Good morning, Traders!

Right now, we’re out of the Nasdaq 100 E-mini (NQ) as we wait for the current retracement to reverse back toward a bullish run.

The long-term direction for the market is still up, but we’re looking for the NQ’s price to settle down a bit more before it turns around and moves back into the buy zone.

These retracements (temporary price dips) shouldn’t worry us too much. When the market dips like this, it gives us an opportunity to buy the market again at a low price once it turns bullish.

It’s tough, but sometimes the best thing to do is wait for the market to move into a position that gives us the best chance of making money.

Let’s jump into the NQ timeframe analysis to get more details about the current setup:

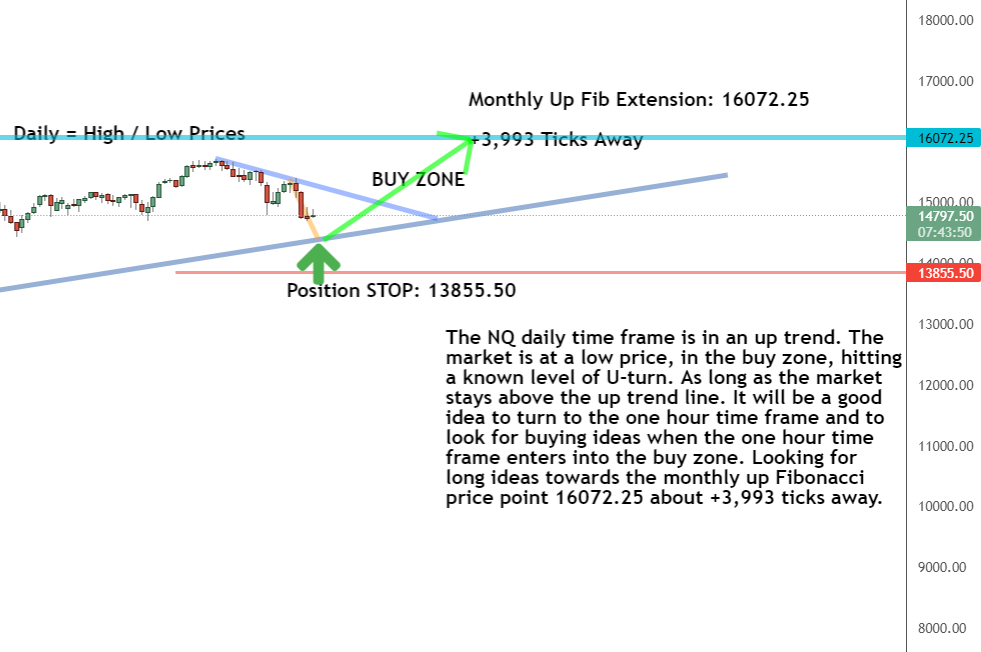

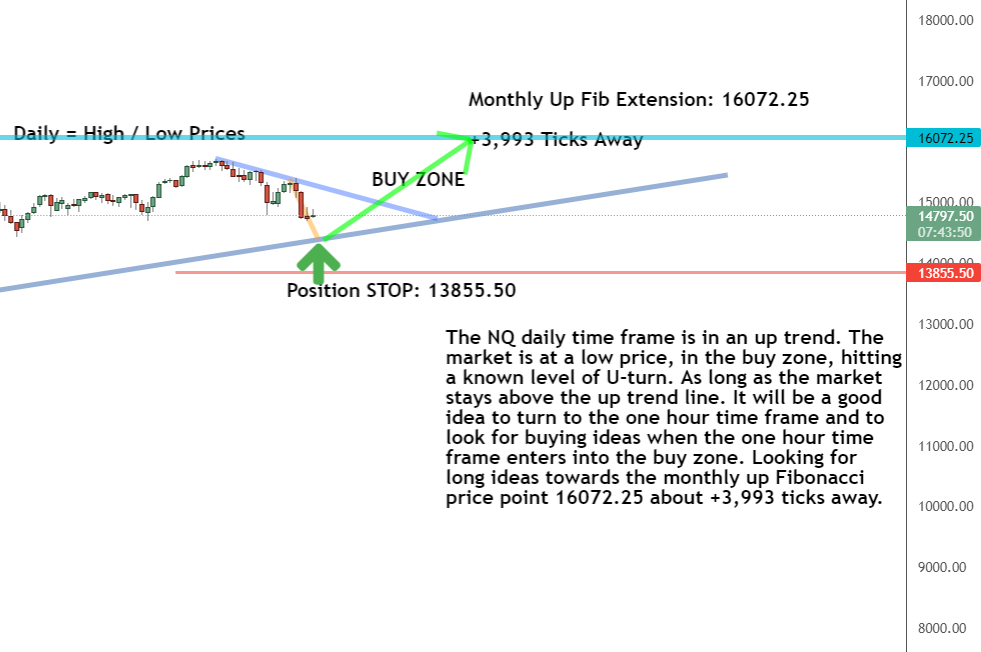

Daily Timeframe Analysis

According to the daily timeframe, we need to wait for the price to drop closer to the trendline (bottom grey line) in the daily timeframe before expecting it to reverse back toward a bullish run.

