Hey, Ross here:

PPI data came in hot again yesterday. Markets are reacting.

But here’s an interesting question – just how much do rate cuts matter? Today’s chart takes a look at the data.

Chart of the Day

This chart is a bit confusing, so let me explain.

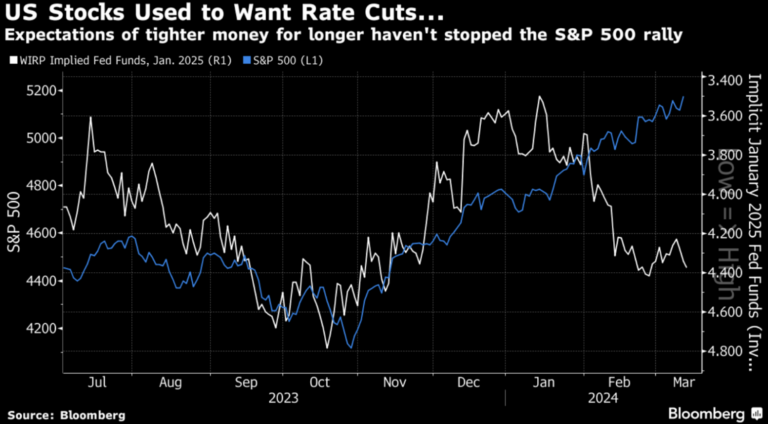

The blue line is the performance of the S&P 500, corresponding to the y-axis on the left.

The white line is the implicit fed funds rate for January 2025 – essentially a compiled forecast for what the Fed funds rate would have been by January 2025 – and it corresponds to the y-axis on the right. Note however that this y-axis is inverted, going from higher to lower.

Conventional wisdom would expect both the blue lines and the white lines to track with each other.

As the white line trends upward – meaning the implicit fed funds rate is getting lower – you would expect the market, represented by the blue line, to go up.

And as the white line trends downward – meaning the implicit fed funds rate is getting higher – you would expect the market to go down.

That’s not what’s happening.

As you can see, since January 2024 – the implicit Fed funds rate has been going higher – represented by the white line trending lower.

But the market has only been going higher – creating a clear divergence.

In short, the market has been ignoring the effect of expected higher interest rates.

Will this last? That remains to be seen.

But what it does show is that even if rate cuts keep getting pushed back, the market could still keep going up.

Insight of the Day

The best move right now is to keep playing.

Could the market enter a real pullback with the PPI data essentially confirming that inflation is still elevated? Yes.

Could it also just shrug it off and keep going up? Yes.

Only time will tell which is which.

But regardless of the outcome, the best move right now is to keep playing by targeting the leading stocks.

If the market pulls back, that means we can buy into these stocks at better prices.

If the market keeps going up, we can pocket the gains while protecting our downside.

That’s the kind of scenario I like.

And that’s why in just a bit at 11 a.m. Eastern later today…

I’m going LIVE for a masterclass that will allow you to position yourself in the best of these leading stocks…

The kind that could keep rising even if the market dips.

So, before spots fill up – click here to guarantee your spot in my masterclass later…

And you’ll get the login details shortly.

The sooner you act to position yourself, the better off you’ll be.

See you soon.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily