Good morning, Daily Direction readers!

We’re currently out of the Nasdaq 100 E-mini futures market (NQ), as it remains above our limit price.

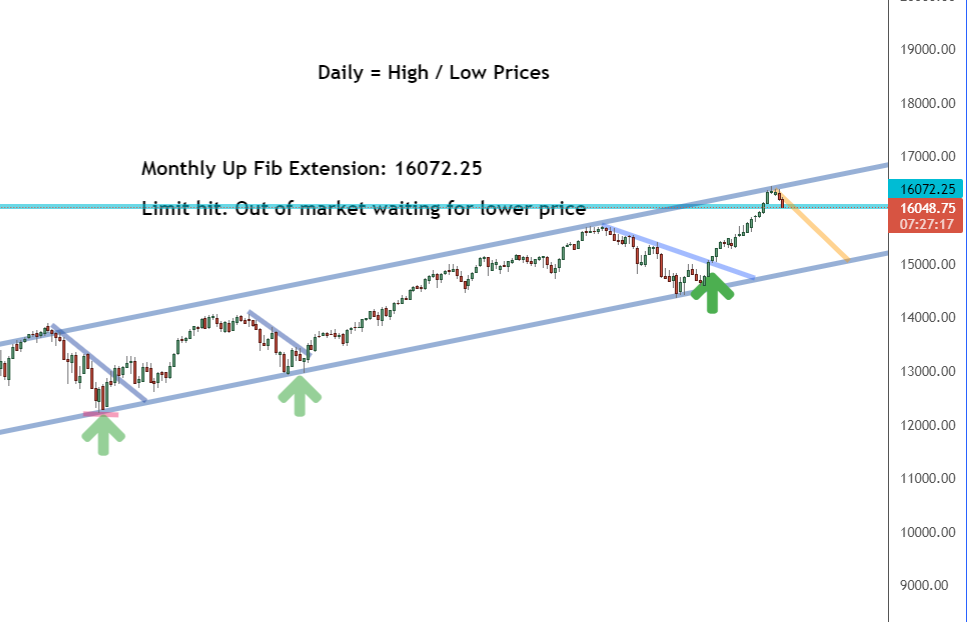

The market hit the very top of the channel, fulfilling the Fibonacci extension. That means the market is too high to buy right now.

