We finally got a positive week for stocks last week, but it wasn’t enough to get me excited.

As you can see in the image below, the S&P 500 is having a hard time even getting above its 21-day moving average.

And there are still the declining 50-day and 200-day moving averages to contend with.

As of Friday, only 25% of stocks traded above their respective 50- and 200-day moving averages…

What that means is that the market is still incredibly weak.

Pockets of Strength

However, as with any bear market, there is usually at least one pocket of strength to be found.

Earlier this year, that was the energy space.

Dozens of oil and gas stocks made huge moves higher despite the indexes trading lower.

After a good-sized correction in June, the energy sector is again showing signs of life.

As you can see in the chart of the Energy Select Sector SPDR Fund (XLE) above, the sector is breaking out from a four-month consolidation base.

Several energy names in the group are emerging from similar patterns.

It’s still too early to say whether the market has indeed bottomed or if there is further to fall.

But if you’re looking for stocks to buy, the energy group looks the best to me right now. Here are a few names to keep an eye on, plus one short idea below…

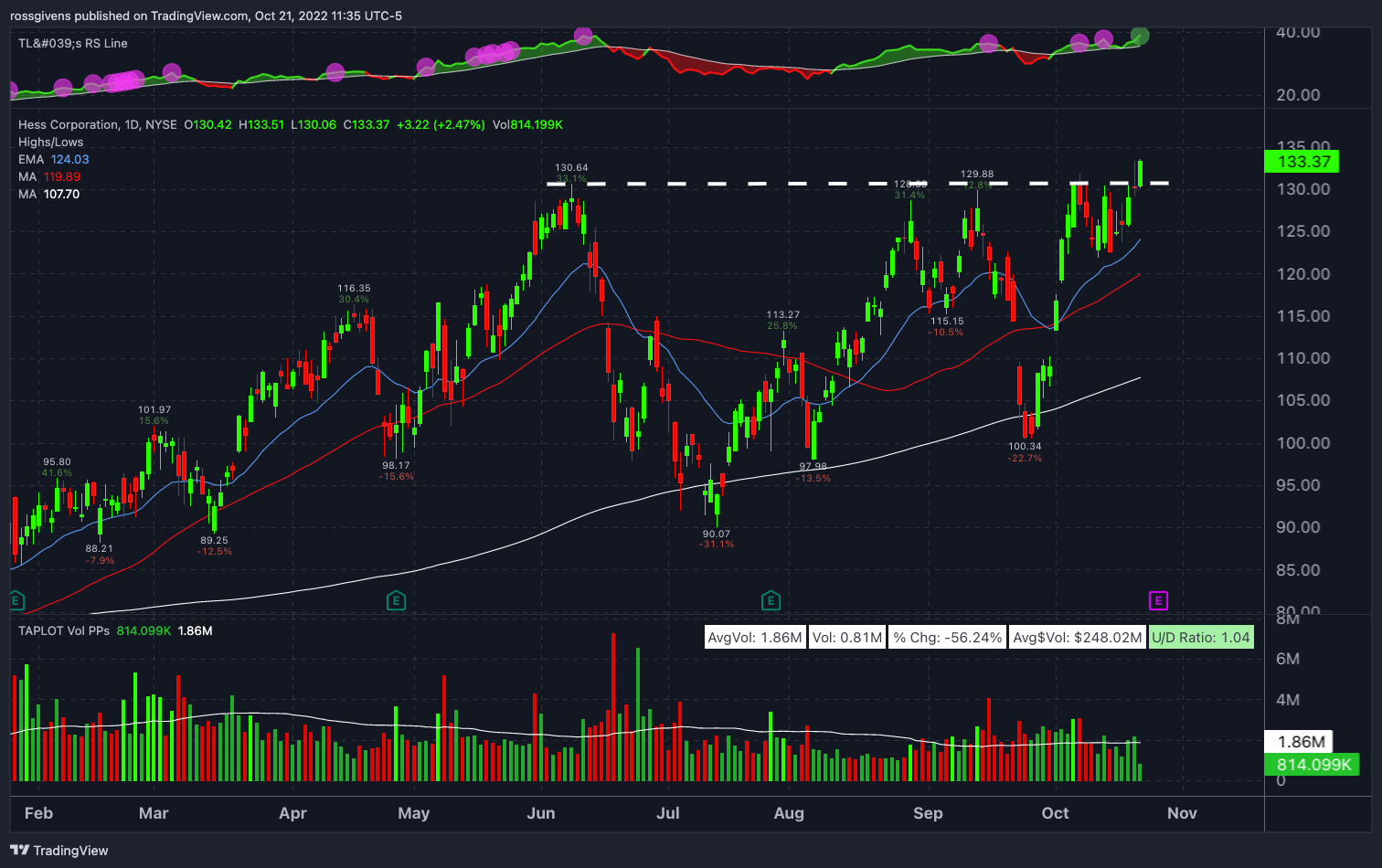

Hess Corporation (Long Idea)

After a 31% rally higher Hess Corporation (HES) created a higher low at our supply level and is now beginning to break out higher.

HES is now trading above all three of our moving averages.

The swing low is just beneath its 21-day moving average, setting up a low-risk buy point here.

I’d like to see the $130 level, which previously served as resistance, provide support to the stock and for the shares to hold above that level.

Chevron Corporation (Long Idea)

After choppy price action for two months, Chevron Corporation (CVX) has finally broken out of a clear level of resistance and is beginning to create a clear level of higher highs and higher lows.

Wednesday’s rally broke through the supply level that was previously holding the stock back.

What once acted as resistance when the stock traded below it will sometimes become support once the stock breaks above it.

The white dotted line on the chart highlights this key support/resistance level.

CVX is now within 5% of all-time highs, so don’t be surprised to see it pause if it hits that level.

However, not many stocks are within spitting distance of their highs in this market, so this is a good sign of strength for Chevron and the energy sector.

United Airlines Holdings, Inc. (Short Idea)

If you’re looking for a short trade, United Airlines Holdings, Inc. (UAL) is giving us a nice place to bet against the stock.

After breaking below its 200-day moving average in June, UAL has been unable to trade back above it.

The 200-day is a “line in the sand” for most stocks that separates those trading above or below the long-term trend.

UAL reported better-than-expected numbers in last week’s earnings report, which pushed the stock up against this crucial level.

But odds say the stock will likely fail on its first test of the 200-day. Traders might consider a short position on UAL here with a tight 3%-5% stop.

Trade Under the Radar

Institutional investors like pension funds, mutual funds, hedge funds and other large players make massive institutional buys that fly under the radar of most individual investors.

But if you know how to spot those buys in real time, you can potentially follow the big money to big gains.

This is what I focus on inside my premium Stealth Trades research service.

Look, if you haven’t been making money in these markets, it’s time to try something new…

Take a few moments to click here and watch my brand-new Stealth Trades video bulletin…

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily