Hey friend,

More sideways market action.

Is this just a pause before the next big leg up – or will we see a pullback as well?

The Fed’s preferred inflation gauge – the Personal Consumption Expenditures Price Index – will be released tomorrow.

Let’s see how the markets react then.

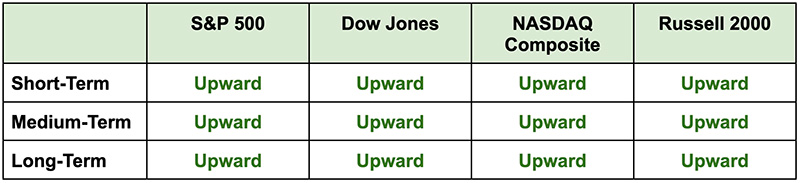

The Daily Direction

Note: All indexes except the Dow closed marginally higher yesterday. All index directions remain in the green.

The Daily Nugget

The best traders are highly comfortable with “unfamiliar” stocks.

There’s a saying that goes “no one ever gets fired for hiring IBM”…

Which basically says that, if you make the popular “accepted” choice – and it fails – it’s easy to absolve yourself of blame.

The same goes with trading and investing.

It’s easy to only focus on the big popular stocks – because if the position doesn’t work out, you can feel “safe” in the knowledge that many many others are in the same boat as you. You can “feel” like you didn’t take much risk.

By contrast, if you take a position in a small little-known stock – you’ll probably feel worse and more alone if the position doesn’t work out.

That’s human psychology for you – and this is a prime example of how it holds many people back from becoming effective traders.

Because the truth is, effective traders are highly comfortable with these “unfamiliar” names – because they know that’s where the biggest opportunities are.

The case of Viking Therapeutics (VKTX) illustrates this perfectly.

Most people have never heard of this stock in their lives…

But Ross Givens’ FIRE strategy – based on the top-performing chart pattern in history – pinpointed VKTX as a leading stock on the verge of a potential breakout on January 9.

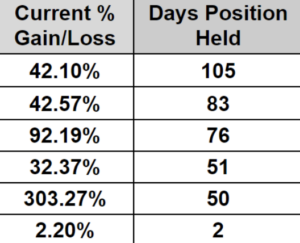

And as of yesterday’s close, this VKTX position is up 303% – quadrupling your initial stake (the table below shows the other open gains from this strategy).

That’s the potential of ignoring how “popular” stocks are and instead only focusing on whether it meets the strategy’s parameters or not.

Yesterday afternoon, Ross went live for a masterclass that will allow you to start using this strategy to target breakout stocks – even if the market is moving sideways like now.

The masterclass was very popular…

So if you missed it, please make sure you click here to watch the replay now…

Because this strategy has also identified more stocks that could be about to break out – and you don’t want to miss it.

The Traders Agency Team