Hey, Ross here:

Metals are the trade of 2026. Copper, gold, silver — they’re all making historic moves right now. And this isn’t some temporary blip. It’s the beginning of something much bigger.

A perfect storm of factors is creating an investment opportunity unlike anything I’ve seen in years. What comes next isn’t speculation. It’s inevitable.

Copper Just Exploded

Copper ripped 8.5% overnight, hitting new all-time highs at $6.68 a pound. Gold just posted its biggest two-day move in years. Silver touched $120 an ounce.

But the headline numbers only tell part of the story. The underlying dynamics are even more compelling.

Look at that candlestick on HGN2026 — a massive vertical spike, up 10.67% in a single session. The price broke sharply away from the previous trend in a parabolic move.

I bought this contract live a couple of days ago. Already up $14,000 on the position.

Five Forces Driving This Rally

What’s behind this metals mania? Five key factors are converging at once.

1. Inflation Won’t Quit

Year-over-year inflation sits around 2.7% — and that’s the government’s number, which likely understates reality. Either way, it’s still above the Fed’s 2% target.

Above-average inflation lifts prices on everything. Eggs. Milk. Copper. Silver. All of it.

2. A Shortage Is Building

This isn’t theoretical. People are actually taking delivery now, exposing the leverage baked into the system.

Think of COMEX like the New York Stock Exchange for metals. Big institutional buyers typically trade paper contracts, not physical metal. Historically, the exchange held far less physical inventory than the contracts represented. That’s fine — until everyone wants their metal at once.

3. Demand Surging, Supply Flatlining

Copper demand keeps climbing, driven by the AI boom and massive grid expansions. Meanwhile, supply is flatlining. Even declining in some cases.

All the good high-grade mines have been tapped. Billionaire mining mogul Friedland put it bluntly: we need to mine as much copper in the next 18 years as we have in the last 10,000 — just to keep pace with demand.

That’s not going to happen. When everyone wants something and there’s not enough of it, prices go up. Simple as that.

