Following a big drop last Friday, the bears returned on Monday morning to push stocks further to the downside.

With that, the Nasdaq 100 (NQ) is back under the June lows and could be threatening to make another big drop.

However, the market formed a low price last week and is showing signs of having a short term bullish pull back towards the down trend line.

Therefore, we are looking for a high price to form before we try to find selling ideas on the hourly time frame…

Trying to Sell the High

Here’s how we see the market shaping up for the Nasdaq 100 Index futures contract…

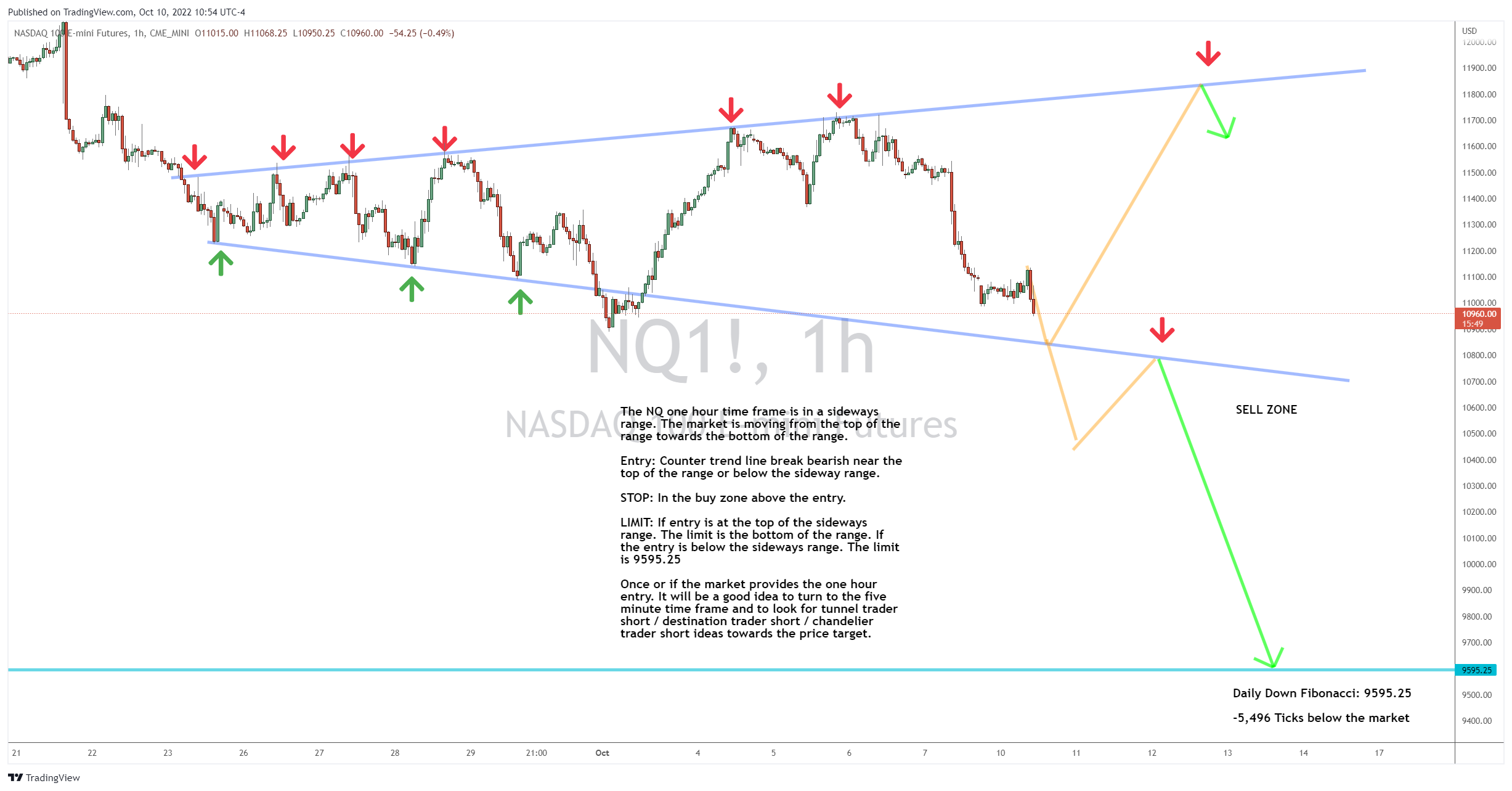

The NQ one hour time frame is in a sideways range. The market is moving from the top of the range towards the bottom of the range.

Entry: Counter trend line break bearish near the top of the range or below the sideways range.

Stop: In the buy zone above the entry.

Limit: If entry is at the top of the sideways range, the limit is the bottom of the range. If the entry is below the sideways range, the limit is 9,595.25.

Once or if the market provides the one hour entry, it will be a good idea to turn to the five minute time frame and to look for Tunnel Trader short, Destination Trader short or Chandelier Trader short ideas towards the price target.

The Bottom Line

There are multiple ways to trade the futures, stock and other markets. We can trade the indexes, both up and down, as well as individual stocks…

But my colleague and equities pro Ross Givens has come up with a brand new strategy that aims to deliver weekly gain opportunities without ever holding a single stock.

If you’re interested, check out the important P.S. below…

For more on the markets as well as trading education and trading ideas like this one, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my stock and futures contract trading tutorials as well as some additional trading ideas.

And before you go, head on over to the Traders Agency YouTube channel for breaking market news, live trading sessions, educational videos and much, much more!

Keep on trading,

P.S. My colleague and expert stock trader Ross Givens just unveiled his brand new “rapid cash” strategy that is totally market neutral.

It doesn’t matter if a stock goes up or goes down… With this strategy, Ross can set up his trades to win in either direction.

The post Which Way Will the NQ Range Break? appeared first on Josh Daily Direction.