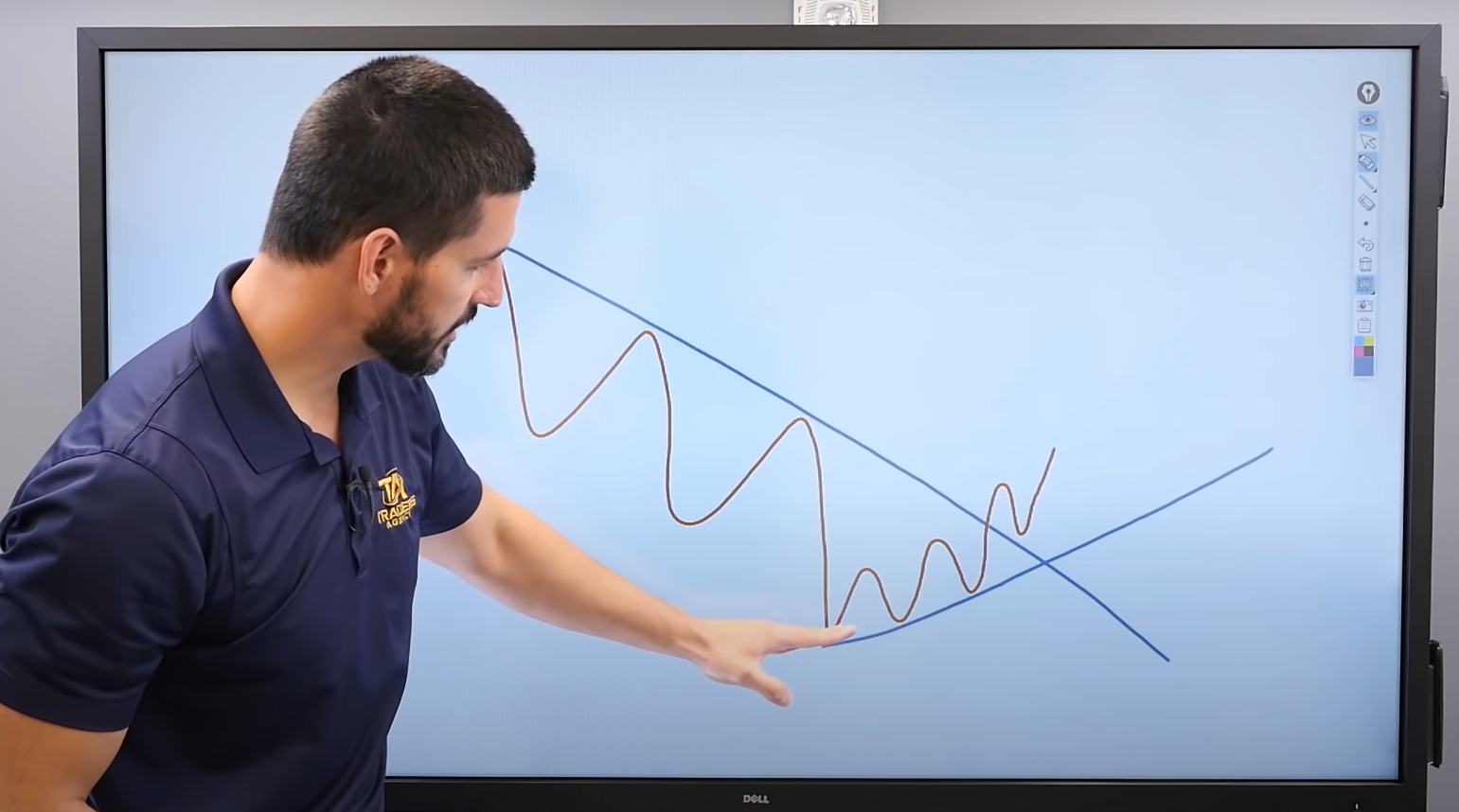

While the long-term direction is up, the short-term direction is definitely down as we expect a significant sell-off very soon.

But that doesn’t mean we walk away from the market entirely. While we can’t buy it at the moment, we’ll want to watch our timeframe charts for the NQ in anticipation of a new bullish push after the sell-off.

For now, let’s look at the timeframe analysis to get a better idea of what the NQ is doing:

Daily Timeframe Analysis

As you can see in today’s daily timeframe chart, the NQ is at the very top of the channel, preparing for a sell-off back down to the bottom. Despite the coming sell-off, the long-term direction for the NQ remains up.

We’ve hit our limit price of 16072.25, meaning we’re out of the NQ for now. We’ll want to wait for the market to hit a stable low price before looking to utilize our buy-in strategy.

DAILY TIMEFRAME

The long-term direction is up for the NQ

1-HR TIMEFRAME

The short-term direction of the NQ is down for now

THE BOTTOM LINE

The NQ hit our limit and is preparing for a sell-off

Learn more about the Daily Direction Indicators here…

Even though the market is currently outside of our range for trading, this is an excellent opportunity to prepare our buy-in strategy as we wait for the market to reach a new low price within the current channel.

The Bottom Line

We’re currently out of the NQ market as it’s risen above our price limit and hit the top of the channel. We’re expecting a significant sell-off that will drive the market to the bottom of the channel before a new bullish rally takes over.

While we won’t trade the NQ during the sell-off, a new low price will give us a great opportunity to get back in the market. We’ll just have to be patient while all of this unfolds!

Without my strategy, you’d be completely confused when it comes to how to handle the NQ futures market right now. That’s why it’s time to start utilizing my knowledge and expertise! You can’t afford to miss out on this.

Keep On Trading,

Mindset Advantage: Accept

It’s what you don’t lose that counts first.

Followed by what you get to keep.

We hear the same story time and time again… the money gets made… the profits are amazing… and then it’s all given back to the harsh maiden of the market.

It’s not because the money isn’t there to be made. It’s often due to good old fashioned greed. Stops get pushed back. Targets get forgotten. That trade made $100… why not turn it into $500 or $1,000?

These are the traps that snare 95% of the trading profit. Take what the market gives you and go about your business. Honor ‘thy stop’ and your risk / reward ratio.

Don’t take that trade if you don’t feel good about it.

The ones you don’t take, or the ones that you end up stopping out of… those are the ones that keep you on the path to consistent profits!

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post Waiting for the Next Bullish Push appeared first on Josh Daily Direction.