Hey, Ross here:

And let’s end the trading week with a chart that gives us plenty of reason to be optimistic about the rest of the 2023 trading year.

Chart of the Day

This is the chart of the Nasdaq-100 – the 100 largest non-financial companies listed on the Nasdaq – going back one year.

And as you can see, yesterday’s close marked its highest point in a full year.

That just adds to my conviction that the bear market is well and truly over. Further, both the NASDAQ and the S&P 500 also closed at their highest points since August 2022..

I’m very optimistic on the trading prospects for the rest of this year. I see a lot of breakouts on the horizon.

Yet, as you’ll see from the Insight of the Day, most retail traders are likely to miss out on these opportunities.

Don’t be one of them.

P.S. Would you like special trade prospects and potential market moves sent directly to your phone? Text the word ross to 74121.

Insight of the Day

Following the herd is how most retail traders get burned.

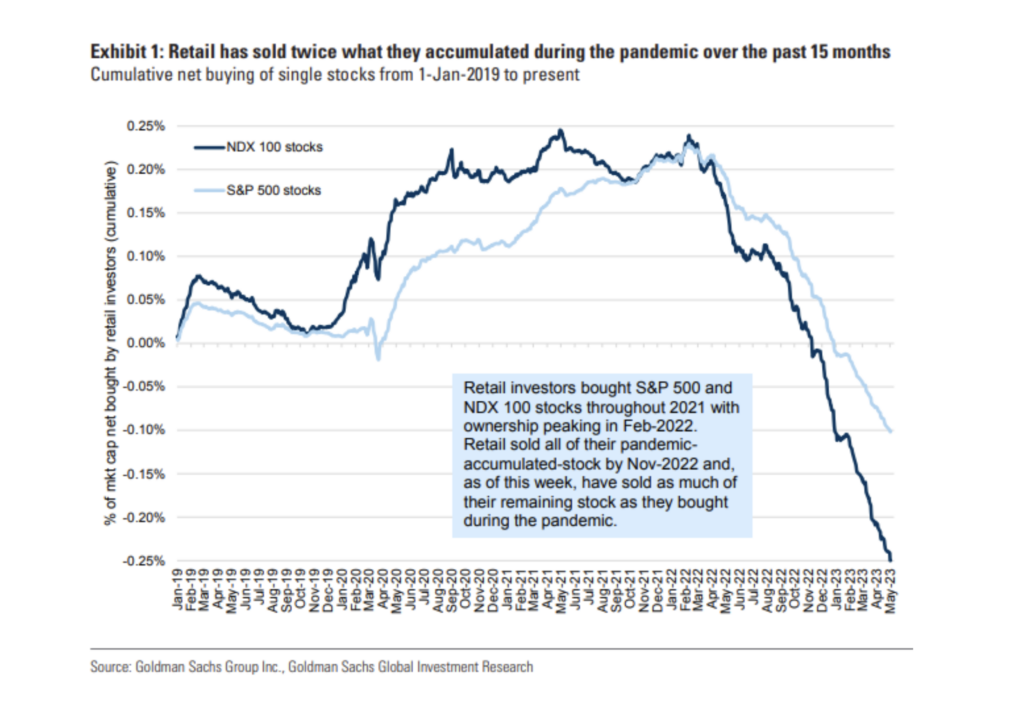

Let’s look at another chart – this time from Goldman Sachs.

The chart shows that retail traders heavily accumulated S&P 500 and Nasdaq-100 stocks throughout 2021 – and have now sold off pretty much ALL of their accumulated stock.

In other words, they bought high and sold low. Most of them undoubtedly got burned.

And now, with the markets rising to new highs, they’re still sitting on the sidelines – afraid to jump back in.

Most of them will likely only get back in AFTER the market has risen far beyond current levels…

Meaning they’ll miss out on the ripest opportunities – the kind you only get at the beginning of a new bull market.

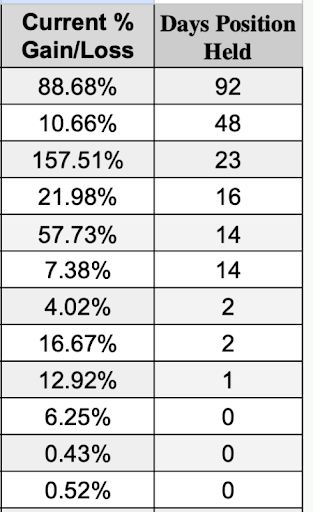

Gains like the ones you see on this open portfolio right here.

Yesterday, I went live and showed hundreds of people the exact strategy used to get the market-crushing gains you see above.

If you missed my live broadcast, make sure you check out the replay by clicking here.

Because in this market, the gains you see above could just be the start.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily