Hey, Ross here:

And let’s look at a chart that examines yesterday’s pullback beyond just blaming it on Fitch downgrading America’s credit rating.

Chart of the Day

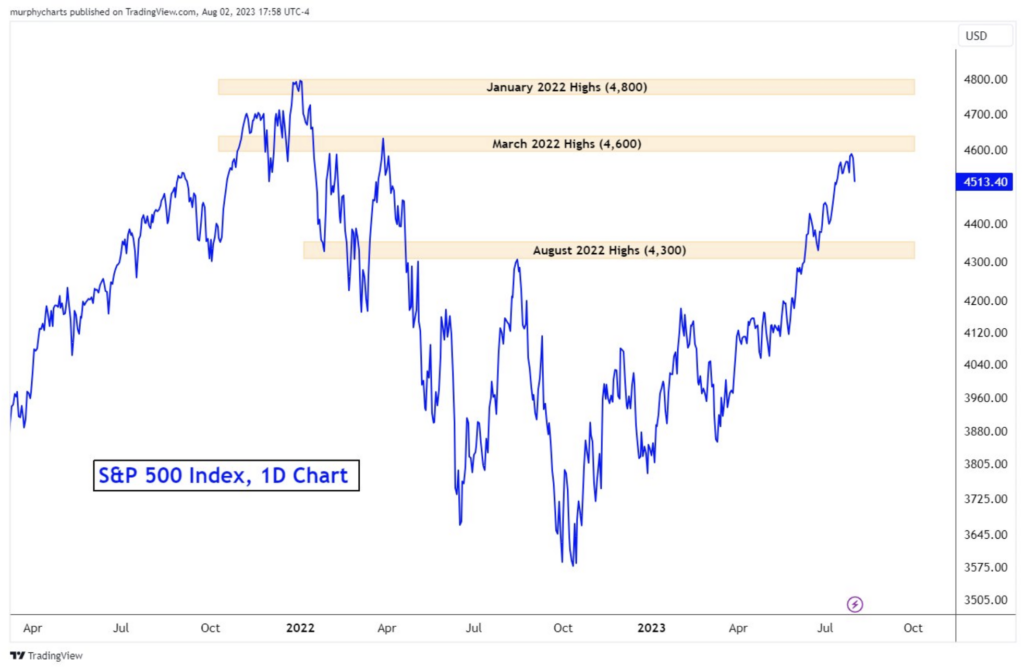

(Chart courtesy of @murphycharts on Twitter)

When markets are on the verge of breaking through a resistance level, it’s natural to see pullbacks along the way.

These pullbacks come from overhead supply – aka the number of sellers still in the market.

So when the price approaches said resistance level, these people start selling.

Whether or not the price successfully breaks through depends on the balance between buying and selling pressure – which we can gauge by studying the price action.

Right now, we’re approaching the 4,600 resistance level – a level also formed by the highs of March 2022.

Considering this was just 6 weeks since we blew past the 4,300 resistance level – formed by the August 2022 highs – it’s normal to encounter significant overhead supply.

In short, I don’t believe that the Fitch debt downgrade is a sign of a long-term market pullback.

As I said yesterday, we can expect this month to be a choppy one as the market digests the previous upward moves.

Stay the course.

Insight of the Day

Others’ hesitancy is your opportunity.

You’ve heard the famous Warren Buffett saying to be greedy when others are fearful and fearful when others are greedy.

That advice is obviously catered more toward long-term investors who plan to hold their stocks for extended periods of time.

Whereas as shorter-term traders, our goal is to target stocks that are breaking out to make quick gains.

But there is a way traders like us can apply this advice – and that is during times when the market is pulling back, like now.

Right now. people may not be fearful per se – but they are more hesitant, and that’s something we can take advantage of.

In fact, my flagship strategy is all about buying into specific stocks during these pullbacks…

With the goal of getting in at the same time as the big institutions so we can ride the subsequent price moves to the top.

So, if you don’t have this strategy in your toolkit already…

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily