Good morning, Daily Direction readers!

We’re keeping a close eye on the markets right now, as volatility has increased across the board. But it doesn’t mean the futures market isn’t full of opportunities.

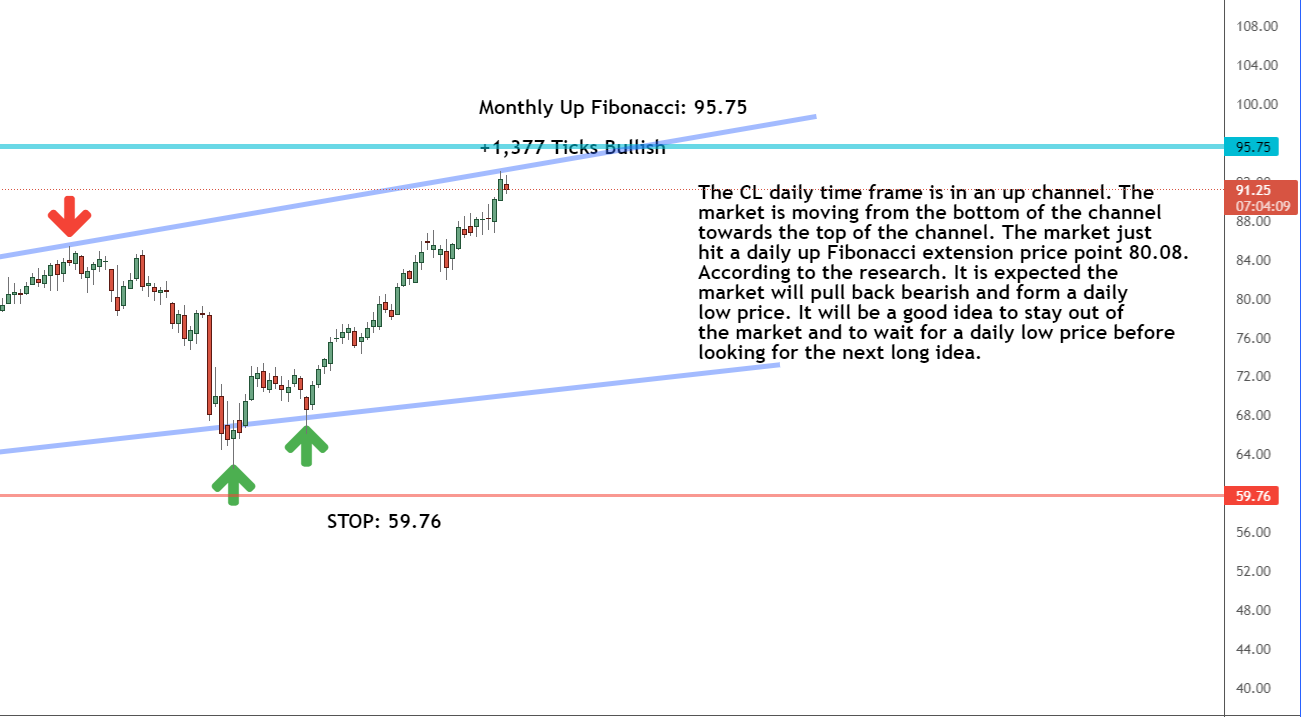

I’m now analyzing light crude oil futures (CL). While the long-term trend is upward, the short-term trend may be in the direction of a sell-off.

The market is at resistance within the daily timeframe. So, with the long-term direction remaining up, a short-term sell-off would give us a low price for us to enter the market.

Remember that in a market with an overall positive direction, we want to buy low and sell high. The market’s occasional price dips allow us to snag a market just before it rises and pushes bullish once more.

As many within Wall Street are worried about the current geopolitical problems, many investors have concerns about oil supply issues.

News headlines will have an big influence on oil prices, particularly as things continue to unfold.

We can implement our CL buy-in plan if we can acquire a cheaper price in a short period of time. Until that happens, we’ll watch our timeframe charts for any changes.

Daily Timeframe Analysis

According to the daily timeframe, the CL has reached resistance within the current channel.

The market is hitting the top trend line after pushing bullish.

The market could either break that trendline and push outside of the channel, or buyers could back off and let the sellers take control, pushing the market back down.

We definitely don’t want to buy the market if the price is about to drop. That would but us in a terrible position within the CL. So, we’ll watch our timeframe charts to see which way the market goes.