When we do get the bullish run, we can expect the NQ to move toward 16072.25

The long-term direction is up for the NQ

The short-term direction of the NQ is down

We’re waiting for the NQ to hit a known U-turn point

Learn more about the Daily Direction Indicators here…

We’ll wait for the NQ to drop closer to the trend line before expecting it to reverse and push bullish again

A retracement isn’t necessarily a bad thing. It drops the price and allows us to buy the market at a low price before it rallies to a new high price. And that’s how we make profitable trades in the futures market!

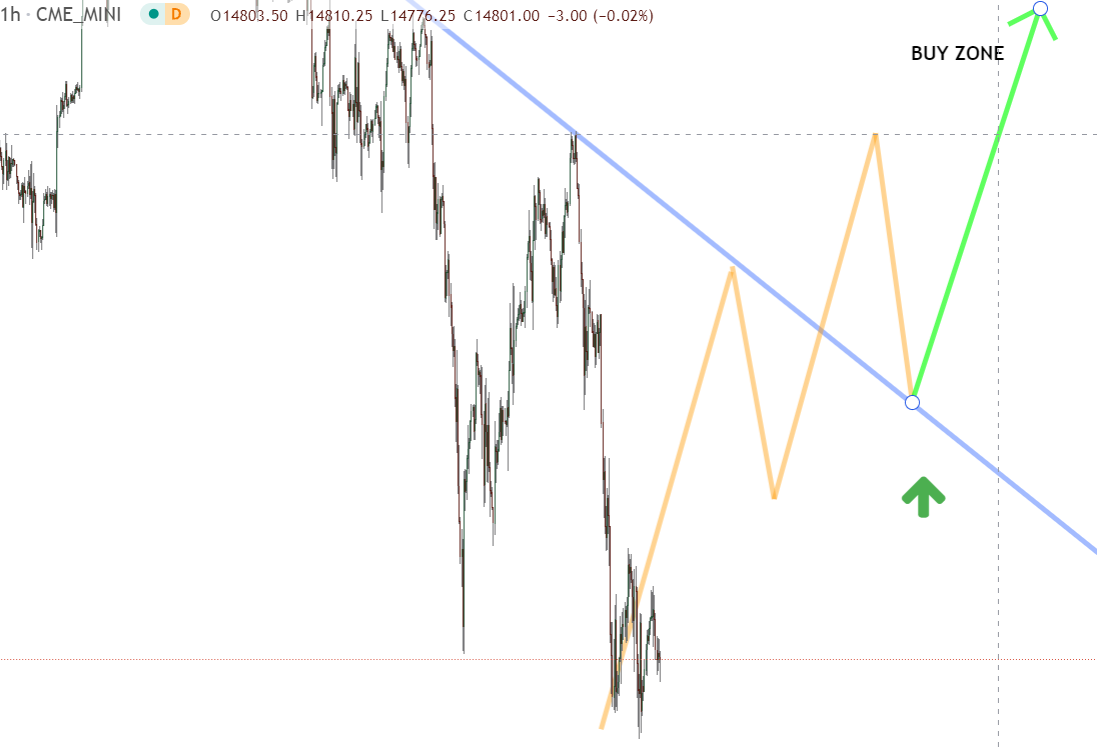

One-Hour Timeframe Analysis

Right now, the one-hour timeframe is below the down trendline. The wise thing to do is wait for the NQ to push above that trendline before looking for buying opportunities. Once we know that the NQ is back in the buy zone, we can then actively look to implement our buy-in strategy for the market.

We’re waiting for the NQ to push above the down trendline and into the buy zone

We’re now playing a game of “hurry up and wait” as we monitor the NQ for signs that it’s headed back for the buy zone.

The Bottom Line

We’re staying out of the NQ right now as we look for signs that the market is headed back to the buy zone. It can be annoying having to wait on the sidelines, but it’s the right call. Jumping into a retracement too soon means we’ll lose money. We need to wait for the market to reverse and head back to a bullish run

We’re waiting for the NQ to turn back bullish

And that’s why following my futures trading strategy can benefit you immensely. You’ll see when it’s profitable to enter a market and when it’s wise to stay away. Now’s the time to get on board if you’re ready to make smart trading decisions ASAP. There’s no reason to keep putting it off!

Keep On Trading,

Mindset Advantage: Accept

It’s not the market. It’s not your indicator. It’s TRADING.

Let it go. The first step toward consistent profits comes when you accept the reality that losses will occur. Prices have a mind of their own at times. The institutions are at the wheel. The sooner you accept this, the more progress you’ll make.

Look at the past, but don’t stare. Accept what’s happened and move on.

Target tighter entries. Get the heck out of those losers you’re hanging on to.

Accept. And start to enjoy trading.

Traders Training Session

Understanding Futures Contract Sizes and Tick Values

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post Waiting is the hardest thing to do appeared first on Josh Daily Direction.