Hey friend,

Let’s see how markets have been moving.

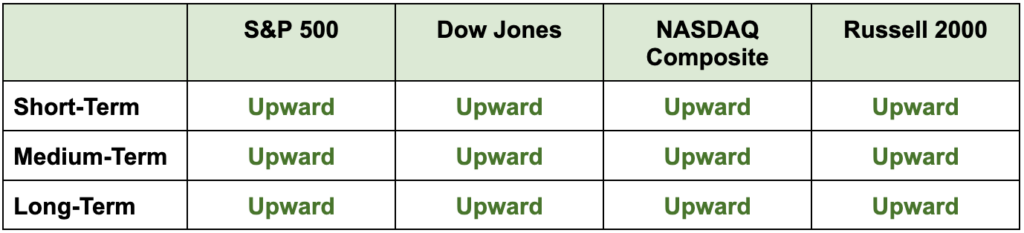

The Daily Direction

Note: A mixed close yesterday with the Nasdaq and Dow Jones closing higher but the S&P 500 and Russell 2000 closing lower. Yet, the moves were minor and all index directions remained unchanged.

The Daily Nugget

When market momentum appears to be stalling can often be the BEST times to buy.

August – especially in the years right before a Presidential election – tend to be down months for the market.

Considering how strong the market has been this year, don’t be surprised if it appears to take a breather this month.

For many traders hopped up on the excitement of this new bull market, such a breather may seem disappointing.

In fact, some of them may even give in to pessimism and believe that the new bull market is over.

That’s not the right move.

Because you see, times when market momentum appears to be stalling can actually be the BEST times to buy a stock.

Where the average trader sees stalled momentum, the skilled trader sees price consolidation.

And that’s when they get in – in anticipation of the next leg up.

That’s why later today at 7 p.m. Eastern, Ross Givens is going LIVE to show you his top-performing strategy for taking advantage of these price consolidations before the next big move up.

Click here to save your seat now…

And get ready to potentially make August your best month in the market yet.

The Traders Agency Team