Hey friend,

The latest Personal Consumption Expenditures data was in line with expectations.

With no nasty surprises there, the market’s upward momentum continued – and all indexes closed higher for the month.

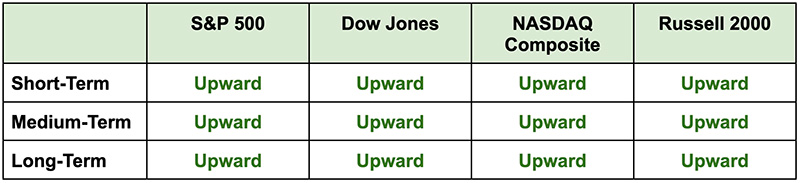

The Daily Direction

Note: All indexes closed higher yesterday, and all index directions remain comfortably upward.

The Daily Nugget

All traders have a view of the market. But the good ones know how to integrate their view with the market’s reality.

Your view of the market is opinion. The market is fact.

As a trader, you need to have some sort of view of the market – otherwise you’d never know when or how to act.

But when that view of the market hits the reality of the market, you need to be able to adjust it as necessary.

One way to do this is to keep a flexible time frame.

A great example of this is Ross Givens’ view that the market is overdue a pullback or at least a pause – a perfectly logical view backed up by lots of evidence.

The reality is that hasn’t happened yet.

But Ross isn’t going around saying that the market is “wrong” and that his view is “right”.

Instead, he’s integrated his view with the market’s reality…

Noting that while a pullback is still very likely, we should take advantage of the continuing rally while we still can.

That’s how you integrate a solid evidence-based view of the market with the market’s current reality.

And one of the best ways to take advantage of this continuing rally is to look at where the billions upon billions in institutional money is flowing…

Because their sheer volume is enough to send many stocks flying.

The Traders Agency Team