Good morning, Traders!

I have my eyes on the Nasdaq 100 E-mini futures market (NQ) as it breaks the inner uptrend line. That means the market could be setting up for a short-term selloff.

But the data also shows that the NQ is establishing a new level of support. If the market can stay above 14900, we can expect the long-term and short-term directions to remain up. But if the market drops below that price point, we can expect a short-term selloff.

We see this very scenario playing out across many futures markets today, so we shouldn’t be too surprised by what’s happening in the NQ. Remember that sell-offs happen. They’re part of how the market moves in waves. We shouldn’t allow these types of market movements to intimidate us!

To better understand what’s happening with the NQ, let’s examine our timeframe charts in preparation for the trading day:

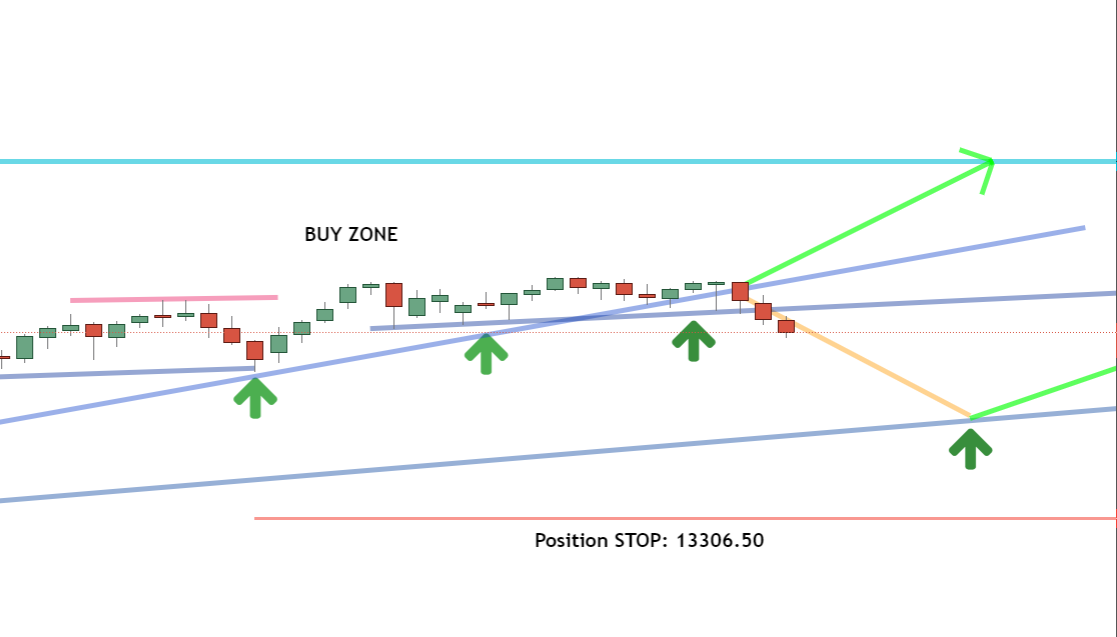

Daily Timeframe Analysis

The NQ is clearly breaking the inner up trendline in the daily timeframe (top grey line). That means the direction of the market could be shifting toward a sell-off. But, it looks like the market is forming a new level of support as well (second-from-top grey line).

If the price within the daily timeframe can stay above the 14900 price point, the overall direction for the market could remain positive. But if we see the price drop below that point, we should prepare for a sell-off.DAILY TIMEFRAME

The direction within the daily timeframe is up for the NQ

The short-term direction of the NQ could be turning bearish

We’re waiting for the NQ to rebound back toward a positive rally

Learn more about the Daily Direction Indicators here…

The NQ is breaking the inner up trendline in the daily timeframe. If it stays above 14900, the short-term direction will remain up. If not, we could see a sell-off

It would be wise to watch the daily timeframe and see which way the price turns within the timeframe chart. That way, we can prepare our strategy accordingly. Of course, this assumes that you follow my trading strategy for futures. If not, none of this will work for you. That’s why it’s important to follow my futures trading strategy as I provide this data!

One-Hour Timeframe Analysis

Our one-hour timeframe also shows signs of a sell-off developing, as the market is dropping away from the bottom of the up channel and settling toward a lower price. This confirms what we see in the daily timeframe.

Our best strategy is to keep an eye on the one-hour timeframe to see how deep of a sell-off we could see. Remember, lower prices aren’t necessarily a bad thing so long as the long-term direction remains up.

The NQ is dropping lower in the one-hour timeframe. We’ll want to keep an eye on this chart to get a better understanding of how we should adjust our buy-in strategy

Once the market finishes selling off, we’ll use the one-hour timeframe to watch for the NQ to rebound back into the buy zone in a bullish rally. That’s when we’ll execute our buy-in strategy and make money! Until that happens, we’ll keep watching our timeframe charts for more information.The Bottom Line

We’re anticipating the possibility of a short-term sell-off in the NQ market. That doesn’t mean we walk away from the market. We simply need to watch our timeframe charts and adjust our strategy accordingly. Lower prices are a good thing so long as the long-term direction for the NQ remains positive.

We’ll keep gathering data from our charts and see what the NQ decides to do. And my strategy will allow us to jump into the NQ the minute it becomes a buy!

We’ll keep our eyes open for when the possibility of a short-term sell-off within the NQ

As you watch the NQ move within the timeframe charts, now is the time to get the tools you need to become a successful futures trader. And I’m here to help you realize your money-making potential in futures. Just follow along as I reveal the crucial aspects of my trading strategy that will allow you to become a profitable futures trader!

Keep On Trading,

Mindset Advantage: Breathe

If you’re not breathing, you’re not focused. If you’re not focused, you can’t see the market. Opportunities slide by in an instant. Hazards reveal themselves only when it’s too late.

You need to breathe. Breathing exercises have proven to reduce stress and increase focus.

Sure, you’re already breathing if you read this. But when you trade… you need a breathing regimen. Whatever it is: Through your nose, out your mouth counting to 10 or 100. Find a method and routine that works for you.

You’ll find balance, clarity and focus when you trade. Your heart rate will come down and you’ll just feel better.

Try it. And enjoy your trading.Traders Training Session

Understanding Trading Margin and Managing Losing Trades

The post Don’t let the market waves intimidate you! appeared first on Josh Daily Direction.