elaborate more below.

P.S. Yesterday evening, I released my latest edition of 2 Trades in 2 Minutes – completely free. If you missed it, it’s probably because you weren’t on the SMS list. Text the word “trade” to 87858 to get on the list, and ensure you’ll get the next edition instantly when it’s out.

Insight of the Day

Earnings releases can cause big price moves because they “reset” expectations.

But expectations are always subjective – inevitably influenced by the media and overall sentiment.

While earnings numbers are purely objective – cold hard numbers. They’re reality.

When earnings numbers are released, the market compares them to the expectations.

If there’s a big mismatch, the expectations are effectively “reset”.

And since the market trades on expectations, a big “reset” also causes big price moves.

That’s the opportunity.

And if you know which direction those expectations could be “reset” in…

You can easily exploit this opportunity.

Nvidia’s earnings later today could cause a big “reset” in expectations not just for its stock…

But for the ENTIRE market.

That’s how important it is.

And that’s why later this afternoon at 3 p.m. Eastern…

I’m hosting a LIVE briefing ahead of Nvidia’s earnings call…

To show you exactly how a select group of traders are exploiting earnings releases to make trades that even Wall Street can’t beat.

I’m talking about the corporate insiders…

Those who already know what the numbers are going to say before anyone else does…

And are legally trading on this information thanks to an SEC loophole.

In my live briefing later, I’m going to show you my exact strategy for mirroring these insider moves…

A strategy we’ve used to find wins of 771% in two months…157% in two weeks… even 321% in two days…

Plus, I’ll also hand you the details of three stocks insiders are loading up on right now.

So click here to guarantee your seat for my live briefing if you haven’t yet…

And I’ll see you later this afternoon at 3 p.m. ET.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

Customer Story of the Day

“Life changing! Literally.

I immediately realized within a week how great and low risk Ross’s strategies are!”

Ross Givens

Editor, Stock Surge Daily