Good morning, Traders!

The Nasdaq Futures Market (NQ) fulfilled our limit just as I predicted and is now poised for a +4445 tick movement! We had a clear counter trendline break into the buy zone, which led to the market heading right for our limit price of 13974.

The main reason this worked so well is because of our stop placement. It kept us from stopping out of the market too soon when the market produced a false reversal. And it served as protection in case the reversal turned out to be legitimate.

What’s happening in the NQ right now is a prime example of why my strategy is so important if you want to make winning trades and limit your risk in the market! Check out my article on how to get started with my trading strategy here.

Now it’s time to review the daily and one-hour timeframes for the NQ to see what our next steps should be for this market:

Daily Timeframe Analysis

The NQ direction remains up according to the daily timeframe chart. The market hit the uptrend line (diagonal grey line) and U-turned bullish to our next Fibonacci of 14895.5. That’s a +4445 tick movement potential!

The NQ’s direction remains up, according to the latest daily timeframe chart. The market bounced off the uptrend line (grey line) and is headed for the next up Fibonacci of 14895.50 (upper light blue line)

As the NQ continues to move up toward the next Fibonacci extension, we’ll want to watch our one-hour timeframe for opportunities to buy the market. Don’t forget to check out my article on long-term vs. short-term timeframe trading to learn more about why we use these charts with our strategy.

One-Hour Timeframe Analysis

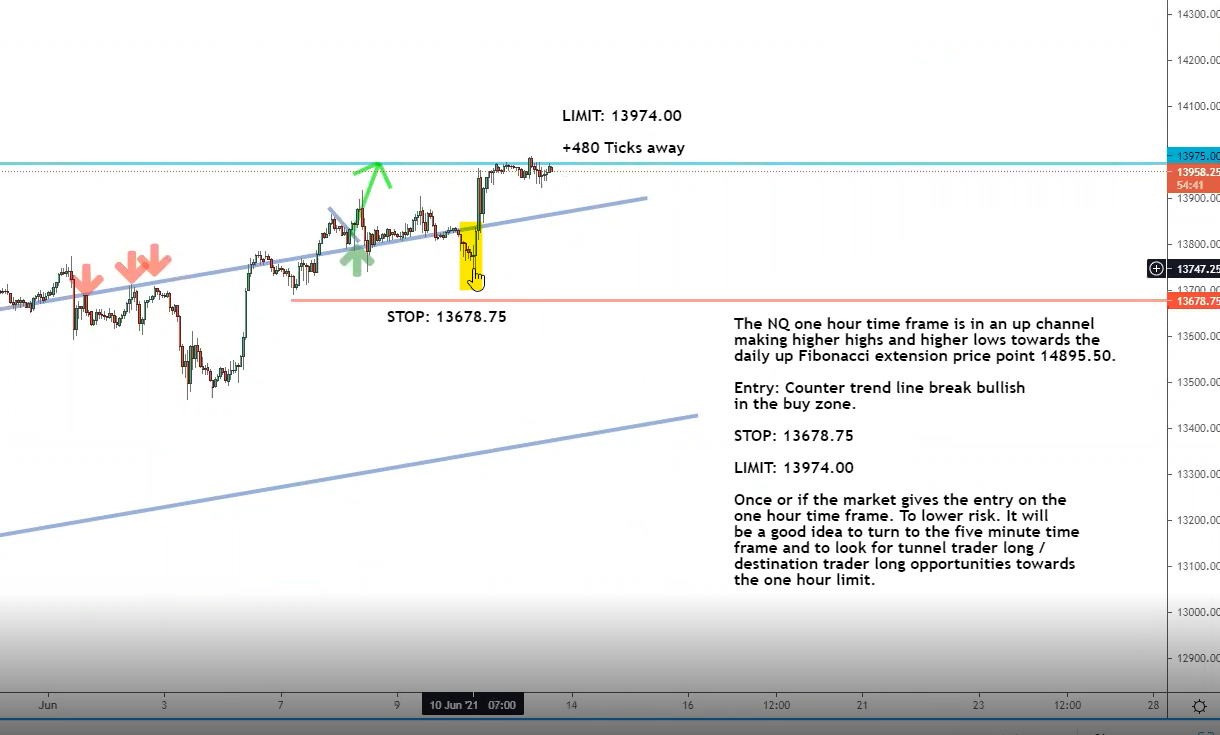

You can see the false reversal hit in the one-hour timeframe (highlighted section). A false reversal is when the market starts to reverse its positive movement but bounces right back up.

A smart stop placement (red line) helped us fulfill the NQ limit in the one-hour timeframe. We avoided a false reversal (highlighted area) as the market then U-turned upward.

As you can see in the chart, our stop was placed in just the right spot (red line) at the previous low price. Since the false reversal didn’t get low enough to trigger it, we were able to stay with the market as it bounced back.

Remember that we use stops to limit our losses when a market begins to turn negative. Without stops, we’d lose a lot of money when prices head south. And for more information on how to manage potential losses, check out my writeup on managing trades that try to turn against you.

The Bottom Line

The current NQ movement shows how well my strategy works when trading futures markets. A properly placed stop is worth its weight in gold. And thanks to our stop in the NQ, we can keep trading the market as it heads for its next high price.

The short-term and long-term directions for the NQ are clearly up. We’ll keep an eye on our timeframe charts as we look for opportunities to buy the NQ

Are you missing out on these setups? Are you still trying to figure out how to master the futures market? I’m here to help! Don’t get frustrated trying to do this all alone. Let me show you how to build success as a futures trader today. You’ll be ready to make money with the next big trading opportunity!

Keep On Trading,

Mindset Advantage: Forget About It

Move on with your trading and leave the past where it belongs…. in the past.

It’s a recurring theme. It happens over and over again. You can feel it the second it comes on. The market is going to do ‘it’ – whatever ‘it’ is – again… to you and your account. The flashbacks start pouring in. It’s impossible not to relive it all.

In an instant, a calm Tuesday morning is now haunted by a trading session ages ago. Just when you thought you would never, ever, ever find yourself in that situation again.

It’s time to move on. Sure, mistakes repeat themselves, but the key to getting past errors and losses of the past is first to embrace them. Own them. Take them as they are. After all they’re yours.

Traders Training Session

Understanding Futures Contract Sizes and Tick Values