Hey, Ross here:

And let’s look at a chart that shows why a bumpy ride to the top is not an anomaly – but the norm.

Chart of the Day

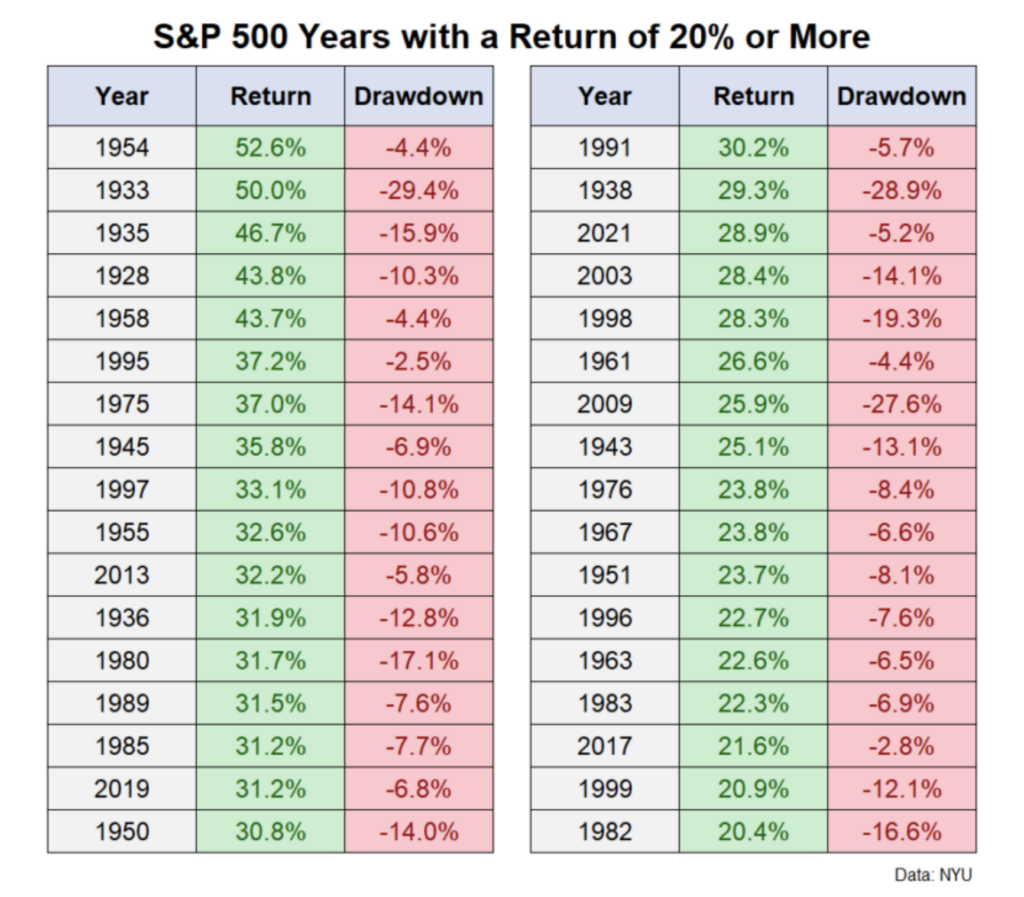

The table above shows a list of the years where the S&P 500 rose by at least 20%.

The green column shows the index’s return for that specific year, while the red column shows the depth of the biggest pullback that occurred in that same year.

And as you can see deep pullbacks of 10% or more are not the anomaly – but the majority.

So, if the current pullback has got you concerned – that’s perfectly normal.

But you should also understand that these pullbacks are completely natural – and the data proves it.

Insight of the Day

It’s almost always a bumpy ride to the top – which is why so few make it there.

Human beings crave certainty. For us, certainty = security. And uncertainty = anxiety.

But when it comes to the markets, certainty is in very short supply. Uncertainty dominates.

When you’re in the middle of a deep pullback, you feel anxious… worried that the bull trend is over… and that if you don’t get out now you’re going to lose.

It’s all understandable.

But this is also why so few make it through the bumpy ride to reach the top. They get scared and hop off halfway through.

That’s why later today at 12 p.m. Eastern, I’m going LIVE to explain what’s going on in the markets right now – and spotlight all the opportunities I’m still seeing.

So click here to save your seat for later…

And I’ll explain everything.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily