The Federal Reserve just made its latest interest-rate announcement this afternoon.

As expected, the central bank raised the target federal funds rate range by 75 basis points (0.75%) to 3.75%-4%.

Markets moved upon the announcement, and there will likely be further gyrations as the press conference with Chair Jerome Powell gets going.

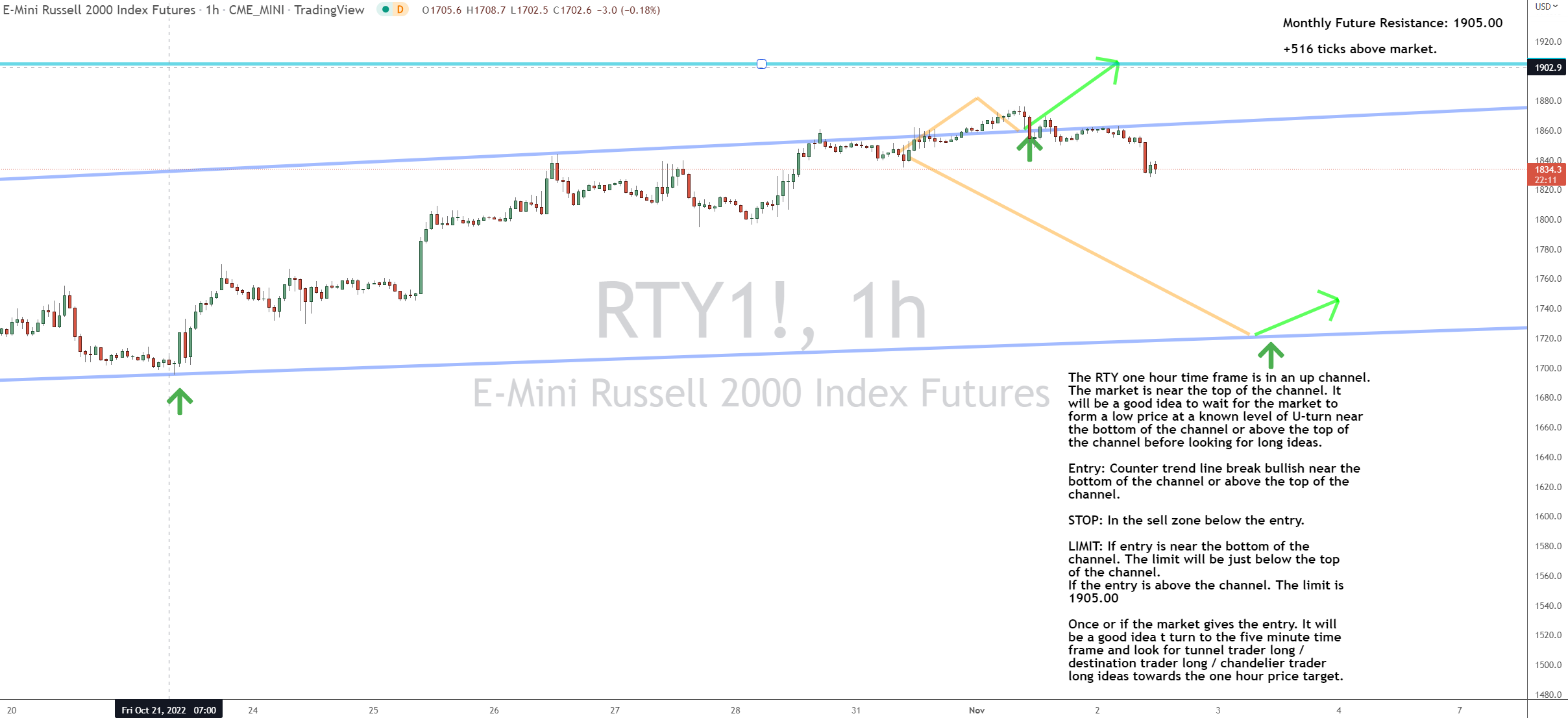

Investors and traders will be looking for clues about short-term direction, but the Russell 2000 (RTY) futures market is set up for a bullish idea regardless of the next market move.

Two Ways to Play

Here’s how the hourly chart is shaping up with multiple paths to potential bullish ideas…

The RTY one hour time frame is in an up channel, with the market near the top of the channel.

It will be a good idea to wait for the market to form a low price at a known level of U-turn near the bottom of the channel or above the top of the channel before looking for long ideas.

Entry: Counter trend line break bullish near the bottom of the channel or above the top of the channel.

Stop: In the sell zone below the entry.

Limit: If entry is near the bottom of the channel, the limit will be just below the top of the channel. If the entry is above the channel, the limit is 1,905.00.

Once or if the market gives the entry, it will be a good idea to turn to the five minute time frame and to look for Tunnel Trader long / Destination Trader long or Chandelier Trader long ideas towards the one hour price target.

The Bottom Line

Most people know me as a futures trader, but I also dabble in plenty of individual stocks.

And I have a new way of picking out opportunities in “marked stocks”… To learn more, check out the P.S. below.

For more on the markets as well as trading education and trading ideas like this one, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my stock and futures contract trading tutorials as well as some additional trading ideas.

And if you know someone who’d love to make this a part of their daily trading routine, send them over to joshsdailydirection.com to get signed up!

Keep on trading,

P.S. Stock markets may be unsettled, or even bearish. But that doesn’t mean that there aren’t opportunities…

All it takes is riding the coattails of a stock after it’s been “marked.”

To learn more about how to identify and trade these specific stock opportunities, click here.

The post Two Ways to Play RTY Futures appeared first on Josh Daily Direction.