Learn more about the Daily Direction Indicators here…

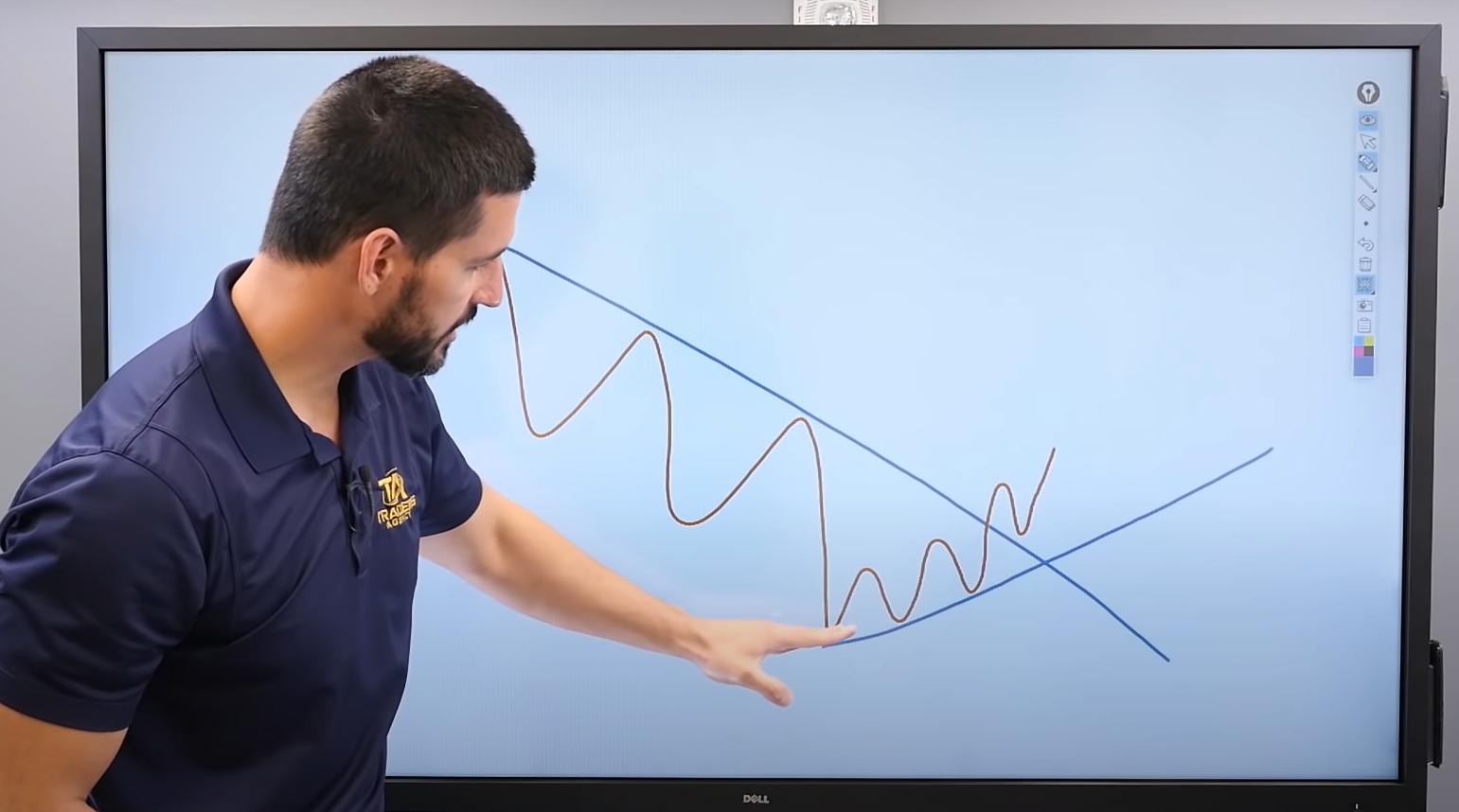

This is when having a good knowledge of the importance of trendlines comes in helpful. They’re one of our most effective instruments for determining whether to enter a market and how much risk to undertake.

For more information about properly drawing trendlines and applying them to your charts, check out this free helpful resource I put together.

The Bottom Line

Volatility makes traders nervous, and that’s ok. Having a solid strategy in place can help you minimize risk.

For the CL, we’ll continue to watch our timeframe charts for clear indications of the short-term direction. Once that’s determined, we’ll know what action we can take.

Waiting can be difficult, but it helps us make wise trading decisions.

Keep On Trading,

Mindset Advantage: Mind The Gap

There’s always a gap.

The gap between you and the results you’d like.

The gap between the losses you can sustain – and the losses you ARE sustaining.

The gap is what’s holding you back.

Not the market.

Not your charts.

You.

Focus on what you need to change to close the gap a little each session.

Apply a little more discipline.

Get out of that loser a bit faster.

Take those profits sooner and forget the rest.

Mind the gap.

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post Waiting for the Short-Term Direction appeared first on Josh Daily Direction.