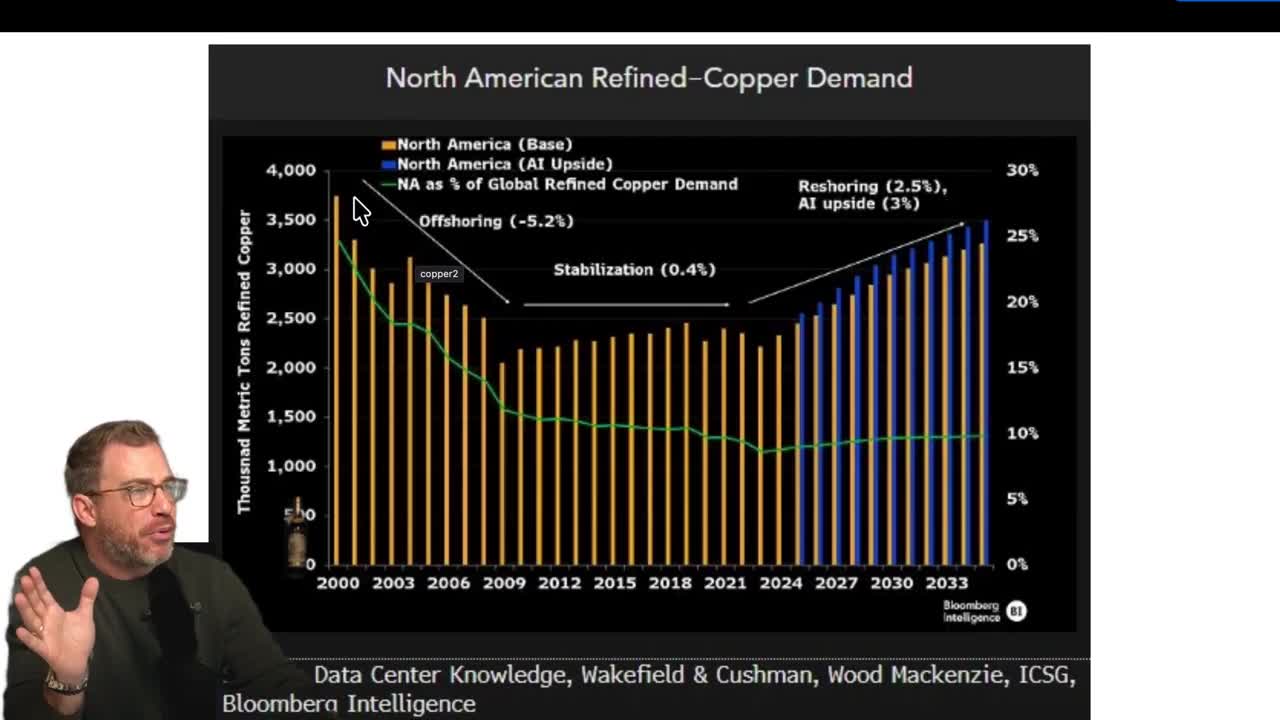

From 2000 to 2010, offshoring crushed North American copper demand by 5.2%. Now? Reshoring and AI are projected to drive 2.5% and 3% growth respectively. The trend has completely reversed.

4. Tech Giants Don’t Care About Price

Who’s consuming all this copper? OpenAI. Google. Amazon. Microsoft.

These trillion-dollar companies won’t pause their AI buildout because copper jumped from $6 to $16 a pound. For them, the price is almost inconsequential. That makes demand nearly inelastic — they’ll pay whatever it takes.

5. The Dollar Is Sinking

When the dollar falls, it takes more dollars to buy the same assets. The US dollar index is down 13% since this time last year.

A declining dollar acts as a tailwind for asset prices across the board. Stocks go up. Commodities go up. Metals especially.

The Silver Squeeze

Silver’s situation is particularly acute. Bloomberg’s data shows inventories falling off a cliff while prices surge higher.

Classic squeeze dynamics. When physical supply dries up and paper claims keep stacking, something has to give.

Mining Stocks: Leveraged Upside

Here’s another way to play this: mining stocks.

If it costs $20 an ounce to mine silver and you’re selling at $120, your profit margins explode. The leverage works in your favor.

Track their earnings closely. Moomoo’s earnings calendar is a solid resource — just hit market analysis and pull up the calendar.

Names I’m watching:

- Southern Copper — February 11th

- Teck Resources — February 20th

- Pan American Silver (AG) — February 23rd-24th

- Royal Gold — February 18th

Become a member of my Black Ops Trading Club to get access to my live classes every Monday and Thursday.

Aluminum: The Backup Play

I’m adding aluminum to my watchlist too. It’s an alternative to copper at about a quarter of the price. Not as durable, safe, or efficient — but it’s the cheap backup option when copper gets too expensive.

Even the backup metal is ripping higher.

Trump’s Dollar Problem

President Trump recently said the dollar is “doing great.”

The DXY tells a different story. The US dollar index is collapsing at a record pace — down 13% year-over-year. That means it takes 13% more dollars to buy the same goods today versus last year.

Politicians can say whatever they want. The charts don’t lie.

Risk Appetite Is Surging

This isn’t a cautious environment. Goldman Sachs’s Risk Appetite Indicator just hit its highest level since the 2021 post-COVID bubble.

People are getting rich. And they’re putting that money to work.

The Bottom Line

Let me lay it out:

We have a major shortage building in crucial metals and minerals. Demand for copper, silver, aluminum, and steel is surging while supply can’t keep up. The US dollar is declining. Investor risk appetite is at five-year highs. And inflation remains stubbornly above target — likely heading higher.

It doesn’t get more obvious than this.

Metals are the play. Own them physically. Own them through stocks. Own them through ETFs. Get some exposure in this space.

This is the trade of 2026. My foot is fully on the accelerator.

If you want a deeper analysis on where capital is rotating next — and how to position before the crowd — become a member of my Black Ops Trading Club. I provide updates like these every Monday and Thursday in my live classes.