Hey, Ross here:

The Fed is almost certainly going to hold rates steady today.

If they cut again, it would be a massive (though positive) shock for stocks.

Even with them likely holding rates flat though, Powell flapping his lips at the afternoon press conference will still most likely send ripples through the market.

But for this morning, let’s look at how – despite all the rhetoric around the “overvalued” U.S. market…

The money keeps flowing in.

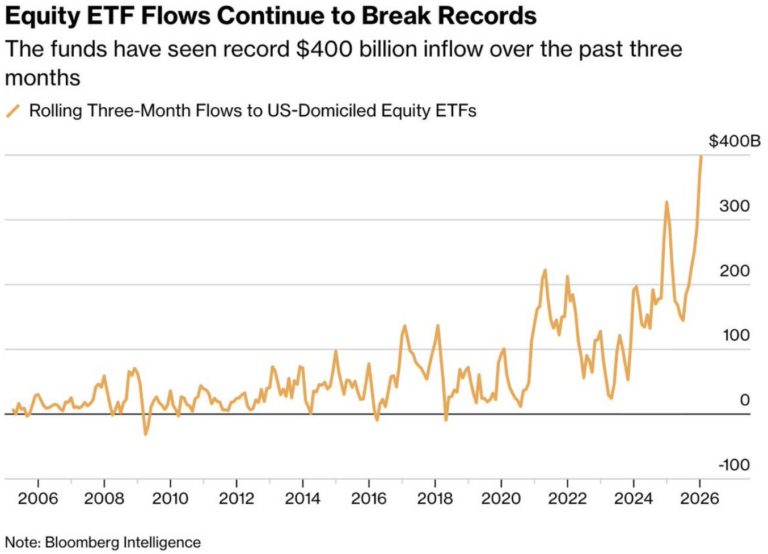

Chart of the Day

Yes, the dollar just fell to multi-year lows – while gold has printed new fresh highs.

Yes, compared to other countries’ stock markets, the U.S. has relatively underperformed.

And yes, there are real and legitimate concerns about whether the valuations of some of these tech companies have run too far ahead of fundamentals.

But as you can see from the chart above…

Despite all of that – the money still keeps pouring in.

Investors – both domestic and global – can’t get enough of the American stock market.

And it’s not showing signs of slowing down either.

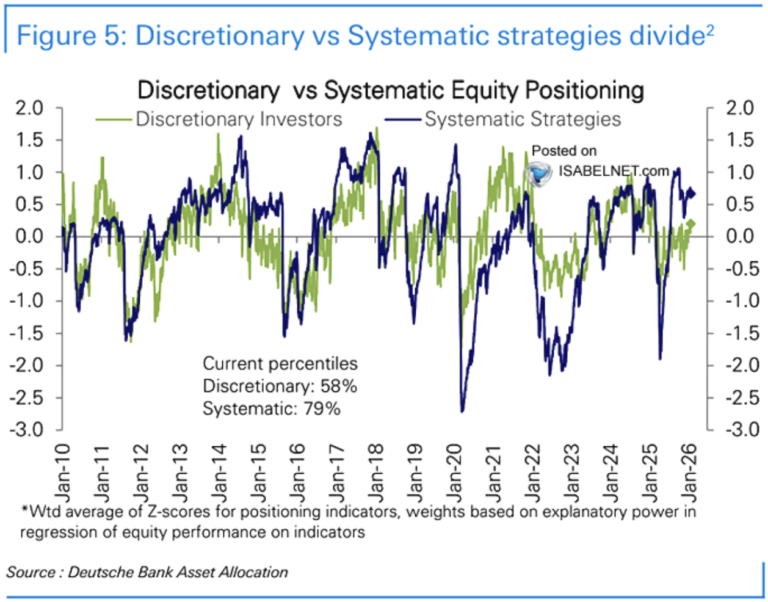

Take a look at this chart.

It shows how invested two different kinds of investors – systematic and discretionary – are in equities.

Systemic strategies are basically rule-based systems that automatically follow trends.

Discretionary strategies are the stock pickers.

Institutional investors comprise both these types of investors, by the way.

Anyway, as you can see…

While systematic strategies are currently heavily invested in equities (not surprising as we are at all-time highs)…

Discretionary strategies are still under-positioned – suggesting that this rally still has plenty of juice left.

So to sum it up…

The money is not only flowing in…

But there’s still plenty of money out there not invested in America equities that could keep this rally going.

Insight of the Day

You want can take advantage of both the systematic and discretionary institutional investors.

Right now, the market’s trend is unmistakably upwards.

We can see this clearly in how heavily positioned the systematic investors are.

And there are still plenty of discretionary investors waiting on the sidelines, waiting for the right opportunity to pop up.

We can take advantage of both these kinds of investors by targeting their money flows.

Now it’s true that both these kinds of investors are different.

Why they buy is not the same.

But the WAY they buy?

Once you see it, you’ll never look at the market the same way again.

Yesterday morning, I went live to reveal a formula for tracking these institutional “footprints” to see precisely where they’re moving their money…

And even revealed details of some of the top trades they’re piling into right now.

Every single trade this formula spotted this month alone is up double-digits.

And this could be just the start.

So if you missed my live session yesterday…

Customer Story of the Day

“Ross and his team are very knowledgeable about swing trading successfully, and are honest about how to get there.

Super grateful for Ross’s insight into market activity, I swear the guy doesn’t sleep, constantly providing videos and educating any one who wants to make money in the market!”

Ross Givens

Editor, Stock Surge Daily