Hedge funds are betting big on artificial intelligence, but they’re not buying Nvidia anymore. Their latest investments have nothing to do with chips. Wall Street has fundamentally shifted its focus. They’re buying the power that keeps AI alive. BlackRock, Blackstone, and dozens of others are going beast mode on utility stocks..

These companies have historically been pretty boring, but not anymore. They could be some of the biggest winners over the next few years.

BlackRock just acquired Minnesota Power for $6.2 billion. Blackstone is dropping $11.5 billion on TXNM Energy.

This is just the tip of the iceberg. Energy is Wall Street’s trade of the year. I have my eye on 3 stocks set to benefit from this Energy revolution.

The Aggressive Move into Infrastructure

The scale of money moving into this sector is staggering. This isn’t speculation. It’s a coordinated capital rotation.

Last year, BlackRock acquired Global Infrastructure Partners for $12.5 billion. This expanded the fund’s energy footprint to create a $170 billion infrastructure powerhouse.

What’s most telling is how they paid for it. BlackRock didn’t even have the money to buy it. They issued 12 million new shares to get the deal done. They diluted shareholders. That’s how bad they wanted it.

Their buying spree hasn’t slowed down since:

- $500 million for a 20% equity stake in Recurrent Energy, a cutting-edge solar company spun off from Canadian Solar

- Natural gas giant Vanguard Renewables — all of it, the whole thing

- Jupiter Power, Acacia Energy, and New Zealand-based Solar Zero

And that’s just on the renewable side. BlackRock is buying up utility companies and grid infrastructure hand over fist. A few months ago, they acquired Allette, which owns Minnesota Power and Wisconsin’s Superior Water, Light, and Power for a cool $6 billion.

They teamed up with Morgan Stanley to pick up a stake in Portland’s pipeline business via TC Energy. Just two weeks ago, BlackRock increased its stake in California utility operator PG&E, and it continues to add to its holdings in NextEra Energy. The stock just hit its all-time high.

And I haven’t even mentioned their legacy holdings in Exxon, Chevron, and Diversified Energy.

BlackRock is on a buying spree. They’re spending like a teenager who just got her first credit card. This is Wall Street’s next gold rush. And this time, it’s not apps, chips, or data. It’s energy.

The Silent Emergency

Artificial intelligence is seeing rapid adoption. Even if you’re trying not to use it, you probably are. AI is embedded in search engines, trading algorithms, even your smartphone.

But behind the optimistic headlines is a silent emergency.

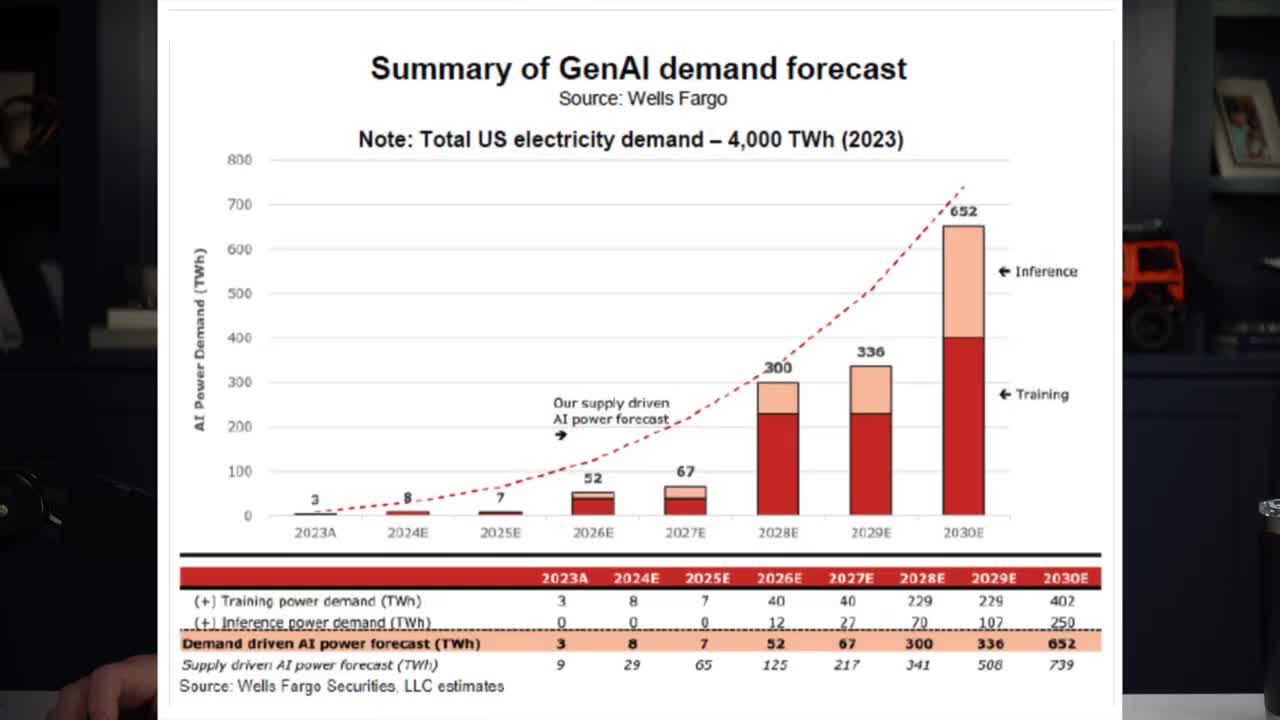

The AI boom is consuming power faster than our electrical grid can possibly keep up. Today, US data centers consume 5% of all electricity generated. Over the next three years, that number is expected to double.

Data centers are the new factories of this digital age. Massive, relentless, and always on. They hum day and night, processing trillions of computations per second. But there’s just not enough juice.

Every single AI model, every image generated, every chatbot reply burns electricity. Energy isn’t just a line item anymore. It’s a pressure point. And those who control it wield enormous power over the industry.

We taught machines to think but forgot how to keep the lights on.

Energy Is the New Gold

While amateurs argue over who has the best language model, the real billion-dollar play is who controls the grid.

BlackRock knows it. Blackstone knows it. They’re not chasing the next OpenAI. They’re chasing the power OpenAI needs to survive.

AI isn’t just software anymore. It’s infrastructure. And infrastructure runs on electricity.

The AI boom has flipped Wall Street’s logic. Historically, it has invested in innovation. Today, it’s investing in what innovation consumes.

Every ChatGPT query, every GPU cluster, every AI-generated image of a cat playing the violin — it all burns megawatts. The smart money is moving fast. They’re not betting on startups. They’re buying the power plants that fuel them.

To put it simply, AI made energy the new gold.

Get an entire year of live weekly mentoring sessions, my newsletter, indicators, bonus reports, tons more. Click the link and I’ll see you in the next live session.

Top Institutional Pick: NextEra Energy

Wall Street is getting in early, as they do. Here are three utility stocks being bought heavily right now by institutional investors.

First: NextEra Energy (NEE).

NextEra is currently undergoing a strategic transformation from a traditional defensive utility into a critical infrastructure provider for the AI era. The company is leveraging its massive renewable energy backlog and nuclear assets to secure long-term contracts with the hyperscalers.

That includes a 25-year power purchase agreement with Google for electricity from its Dwayne Arnold nuclear plant.

NextEra is also expanding its natural gas assets. Last month, the company increased its stake in the Mountain Valley Pipeline. Its acquisition of Energy Capital Partners is expected to close this quarter, which will expand the company’s customer supply business across 34 states.

The Data Center Play: Dominion Energy

Second: Dominion Energy (D).

Dominion is a primary play for AI growth thanks to its position as the power provider for Data Center Alley in Northern Virginia. The company already has a foothold with the major players and stands to benefit as they continue to expand.

They’re also in a $500 million joint venture with Amazon to develop a 300-megawatt small modular reactor near the North Anna nuclear plant.

The Nuclear Bet: Talen Energy

Third: Talen Energy (TLN).

Talen is betting big on nuclear, which many believe will be the future of domestic energy production.

In June, the company expanded its relationship with Amazon Web Services through a new power purchase agreement. This deal will provide 1,920 megawatts of carbon-free nuclear power through 2042. That power will be fed straight into Amazon’s data center campus, which is adjacent to Talen’s nuclear plant.

Price hedges ate into the company’s bottom line in 2025. As these hedges roll off, management expects to collect higher prices on 40% of its production this year. That number jumps to 75% by 2027.

Plus, unlike variable renewable sources, Talen’s high-volume generation platform provides the reliable, continual supply required by these data centers.

The War for Electricity

The AI revolution won’t be won by who codes the best. It will be won by who controls the electricity.

It doesn’t matter how good your competitor’s model is. If you control the grid, he can’t run it.

Is it cutthroat? Yeah. Welcome to capitalism.

The smart money has already identified the bottleneck. They’re buying the assets that control the flow of power. You can ignore this shift, or you can position yourself alongside the institutions that are rewriting the energy map of America.

Get an entire year of live weekly mentoring sessions, my newsletter, indicators, bonus reports, tons more. Click the link and I’ll see you in the next live session.

DISCLAIMER: Traders Agency does not offer financial advice. The information provided is for educational purposes only and should not be considered financial advice. Traders Agency is not responsible for any financial losses or consequences resulting from the use of the information provided. Trading carries inherent risks and may not be suitable for all individuals. You are advised to conduct your own research and seek personalized advice before making any investment decisions, recognizing the potential risks and rewards involved