Hey, Ross here:

Hope you had a great long weekend.

Welcome to the first trading day of a new month…

A month that, historically, is the worst ever for the markets.

Chart of the Day

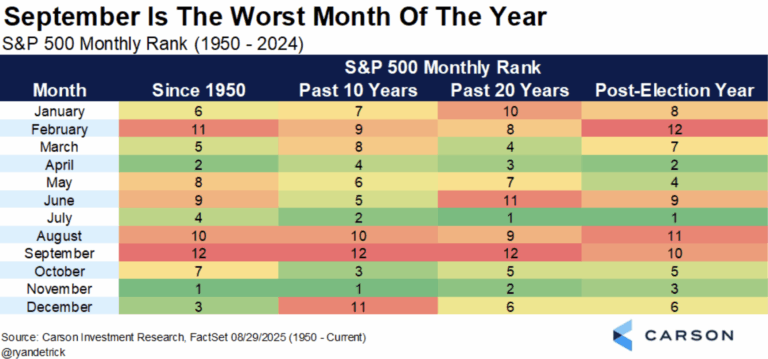

This chart ranks the monthly performance of the S&P 500 for various time frames – since 1950, the past 10 years, the past 20 years, and all post-election years.

The higher the rank, the better.

And as you can see, for almost all those time frames…

September is the worst month for the index.

That’s what traders call seasonality. Seasonality can be positive or negative – but in the case of September, it’s most definitely negative.

That said, seasonality is not destiny.

For instance, August is supposed to be the second-worst month for the markets…

And yet, both the S&P 500 and the Nasdaq rose more than 3.5% over the past month.

The biggest factor that determines whether we see a strong September or shaky September?

Whether the Fed cuts rates on September 17 or not.

That is by far the most important market catalyst this month.

The question is – how do we prepare?

I explain below.

P.S. Later this evening I’m releasing my next edition of 2 Trades in 2 Minutes. To get them as soon as they’re released, just text the word “trade” to 87858 and my team will send them straight to your mobile when they’re out.

Insight of the Day

You need to position yourself to benefit REGARDLESS if the Fed cuts rates.

Right now, the market is estimating a close to 90% chance of a Fed rate cut.

I believe a 25-point cut is largely already priced in, while a jumbo 50-point cut would send markets soaring.

Obviously, I would prefer a 50-point cut – but I’m not the one in charge.

But since a smaller rate cut is likely already mostly priced in…

That means if the Fed DOESN’T cut rates in a couple weeks…

We’ll likely see a major pullback – and September will turn out to be one of the worst months of the year.

The good news is we already know the catalyst that will determine whether this will be a strong or shaky month – so we can prepare for it.

The smartest move is to position ourselves to benefit regardless of what the Fed does.

That’s why later this morning at 11 a.m. Eastern…

I’m going LIVE for a special session to show you exactly how to prepare for the Fed’s move…

By revealing my strategy that delivered a 519% gain even as the markets were bleeding red from March–April…

And then kept crushing it even as the markets shot up after the April low, delivering wins like:

- 102% in 12 days…

- 118% in 2 days…

- 101% in 5 days…

- And 207% in 5 days…

This is how you position yourself to win “both ways”.

So if you haven’t yet – click here to secure your seat for my live session in a few hours…

And I’ll see you in a little bit at 11 a.m. ET sharp.

P.S. If you’re planning to attend on a mobile device, make sure you download the presentation app now so you don’t miss anything when it starts. See you there.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps

Customer Story of the Day

“These people are the best; they have their finger on customer support. They handled my request before I was a member.

And they make me a ton of money, a ton.”

Ross Givens

Editor, Stock Surge Daily