Good morning, Daily Direction readers!

Right now, we’re keeping a careful eye on the markets since volatility has risen across the board. But that doesn’t rule out the possibility of profit in the futures market.

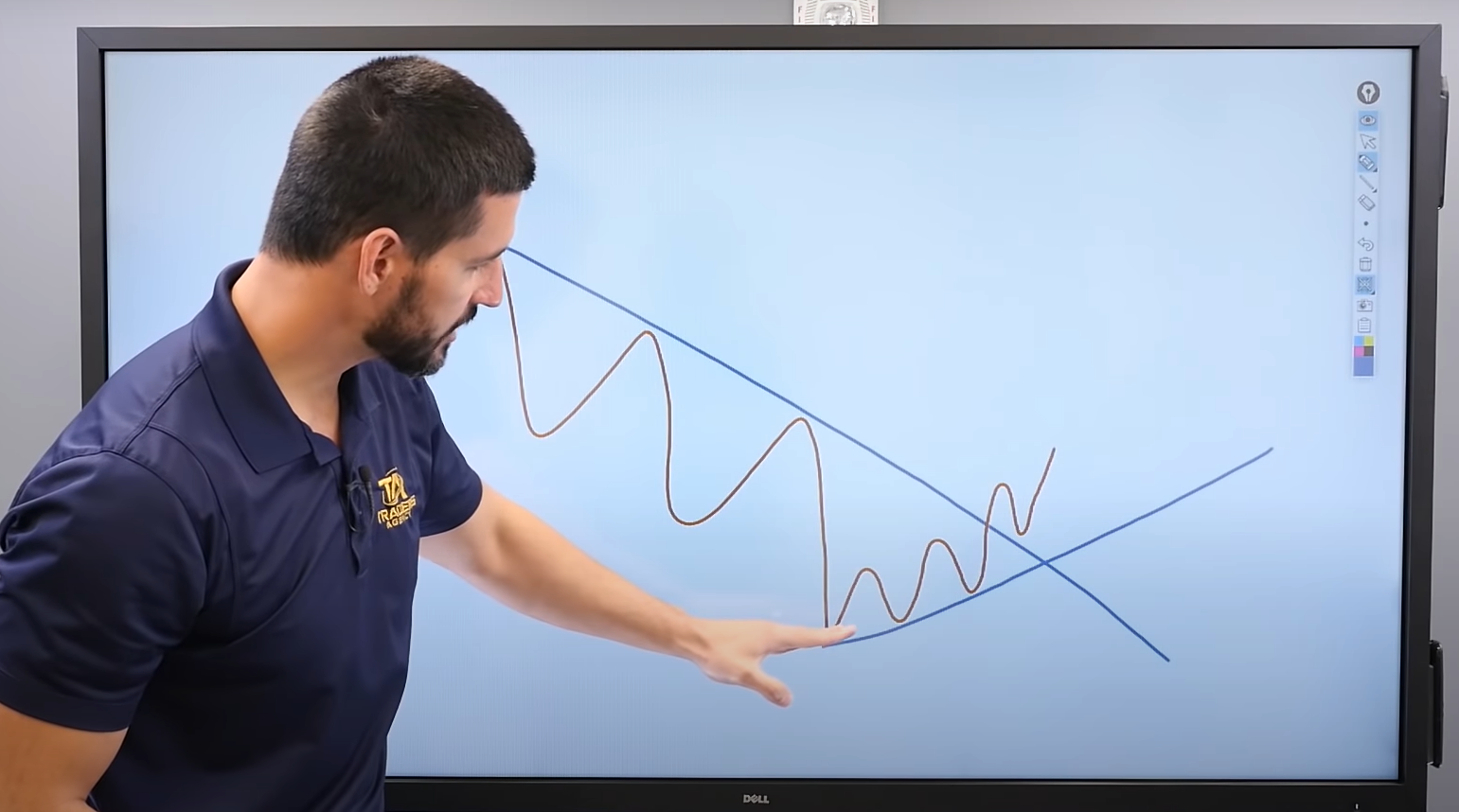

I’m now analyzing light crude oil futures (CL). While the long-term trend is upward, the short-term trend may be in the direction of a sell-off.

The market has hit and pushed past our current limit, so we’re out of the CL for now.

It’s important to remember that in a market that’s trending upward, we want to buy low and sell high. The market’s periodic price falls allow us to catch a market right before it rebounds and pushes bullish again.

As many within Wall Street are worried about the current geopolitical problems, many investors have concerns about oil supply issues.

Daily Timeframe Analysis

According to the daily timeframe, the CL is pushing past our price limit. That means we’ll take a step back and wait for the market to pull back.

The market may either close above the upper trendline and move outside of the channel, or buyers might back off and allow sellers to gain control, causing the market to sell off.

My analysis shows the market backing off from the top of the channel. When and if that happens, we’ll have an opportunity to jump back in!

Learn more about the Daily Direction Indicators here…

This is when understanding the significance of trendlines comes in handy. They’re one of our best tools for deciding whether or not to enter a market and how much risk to assume.

The Bottom Line

Volatility makes traders nervous, and that’s ok. Having a solid strategy in place can help you minimize risk.

For the CL, we’ll stay out of the market until the price drops and the market sells off, giving us an opportunity to get back in.

Keep On Trading,

Mindset Advantage: Mind The Gap

There’s always a gap.

The gap between you and the results you’d like.

The gap between the losses you can sustain – and the losses you ARE sustaining.

The gap is what’s holding you back.

Not the market.

Not your charts.

You.

Focus on what you need to change to close the gap a little each session.

Apply a little more discipline.

Get out of that loser a bit faster.

Take those profits sooner and forget the rest.

Mind the gap.

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post What to Do When We Hit Our Limit appeared first on Josh Daily Direction.