Hey friend,

The European Central Bank lowered its forecast for annual inflation yesterday – though it still held its benchmark interest rates steady.

Still, those lower inflation expectations helped boost markets over here too.

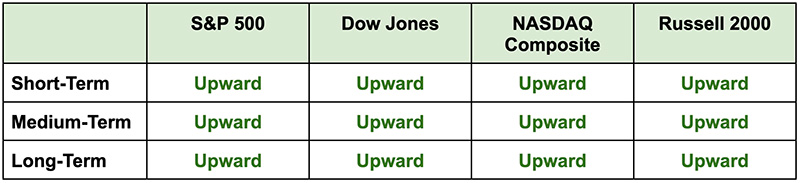

The Daily Direction

Note: All indexes closed higher yesterday, with the short-term direction for the Dow Jones flipping back upward.

The Daily Nugget

Don’t get bold when the trade gets cold.

Just because most indexes are at new all-time highs doesn’t mean all of your trades will work out.

Some of them will inevitably hit their stop loss points – that’s just the name of the game.

And when that trade goes cold, the last thing you want to do is get bold. Stick to your stop losses – because that’s how you consistently win over time.

Ironically, it’s actually harder to do this when markets are doing well – like they are now – than when they’re doing poorly.

In times like these, traders tend to think that their stopped-out trades have a better chance of recovering if they just give it time.

While that may be true in some cases, the long-term negative consequences of undisciplined risk management far outweigh a few stopped-out trades eventually recovering.

So remember – regardless of what the market is doing – if the trade goes cold, don’t get bold. Just cut it off and move on to the next one…

Because in times like these, opportunities are plentiful.

And if you follow the strategy Ross explains here…

You can target the best of them right now.

Have a good weekend.

The Traders Agency Team