Digital currencies remain volatile, and the recent price action has made them even more so.

But that also means they’re providing plenty of opportunities. So, rather than just ignoring these markets, I continue to work on them and their charts.

This in turn is providing evidence of trading opportunities that others may be missing for gains over time.

BTC is of course the mega digital currency that has my attention right now for this week.

So, I am sharing my analysis with you as well as the trading opportunity I see potentially developing…

The BTC Trade Setup

Here’s how the chart shows the potential gain in BTC setting up…

And here’s how I’ve outlined my analysis…

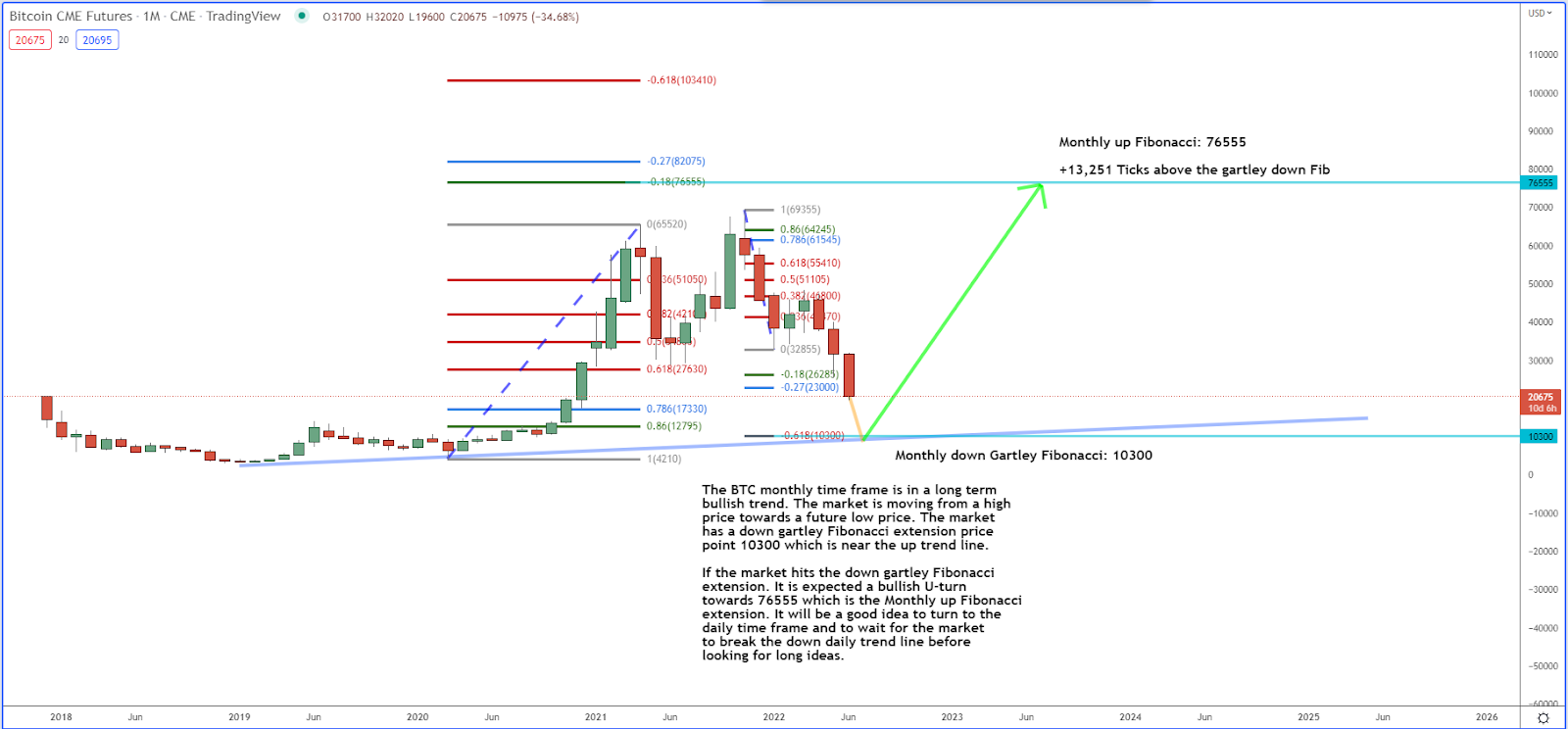

The BTC monthly time frame is in a long term bullish trend. The market is moving from a high price towards a future low price.

The market has a down Gartley Fibonacci extension price point 10,300, which is near the up trend line.

If the market hits the down Gartley Fibonacci extension, a bullish U-turn is expected towards 76,555, which is the monthly up Fibonacci extension.

It will be a good idea to turn to the daily time frame and to wait for the market to break the down daily trend line before looking for long ideas.

The Bottom Line

For more on the markets as well as trading education and trading ideas like this one, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my stock and futures contract trading tutorials as well as some additional trading ideas.

This includes additional alternative assets like crude oil, which is being presented by my partner here at Traders Agency, Anthony Speciale. Check out the link below the signature below for more…

And if you know someone who’d love to make this a part of their daily trading routine, send them over to joshsdailydirection.com to get signed up!

Keep on trading,

The post Where We’re Expecting a U-Turn in BTC appeared first on Josh Daily Direction.