Hey friend,

Inflation data just came in this morning – and the market is still processing how the Fed may react to it.

The next few days will be crucial in determining the market’s next direction and the fate of this rally.

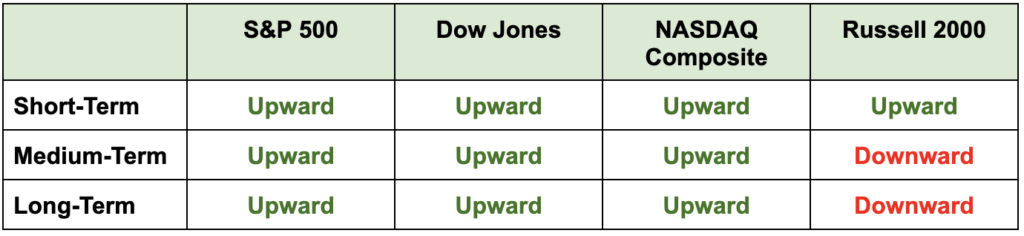

The Daily Direction

Note: Indexes closed largely flat yesterday in anticipation of this morning’s inflation data. No change in any index directions.

The Daily Nugget

Being too greedy when following the trend can backfire.

Yesterday, we talked about the critical difference between following the trend and following the opinions of the crowd.

Today is about how – even if you’re correctly following the trend…

Being too greedy when doing so can backfire.

How?

Because if you try the entire move of the trend – instead of waiting for price confirmation that the trend is real and taking profits on the way up…

You could end up buying into “false starts” and holding on long after the rally has fizzled out.

You don’t need to catch the entire move of the trend – a partial move is sufficient AND safer.

That’s why Ross Givens – despite calling so many market moves correctly this year – still waits for proper price action confirmation AND recommends strategically taking profits on the way up.

This has already been paying off in this rally…

So if you want in on his flagship strategy for intelligently playing this rally…

Make sure you read this page for all the details.

The Traders Agency Team