Hey friend,

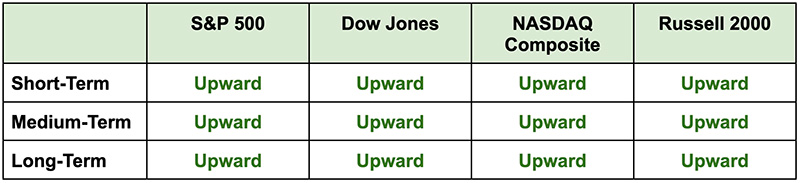

The bull market continues – and the Daily Direction table remains solidly in the green.

The Daily Direction

Note: Indexes closed higher yesterday in anticipation of Big Tech earnings and the Fed’s monetary policy meeting this week. No change in any index directions.

The Daily Nugget

Adjust your position sizing according to the magnitude of opportunities available.

Position sizing is highly individual. Every trader will have different position sizing.

But even on an individual level, position sizing should still significantly vary according to the market situation.

If the market is stagnant or falling, reduce your position sizing and take fewer trades.

But if the market is booming – like it is now – you can intelligently increase your position sizing and take more trades.

And right now, the market is brimming with opportunities – what with Big Tech earnings and the Fed’s policy decision on the slate for this week.

It’s extremely rare for such market-moving catalysts to line up so perfectly…

Which is why later today at 12 p.m. Eastern…

Ross Givens is going LIVE for a masterclass on how to leverage insider trading signals to sniff out the highest-potential opportunities out there right now.

So just click here to confirm your spot for his masterclass…

And we’ll send you the login details in your inbox shortly.

Don’t waste this rare chance.

Ross will see you there.

The Traders Agency Team