Stocks in the US have been on a wild ride since Thursday morning’s CPI release.

The Nasdaq 100 (NQ) gained 2.2% that day, followed by a 3.1% decline on Friday and a 3.4% rally yesterday.

Needless to say, the market has been volatile.

But with today’s initial rise bringing the NQ up to down trending resistance and running out of steam, the next move could well be lower again…

Trying to Sell the High

Here’s how we see the market shaping up for the Nasdaq 100 Index futures contract…

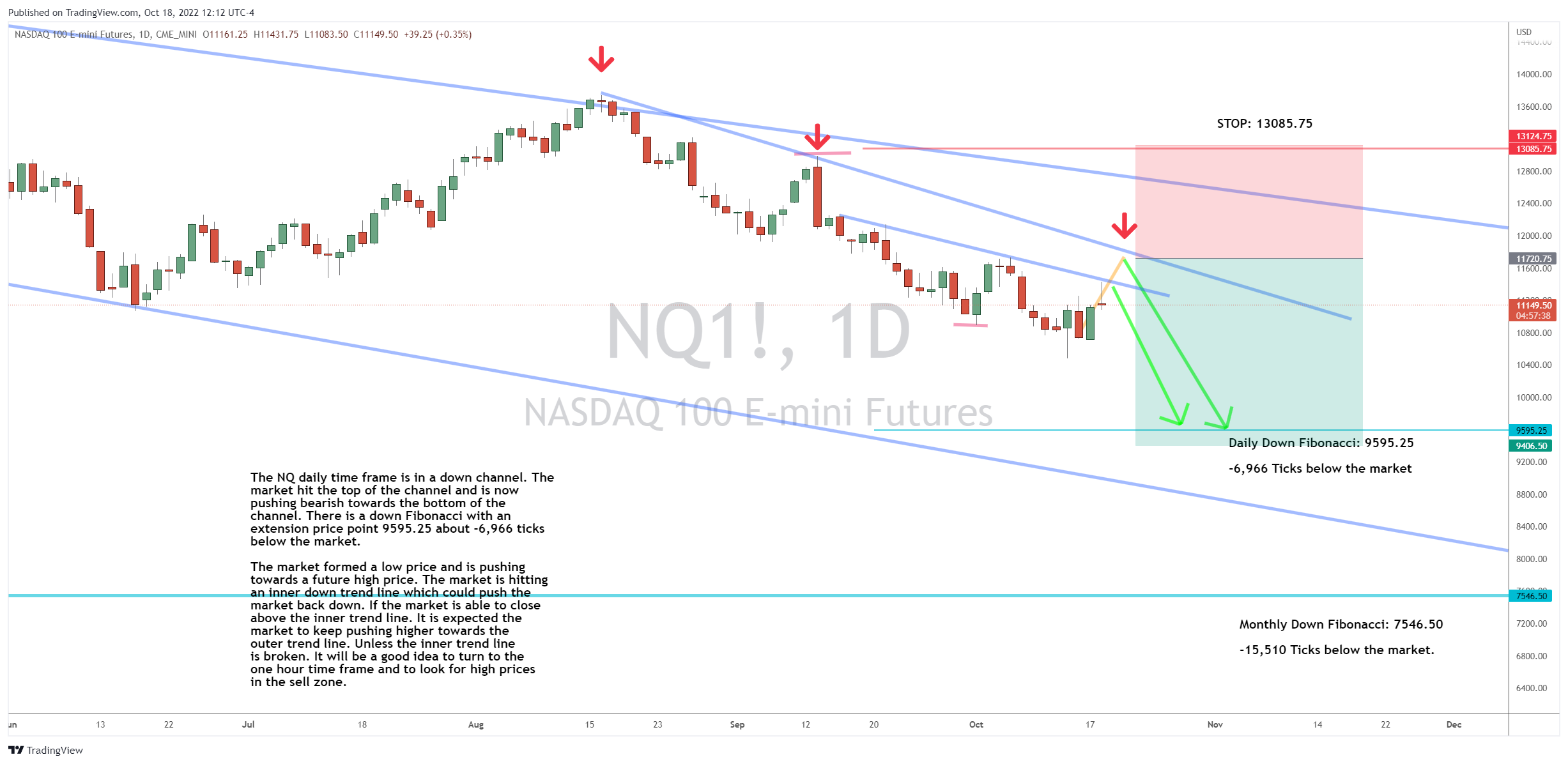

The NQ daily time frame is in a down channel. The market hit the top of the channel and is now pushing bearish towards the bottom of the channel.

There is a down Fibonacci with an extension price point 9,595.25, about -6,966 ticks below the market.

The market formed a low price and is pushing towards a future high price. The market is hitting an inner down trend line, which could push the market back down.

If the market is able to close above the inner trend line, it is expected the market to keep pushing higher towards the outer trend line.

Unless the inner trend line is broken, it will be a good idea to turn to the one hour time frame and to look for high prices in the sell zone.

The Bottom Line

With inflation on a fast-track, you need to know how to amplify your gains.

To see how I do it, check out the link in the P.S. below…

For more on the markets as well as trading education and trading ideas like this one, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my stock and futures contract trading tutorials as well as some additional trading ideas.

And if you know someone who’d love to make this a part of their daily trading routine, send them over to joshsdailydirection.com to get signed up!

Keep on trading,

P.S. Countless everyday Americans are earning anywhere from an extra few hundred bucks a week…

Get the urgent details — and a special $5 deal for a full year of my War Room — right here…

The post Nasdaq 100 Hits Overhead Resistance appeared first on Josh Daily Direction.