Hey, Ross here:

Nvidia just crushed earnings expectations once again.

Its stock shot up nearly 5% in the afterhours – no small feat for a $4+ trillion stock.

It’s also helped ease concerns about AI overvaluations, though those won’t go away anytime soon.

And of course, with Nvidia stock rising…

It also means that it’s going to be taking up an even bigger share of the major indexes – sparking even more risks of market concentration.

So, for today, let’s look at just how this stacks up against the rest of the world.

Chart of the Day

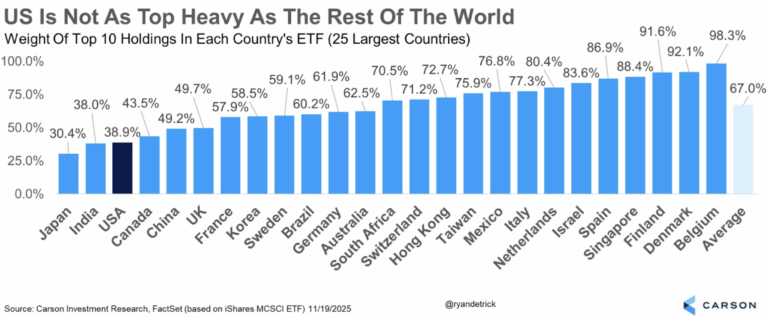

The 10 largest stocks make up 39% of the S&P 500.

It seems like a lot – and make no mistake, it is. There is no denying the major indexes are highly concentrated.

But as you can see from the chart above…

This is par for the course almost everywhere else.

In fact, we’re actually far less concentrated than many other major stock markets.

Again, I’m not saying that concentration isn’t a risk. It is.

But it’s even worse everywhere else.

And remember, when it comes to the institutional dollars – the real market movers – they have to stay invested.

They can’t go to cash, and most of them can’t suddenly just switch asset classes (like going into bonds).

They have to stay in stocks.

They can choose to invest in non-US markets (though many of them are mandated to only invest in US stocks), but they’re “stuck” with equities.

And most major markets are even more concentrated than the US.

So, although the clickbait media may try to scare you with the narrative that institutional money may be fleeing the US markets for greener pastures…

Don’t believe them.

Plus, as I explain below…

Market concentration can actually be a good thing.

Insight of the Day

If everyone is focused on the top stocks, that leaves more opportunities for traders focused on the smaller stocks.

Let’s bring this back to Nvidia.

The stock added nearly $300 billion in market value in hours.

That’s a very impressive number you’ll definitely see the media latch on to.

But if you had bought right before, you would still only be up 5%.

And yet, it’s all people are going to be talking about.

Meanwhile, the smaller stocks that could easily jump double-digits – or even more – during earnings?

Barely anyone is paying attention to them.

Trading volume is thin, which means it only takes a relatively small amount of money to send their prices surging.

Some of the world’s best investors make an absolute killing with this tactic.

And tomorrow, Friday November 21, at 11 a.m. Eastern…

I’m going LIVE to show you exactly how they do it.

I followed these investors into Matador Resources before an 1,868% move…

And while returns like those are extraordinary…

Following these investors has pinpointed multiple triple-digit moves – especially around earnings season.

I’ll show you everything tomorrow.

Just click here to let me know you’re coming…

And I’ll see you Friday morning at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“I’m not someone that usually leaves reviews, however, if I could give more stars I absolutely would!

I am currently enrolled in two of their courses. I knew NOTHING about the stock market when I joined back in March after seeing Ross on The Cartier Family YouTube Channel.

Ross and Jean have rather quickly taught me how to navigate the market. They are so patient with ‘newbies’ like me and have eagerly answered my questions with demonstrations.

I would highly recommend this down to earth and knowledgeable team to anyone that is on the fence about joining. Just take the leap and watch your wallet grow!”

Ross Givens

Editor, Stock Surge Daily